Sovereign wealth fund Abu Dhabi Investment Authority (ADIA) will buy a 20% stake in IIFL Home Finance for ₹2,200 crore, valuing the mortgage lender at Rs 11,000 crore. This will be the largest equity investment in India’s affordable housing finance segment by a financial investor. IIFL Home Finance, a wholly owned subsidiary of IIFL Finance, proposes to use the additional capital to continue its expansion into new markets to meet growing demand for housing loans.

The deal will unlock value in IIFL Finance, which has a ₹52,000 crore loan book and market capitalisation of ₹12,500 crore. IIFL Home Finance has a loan book of ₹24,000 crore and market value of ₹11,000 crore. Shares of IIFL Finance ended flat at ₹329 on Thursday. While confirming the deal, IIFL Group chairman Nirmal Jain said ADIA will bring long-term commitment and rich experience in supporting growing businesses. “Given the volatility in the financial market, the rising interest rate for home loans, and tightening of liquidity, the equity investment is opportune and at the right time to help the company take advantage of likely industry consolidation and market growth,” he said.

Shareholding Pattern

IIFL Home Finance has a customer base of 168,000 with 230 branches. The company offers small-ticket mortgages, loans against property, and construction finance. It also promotes the construction of affordable green buildings in collaboration with housing developers and experts through its proprietary Kutumb platform to reduce the carbon footprint and deliver cost-efficient structures.

The investment in IIFL Housing aims to support the company in its next phase of growth as it meets demand in India’s large, under-served and fast-growing, affordable housing finance market, said ADIA executive director Hamad Shahwan Aldhaheri.

Nirmal Jain and his family have a 25% stake in IIFL Finance. Canadian investor Prem Watsa’s Fairfax Group and the UK’s CDC Group plc own 22.3% and 7.7%, respectively, of IIFL Finance. General Atlantic, Bain Capital, and The Capital are some of the other investors in IIFL Finance.

Earlier this year, HDFC Capital raised $1.8 billion from a consortium of investors led by ADIA for its third low-cost housing fund.

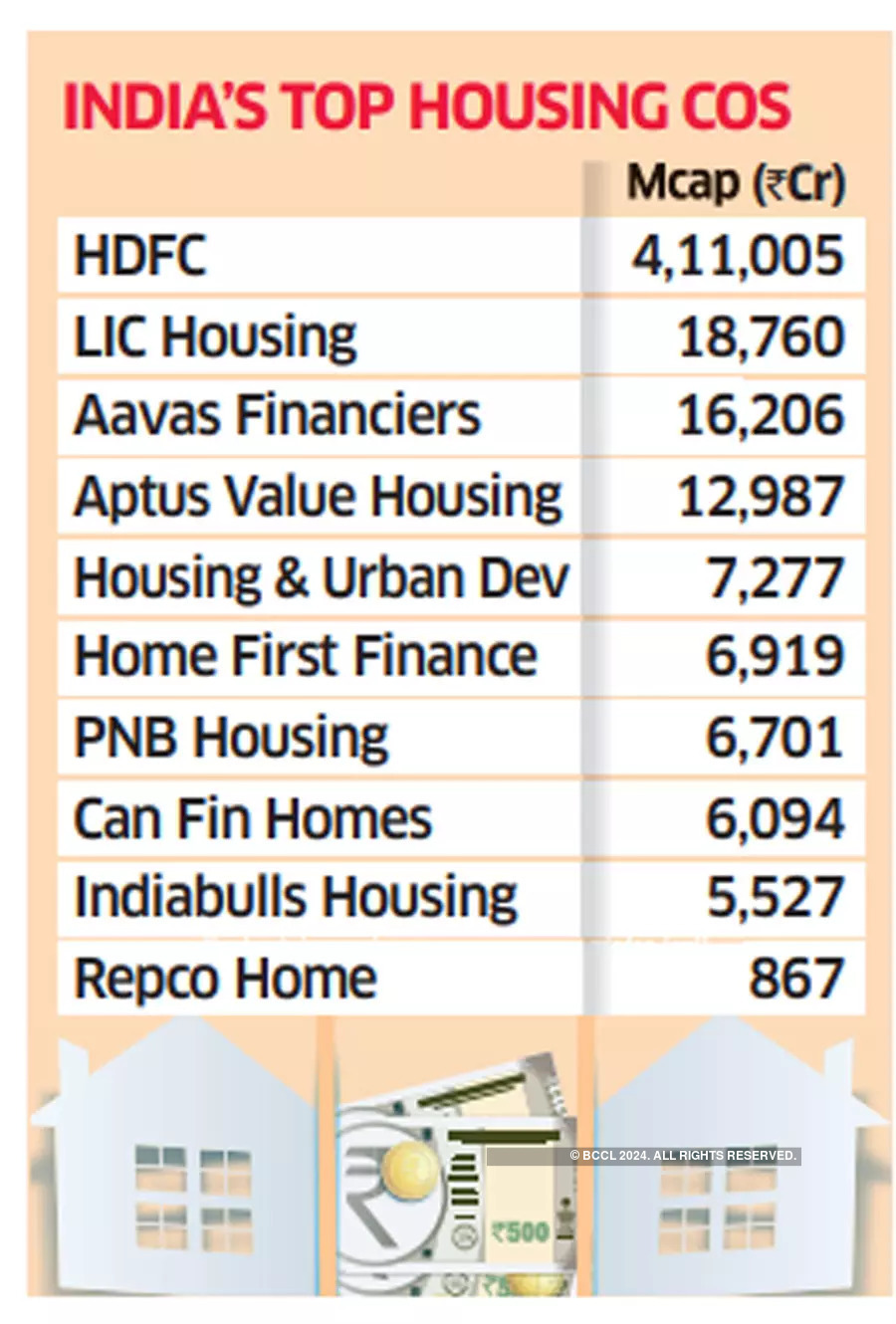

ADIA, with assets under management worth $800 billion, has wide exposure in India. Its significant investments include Flipkart, Reliance Retail, Mindspace REIT, HDFC Capital, Mphasis, Paytm, Nykaa, and Mobikwik. Since 2018, ADIA has invested more than $3 billion in India. In December, ADIA bought about 5.8 million shares of Indiabulls Housing, representing a 1.26% stake. ADIA purchased a 1.2% stake in Reliance Retail for ₹5,513 crore in 2020.

ADIA owns a stake in nearly 25 listed companies such as Coforge, Bharat Dynamics, Birlasoft, Intellect Design, Inox Leisure, GE Shipping, and Chemplast Sanmar, among others.