Aircel may be left with no choice but to slowly wind up operations after the scrapping of its merger with Reliance CommunicationsBSE 0.00 % (RCom), with a court diktat preventing the telco from selling its 2G or 3G spectrum while it continues to lose money amid a fund crunch and high debt, said experts.

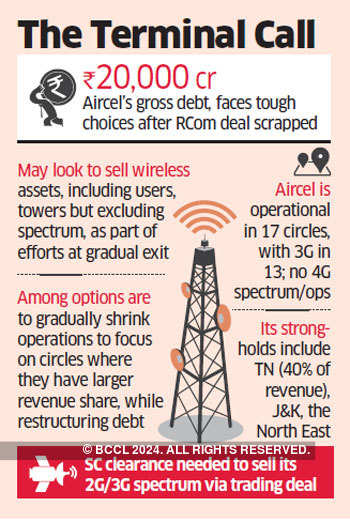

ET spoke to multiple analysts who said the operator, with a gross debt of some Rs 20,000 crore and having no 4G spectrum, may try to structure a deal that could exclude the spectrum it owns. It could hand off its other wireless assets, including nearly 89 million subscribers, to a larger telecom player and its 40,000 towers to another entity, they said. Shutting down via the bankruptcy route would invoke the bank guarantees of Malaysian parent Maxis, which could lead to a long drawn legal tussle, something the company would want to avoid, experts said. Aircel didn’t respond to queries.

The scenario could change if the Supreme Court clears any move by Aircel to sell its airwaves. The apex court has threatened cancellation of Aircel’s licences and barred it from selling its 2G or 3G spectrum until representatives of its Malaysia-based parent company appear before it – a key reason for the cancellation of the telco’s merger with RCom. The representatives – promoter T Ananda Krishnan and former executive Ralph Marshall, who ran Maxis at the time of the Aircel acquisition – still haven’t appeared in court.

Simultaneously, Aircel is trying to restructure its debt while shrinking its operations to focus on a few of its stronger circles including Tamil Nadu, the Northeast and Jammu & Kashmir.

“There is no point in staying if you are losing more money and relevance in the market. Its only option is to sell its customers and revenue to one of the incumbents and offset its debt,” said Sanjay Kapoor, former chief executive of Bharti AirtelBSE -0.54 % for India.

“There is no point in staying if you are losing more money and relevance in the market. Its only option is to sell its customers and revenue to one of the incumbents and offset its debt,” said Sanjay Kapoor, former chief executive of Bharti AirtelBSE -0.54 % for India.

Most analysts believe Bharti Airtel appears the most likely buyer as it needs to add subscribers, such as those from Aircel’s stronger markets like Tamil Nadu, to close in or go past a Vodafone-Idea Cellular combine, which would become No. 1 by revenue market share, and a rapidly expanding Reliance Jio Infocomm. The Vodafone-Idea combine could be potential buyers but the two are busy merging operations while Jio is growing its own base organically and has close business ties with RCom.