An Adani group entity, Sajjan Jindal-owned JSW Cement, and ArcelorMittal Group are likely contenders to buy Vadraj Cement, an ABG Shipyard group company that will be sold under the Insolvency and Bankruptcy Code process, people aware of the development told ET.

The Bombay High Court had, in August 2018, ordered the winding up of Vadraj Cement after a trade creditor, Beumer Technology India, dragged it to the court for recovery of dues.

“But frustrated with the slow progress in selling the assets, the court agreed to transfer the debt resolution process of the cement company to IBC,” one of the persons cited above said. In an order dated September 4, the high court allowed transferring the winding up proceedings to the National Company Law Tribunal (NCLT) based on a bank’s petition.

Lenders have suggested EY-backed Pulkit Gupta as an interim resolution professional for the bankruptcy process of Vadraj.

JSW Cement and ArcelorMittal declined to comment. The Adani Group did not respond to ET’s mailed query seeking its comment on the matter.

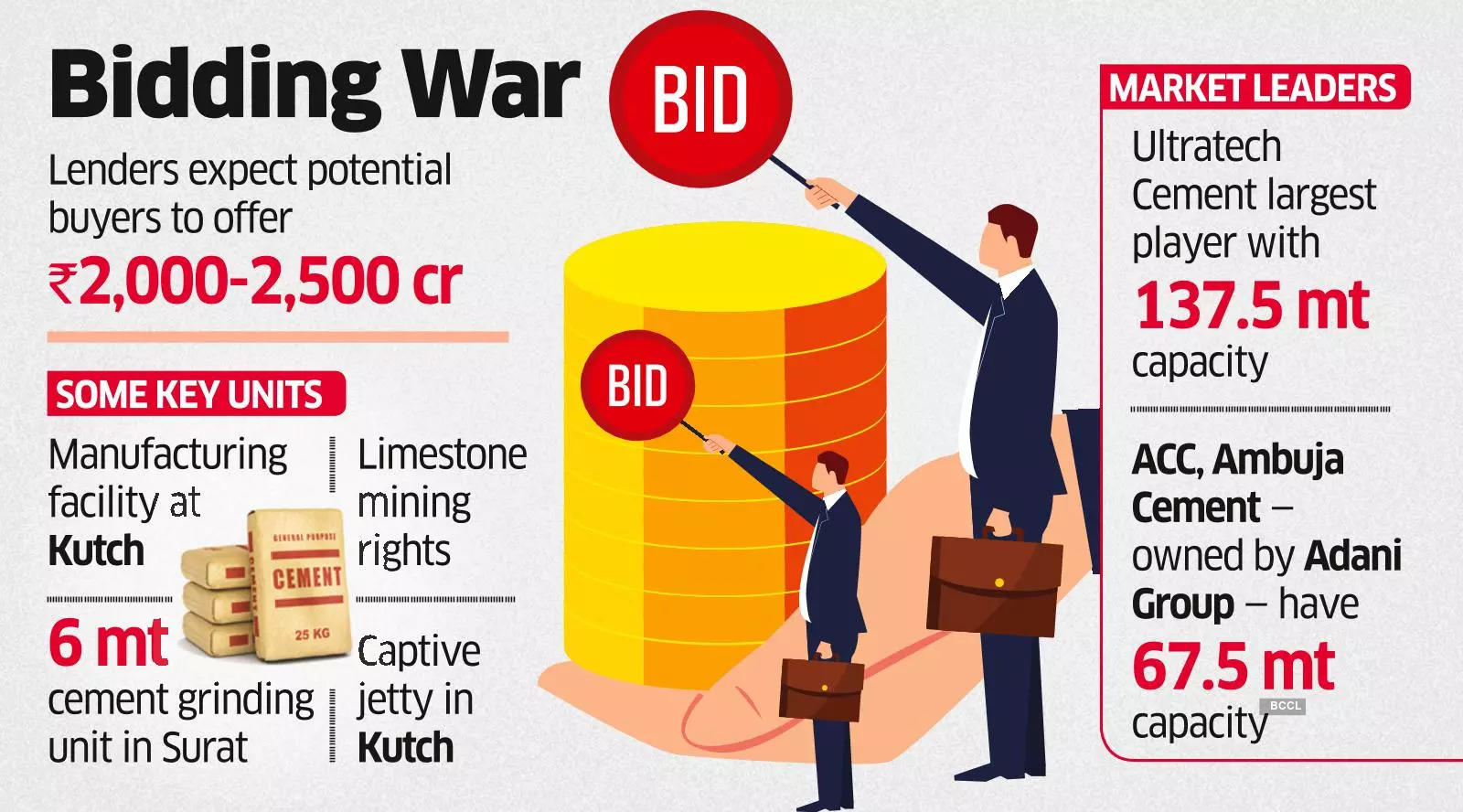

Lenders expect potential buyers to offer between ₹2,000 crore and ₹2,500 crore, said the people cited above. The company has ₹ 7,000 crore debt. Its lenders include Punjab National Bank, Union Bank of India, Central Bank of India, Indian Overseas Bank, Bank of India, Bank of Baroda, UCO Bank and Yes Bank.

The company has an integrated cement manufacturing facility comprising a 10,000 TPD (tonnes per day) clinker unit at Kutch and a 6-million-tonne (mt) cement grinding unit at Surat in Gujarat. It also has limestone mining rights and a captive jetty in Kutch. Both the cement units are not operational because the captive power plants that supplied fuel to the cement plants were sold upon a loan default. Alpha Alternatives Holding, jointly with Algebra Endeavor, acquired Vadraj Energy (Gujarat) in October 2021 under the IBC route, according to a tribunal order approving the plan.

If ArcelorMittal emerges as a successful bidder, it will mark its entry into the cement sector, although in December 2021, it had announced plans to set up an 18.75 mt cement plant in Odisha. The Vadraj Cement unit in Gujarat is close to the steel plant that Arcelor acquired from Essar Steel. The cement plant will complement its steel business since the steel slag has properties that are suitable for making cement, and is used to blend with clinker to lower the clinker factor and costs.

Adani and JSW Cement have declared plans to raise manufacturing capacity over five years. Adani proposed increasing the capacity to 140 mt while JSW Cement proposed raising output to 60mt in five years.

Currently, the Aditya Birla Group, which owns Ultratech Cement, is India’s largest cement maker, with a 137.5 mtpa manufacturing capacity.

It is followed by ACC and Ambuja Cements, both owned by Adani Group, which has a 67.5mt capacity.