Adani Group and Reliance Industries have not submitted revised bids for SKS Power Generation (Chhattisgarh), making it a five-way contest for the 600 MW thermal power project, people familiar with the process said.

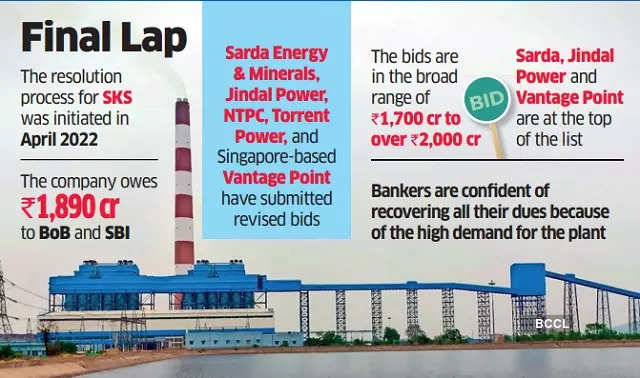

Nagpur-based Sarda Energy & Minerals, Delhi-based Jindal Power, public-sector utility NTPC, Gujarat-based Torrent Power, and Singapore-based Vantage Point Asset Management have submitted revised bids to take over SKS under the corporate insolvency resolution process.

Among them, Sarda, Jindal Power and Vantage Point are at the top of the list with little to choose between their bids, people cited above said.

“The bids have been received in the broad ₹1,700-crore to more than ₹2,000-crore range,” one of them said. “Sarda, Jindal and Vantage are on the top end of the band with less than ₹10 crore between them. It means that banks will have to speak with each of them to clearly assess their plans and try to find out the preferred bidder.”

The resolution process for SKS was initiated in April 2022. The company owes ₹1,890 crore to the Bank of Baroda and the State Bank of India (SBI).

Bankers are confident of recovering all their dues because of the high demand for the plant.

State-owned NTPC, which is currently running the plant in Raigarh district following a government directive aimed at overcoming power shortages, was considered a strong contender, but its revised bid is at the lower end of the band, sources said.

“Among the top three bidders, Jindal has a 3,600 MW power plant within 60 km of this one whereas Sarda has a coal mine less than 50 km from this plant, making it a good acquisition for them because of the synergies at play,” a second person familiar with the resolution process said.

“But the fact is that there are few operational plants with all linkages available as of today, which is why everyone is so keen,” the person said.

The total cost of acquisition, assuming lenders receive their full money, comes to less than ₹4 crore per MW, people cited above said. That compares with ₹9 crore per MW required to build a similar plant today.

The SKS plant has 25 years of fuel agreement with South Eastern Coalfields, a Coal India unit, with a railway line directly transporting coal to the plant – a rare facility.

Moreover, expectations of a harsh summer mean that demand for power is likely to jump in the next couple of months, presenting a good business opportunity for privately owned plants to sell power in the open market, sources said.

The reason for both Adani and Reliance not increasing their bids is not known, though people familiar said both companies had re-evaluated their strategies noting the aggressive bids in the first round. Both companies could not be immediately reached.

Process advisor BoB Capital Markets and resolution professional Ashish Rathi did not reply to ET’s email seeking comment as of press time Sunday.

Creditors will prefer bidders with a higher cash component and will not want to take the risk of deferred payment.

The 600-MW plant had stopped production after Hong Kong-listed owner Agritrade Resources failed to keep it running due to financial difficulties of its own. Agritrade Resources bought the plant in 2019 in a one-time settlement with a group of lenders led by SBI.