Bharti Airtel, the largest shareholder of Indus Towers, will waive its right of first refusal if UK’s Vodafone Group finds an external buyer for its 21.05% stake in India’s top telecom tower company, two people aware of the matter said.

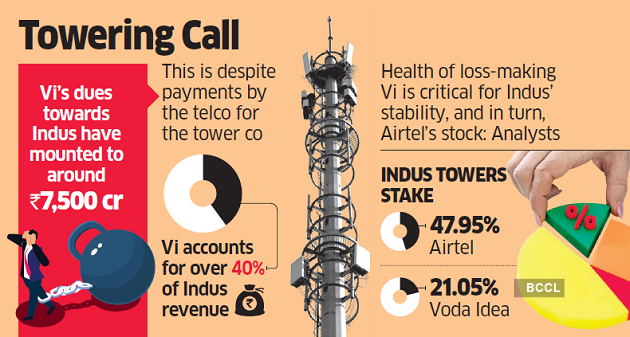

UK’s Vodafone Group and India’s Aditya Birla Group are facing increasing pressure from the government and lenders to infuse equity into Vodafone Idea-their cash-strapped telecom joint venture-to shore up external investor confidence. One of the avenues available to the British telco is selling its remaining or part of the 21.05% stake in Indus and injecting the proceeds into Vi. Bharti Airtel owns 47.95% in Indus.

The British telco, on its part, has previously said it was talking to several interested parties to sell its stake in Indus. ET had earlier reported that Canadian pension fund, Caisse de depot et placement du Quebec (CDPQ), was in talks to buy Vodafone’s 21.05% stake in Indus. But the talks haven’t fructified as yet. Airtel insiders though said the company would not come in the way if Vodafone Plc found an external buyer for its stake in the tower company.

“Airtel is open to waiving its right of first refusal if Vodafone Plc decides to sell its stake in Indus to an external investor,” a top company executive told ET. Vodafone Group declined to offer comment, while ET’s queries to Vi and Bharti Airtel went unanswered as of press time.

Vodafone Group declined to offer comment, while ET’s queries to Vi and Bharti Airtel went unanswered as of press time.

Airtel shares gained 0.93% to close at Rs 765.95, while shares of Indus Towers lost 3.22% to close at Rs 176 on BSE on Tuesday. Vi shares closed 0.97% up at Rs 7.29.

The health of loss-making Vodafone Idea is critical for Indus Towers’ financial stability, and in turn, Bharti Airtel’s stock, say analysts. Vi accounts for over 40% of Indus revenue.

In March 2022, Bharti Airtel bought a 4.7% stake in Indus Towers from Vodafone Group Plc for ₹2,388 crore in cash, to increase its stake to 47.95%. In addition, the UK company sold a 2.4% stake for ₹1,443 crore. Vi then invested the proceeds in Vi, which in turn used the money to clear some of its payment arrears to the telecom tower company.

According to industry executives, Vodafone Plc had pledged a part of its shareholding in Indus Towers to settle its outstanding dues. Subsequently, it approached Indus Towers with a request to allow it to sell these shares with an undertaking to pay the tower company through equity infusion into Vi. It, thus, effectively used the same proceeds to inject equity of ₹3,811 crore into Vi and pay Indus Towers dues.

A report by brokerage BNP Paribas dated January 10 said that Sunil Mittal-led Airtel is likely to increase its stake further in Indus to over 50% in 2023. Airtel declined to comment on this.

Vi’s dues towards Indus have mounted to around ₹7,500 crore, despite the recent payments by the telco for the tower company. It has given a commitment to Indus to pay 100% of its current dues from January onwards, and also clear its outstanding as of December 31, 2022, over seven months, starting this month.

The carrier had sounded out banks to raise around Rs 7,000 crore to clear a bulk of Indus dues. But the lenders in turn have sought clarity on the government’s potential shareholding in the telco, plans for promoters to infuse equity to shore up investor confidence and business scale-up.

Besides needing funds urgently to clear its dues to large vendors such as Indus Towers, ATC, Nokia and Ericsson and banks, the telco has to roll out 5G services as well as expand 4G coverage and rein in customer losses to Reliance Jio and Bharti Airtel.

It is widely believed that Vi needs around Rs 40,000-45,000 crore to become viable. Government officials believe of that, half should be invested by promoters.