Greenko Energy is set to acquire an Indian hydropower unit from Abu Dhabi’s TAQA for Rs 650 crore, the second instance in four months where the Hyderabad-based renewables company is buying out a distressed local asset from a global utilities major, said officials in the know.

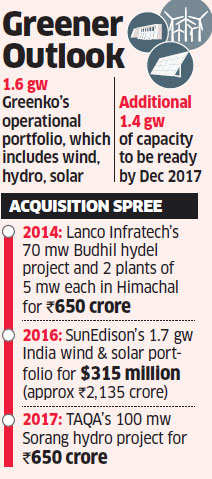

Last September, Greenko pipped several potential suitors to bag the 1.7-gigawatt Indian wind and solar portfolio of bankrupt clean energy giant SunEdison Inc for $315 million.

Abu Dhabi National Energy Company, popularly known as TAQA (‘energy’ in Arabic), operates the near-complete 100 MW Sorang project in Himachal Pradesh.

TAQA had taken over the Sorang plant from a consortium of NCCIL& FS. But even after commencing operations in 2015, the project ran into operational troubles.

TAQA hit the headlines in India when it engaged with Jaypee Group to buy two of its large hydel plants in early 2014 for $1.6 billion but pulled out at the last minute after a sudden change of business strategy and priorities. Since then, it has been withdrawing from many of its global outposts, including India.

Greenko declined to comment. Allan Virtanen, TAQA’s head of media, declined to confirm that a sales process was ongoing, adding the company would issue a stock exchange notification if a sales agreement were to be reached.

GOING GREENER

The acquisition will further diversify Greenko’s portfolio from wind and solar. Upon completion, the company’s total hydel portfolio is expected to touch 500 MW, spread across Karnataka, Himachal Pradesh, Uttarakhand, and Sikkim. In February 2014, Greenko had acquired Lanco Infratech’s 70 MW Lanco Budhil hydropower project and two plants of 5 MW each in Himachal Pradesh for Rs 650 crore.

“Several global players like GDF are exiting India due to a variety of reasons. Greenko has emerged as a formidable force, and often the last resort to lenders, having the capability to take over and turn around assets. They also have the capacity to operate across different stages of a plant cycle,” said a Mumbai-based cleantech consultant who works closely with the company.

Started by two Hyderabad-based entrepreneurs, Anil Kumar Chalamalasetty and Mahesh Kolli, privately held Greenko counts Singapore’s GIC and Abu Dhabi Investment Authority (ADIA) as key shareholders. GIC owns a controlling 60% interest in the company and ADIA has close to 15%. The two founders own the rest.

Formerly listed on London’s AIM exchange, Greenko is among the country’s largest green energy producers with an operational portfolio of 1.6 gw of the wind, hydel and solar, and a pipeline of another 1.4 gw scheduled to be ready by December 2017. The company is expecting to post $200 million EBITDA (earnings before interest, tax, depreciation and amortization) in fiscal 2017, and is looking to treble that by fiscal 2019, on the back of PM Narendra Modi’s ambitious goal of boosting clean energy capacity to 175 gw by 2022.

In June 2016, ADIA pumped $150 million into Greenko at a $1billion post money valuation, said people aware of the matter. The company had a debt of $1 billion then, implying an enterprise value of $2 billion. In March, GIC had invested $80 million into the company.

Greenko appointed former SBI chairman OP Bhatt as its non-executive chairman, effective April 1, 2016, to focus on governance and manage risk perceptions.

“They are fast becoming like a turnaround fund. They acquired Lanco’s hydel asset which had turned into an NPA (non-performing asset). They made their boldest bet with SunEdison and managed to pull together an extremely complex transaction, and now the TAQA buy will further reinforce that sentiment,” added another lender with exposure to the sector.