Billionaire Sunil Mittal-controlled Airtel is in talks with investment bankers to raise the syndicated loan in a month or two, two people familiar with the matter told ET.

“The company may be able to raise the money by August. It makes sense for the company to go for an overseas syndicated loan,” said one of the people cited above.

At least five to six banks are expected to arrange the offshore credit for the telco which is involved in a brutal fight for subscribers with moneyed Reliance Jio.

Vodafone and Idea are also expected to up their game aggressively after their merger to be competitive in a market where revenue and profitability have taken severe hits but the need to keep investing to expand 4G networks is paramount to stay ahead of rivals.

Airtel’s bitter rival Jio too has been building up its coffers. The Mukesh Ambani-owned telco recently tapped the Korean credit market to raise $1 billion (Rs 6,800 crore), a few weeks after it raised Rs 2,500 crore by selling domestic corporate bonds.

Jio also recently raised $500 million through a syndicated Samurai loan from three Japanese banks in a bid to diversify its borrowing sources.

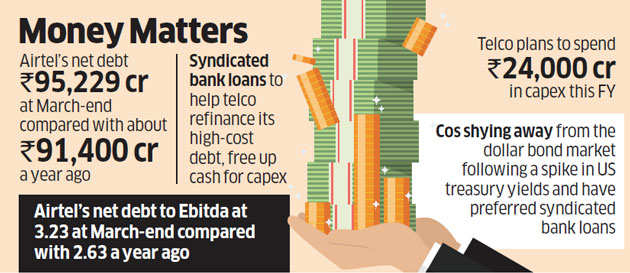

Airtel, which is planning to spend Rs 24,000 crore as capex in this fiscal year ending March 31, 2019, may raise two-three year money, which will be priced after adding a mark-up or spread over the LIBOR (London Inter-Bank Offered Rate), a benchmark gauge, the people said.

The plan to refinance comes at a time the telco has seen its debt increase to over Rs 95,000 crore at March end compared with over Rs 91,000 crore a year back.

Earnings before interest, tax, depreciation and amortization (Ebitda), however, has fallen 12% in the same time, pushing up the net debt to Ebitda to 3.23 from 2.63 a year ago.

Airtel declined to comment. But in a recent interview to ET, India CEO Gopal Vittal had said, “regular refinancing keeps on happening in a cyclical way”, but had declined to comment on the company’s specific fund-raising plan.

Vittal had termed Airtel’s debt to Ebitda ratio as “comfortable”. The mobile phone operator’s shares ended 1.6% higher at Rs367.35 on the BSE Tuesday, outperforming the benchmark Sensex.

The telco, which will soon be replaced by the Vodafone-Idea combine as India’s largest telco, has raised over Rs14,000 crore through stake sales in its tower and DTH units over the last year, besides $6.2 billion through overseas and local bond issuances over the last few years. This though will be the first time in several years that the telco is trying to access syndicated overseas loan.

Experts say companies this year are shying away from the dollar bond market as a spike in US Treasury yields has helped increase the borrowing cost. In the past one year, the US Treasury benchmark yield shot up 50 basis points to 2.87% now.

Their preference instead is for syndicated bank loans.

“There is a lot of capital available in loan form from international banks who have interest in India. It helps builds business relations with Indian corporates,” said the head of a foreign bank, who asked not to be named.