Reliance Industries said a wholly-owned subsidiary of Abu Dhabi Investment Authority (ADIA) will buy 1.2% in Reliance Retail Ventures (RRVL) for Rs 5,512.5 crore. The investment values Reliance Retail at a pre-money level of Rs 4.3 lakh crore.

Reliance Retail has received Rs 37,710 crore from investors including US’ KKR & Co, private equity giant General Atlantic, technology investment firm Silver Lake, sovereign wealth fund Mubadala, GIC and TPG in the past few weeks.

“The investment by ADIA is a further endorsement of Reliance Retail’s performance and potential and the inclusive and transformational new commerce business model it is rolling out,” Reliance chairman Mukesh Ambani said in a statement on Tuesday.

The Mumbai conglomerate is poised for a bigger play in India’s burgeoning retail story with its huge network of brick-and-mortar stores and newly-launched JioMart ecommerce venture.

RRVL also agreed to acquire the business of rival Future Group, which would help consolidate its control over more than a third of India’s estimated $80 billion annual modern retailing market.

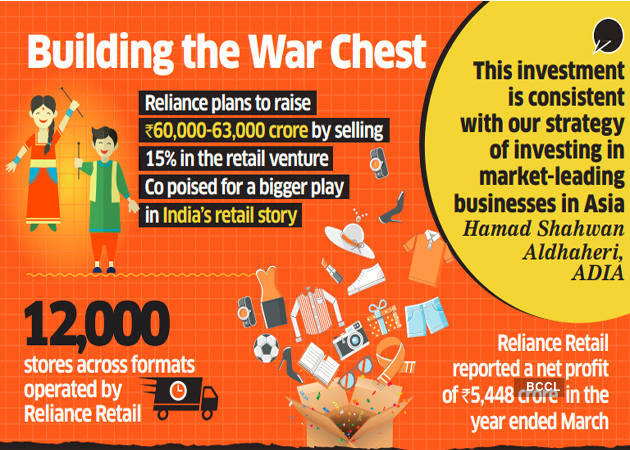

“Reliance Retail has rapidly established itself as one of the leading retail businesses in India and, by leveraging both its physical and digital supply chains, is strongly positioned for further growth,” said Hamad Shahwan Aldhaheri, executive director of private equity, ADIA. “This investment is consistent with our strategy of investing in market-leading businesses in Asia linked to the region’s consumption-driven growth and rapid technological advancement.”

Reliance plans to raise Rs 60,000-63,000 crore by selling 15% in the retail venture. Reliance Retail, which operates over 12,000 stores across formats, reported a net profit of Rs 5,448 crore and a consolidated turnover of Rs 1,62,936 crore in the year ended March.

Source: Economic Times