The Abu Dhabi Investment Authority (ADIA), the sovereign wealth fund of the oil-rich emirate, along with London-based private equity fund HarbourVest, is in discussions to acquire a minority stake in Cohance Lifesciences, a Hyderabad-based pharmaceuticals platform owned by global PE fund Advent International.

The investors are looking to invest $350-400 million (about Rs 2,500-3,000 crore) for a significant minority stake, valuing Cohance Lifesciences at about $1.5 billion (Rs 12,000 crore), said two people aware of the development.

ET’s queries emailed to ADIA and HarbourVest did not elicit a response till press time while an Advent International spokesperson declined to comment.

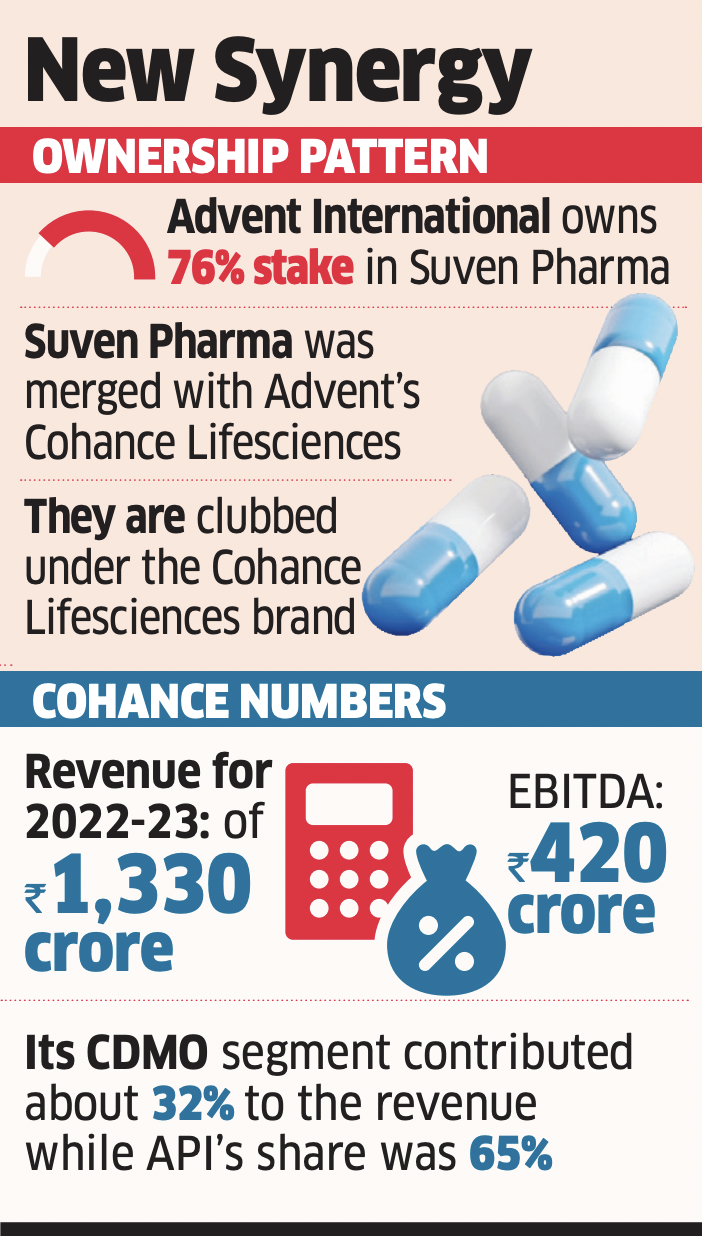

Advent International currently owns a 76% stake in Hyderabad-based Suven Pharmaceuticals, which was merged with the investor’s existing platform, Cohance Lifesciences. The US-based PE fund owns several active pharmaceutical ingredients (API) businesses and contract development and manufacturing organisation (CDMO) companies such as RA Chem Pharma, ZCL Chemicals and Avra Laboratories and has clubbed all under the Cohance Lifesciences brand.

Cohance Lifesciences (excluding Suven Pharmaceuticals) reported revenue of Rs 1,330 crore for 2022-23 with Rs 420 crore EBITDA. Its CDMO segment contributed about 32% to the revenue while API’s share was 65%.

Its new products have a near-term sales potential of Rs 300 crore from key molecules (addressable market of Rs 2,000 crore) while it has a pipeline of products with mid-term sales potential of Rs 1,000 crore in an addressable market of Rs 10,000 crore, said a company presentation.

On a combined basis, the domestic sales of the three companies were only around 19% in 2022-23, with exports accounting for the majority of the revenue (81%). The company recorded 47% of its total operating income from therapies such as gastrointestinal (21%), antispasmodic (13%), antidepressant (9%), muscle relaxant (7%) and anti-Parkinson’s (6%), according to a recent Care Ratings report.

ADIA already has a presence in India’s pharmaceutical sector, owning about 3% stake in the leading company Intas Pharmaceuticals. It acquired the stake in 2022 from Temasek Holdings Pte for $250-270 million (Rs 2,000 crore), valuing Intas Pharmaceuticals at about Rs 65,000 crore. It also owns Galderma India, which is engaged in the manufacture and sale of various dermatological products.

With asset under management worth $850 billion, ADIA has invested in Lenskart, Flipkart, Reliance Retail, Mindspace REIT, HDFC Capital, MPhasis, Paytm, Nykaa and Mobikwik. Since 2018, it has invested more than $4 billion in India.

Its investments in India are overseen by senior portfolio manager Vinod Padikkal, a former director at Advent International, who joined ADIA in 2021.

Advent International had acquired 50.1% stake in Suven Pharmaceuticals in 2022 from its promoter, Venkat Jasti family, for Rs 6,330 crore. Later, it acquired 26% stake through an open offer. In total, it invested about Rs 9,589 crore in the company through Cyprus-based Berhyanda Limited.

Suven Pharmaceuticals exports active pharmaceutical ingredients and advanced drug intermediates, apart from offering certain services to global pharmaceutical and agrochemical majors.

Setting up platforms and acquiring pharma companies under it has been common among private equity funds. Similar to Cohance Lifesciences, another API-focused platform Sekhmet Pharmaventures was launched by PE funds PAG, CX Partners and Samara Capital. The platform acquired Chennai-based Anjan Drug and Hyderabad-based Optimus Drugs.

Advent International is on an exit spree in India and has put on the block several of its portfolio companies. It is planning to sell Bharat Serums and Vaccines four years after buying it out and has hired Jefferies for the purpose. It is also exploring the sale of India’s largest rigid plastic packaging firm Manjushree Technopack.

Advent International has been investing in India since 2007 and has invested or committed more than $3.5 billion across 14 companies in the country.

HarbourVest has more than $112 billion of assets under management as of June 30, 2023. It has backed India-focused business-to-business venture capital fund Avataar Venture Partners with a $300 million investment.