Reliance Industries (RIL) and Adani Power have signed a 20-year power purchase agreement for 500 MW, marking a rare, strategic collaboration between conglomerates led by two of the country’s wealthiest men.

The Mukesh Ambani company will invest Rs 50 crore for a 26% stake in a 600MW unit of Mahan Energen’s thermal power plant. The latter is a wholly owned subsidiary of Gautam Adani-led Adani Power.

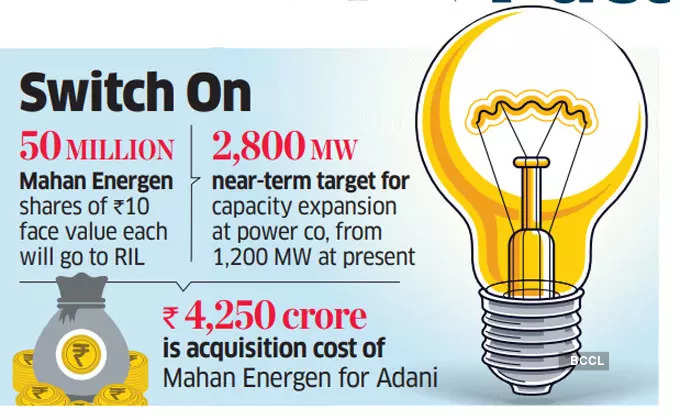

Mahan Energen has agreed to allot 50 million equity shares of Rs 10 face value each to RIL at par, Reliance said in a regulatory filing. “The proposed investment by the company is in compliance with the provisions of the Electricity Rules, 2005,” it said. RIL did not disclose any specific purpose for signing the power purchase agreement.

“One unit of 600 MW capacity of Mahan thermal power plant, out of its aggregate operating and upcoming capacity of 2,800 MW, will be designated as the captive unit for this purpose,” Adani Power said in a regulatory filing announcing the agreement with RIL.

Adani Group is investing around Rs 30,000 crore to ramp up Mahan Energen’s power generation capacity to 4,400 MW, Pranav Adani, managing director (agro, oil and gas) and director, Adani Enterprises, said earlier this month. The expansion from the near-term target of 2,800 MW to 4,400 MW is expected over the next decade.

Mahan is located in Singrauli district, Madhya Pradesh. Mahan Energen, which was incorporated in 2005, has a total capacity of 1,200 MW currently. The unit was formerly owned by Essar Power. Adani Power completed the acquisition for Rs 4,250 crore in March last year, after emerging as a successful bidder in June 2021.

Mahan’s turnover, according to audited standalone financial statements for FY23, FY22 and FY21 was Rs 2,730.68 crore, Rs 1,393.59 crore, and Rs 692.03 crore, respectively. “The investment is not a related party transaction and none of the company’s promoter/promoter group/group companies have any interest in the investment,” RIL said, adding that the deal was subject to customary conditions, including the receipt of requisite approvals by Mahan Energen.

CONSOLIDATING DEBT

In a separate regulatory announcement, Adani Power said it had consolidated different short-term loan facilities worth Rs 19,700 crore — and availed of by six special purpose vehicles (SPVs) — into a single long-term debt. Under the revised arrangement, the company will benefit from a uniform tenure and reduce effective interest rate, according to the filing.

The company said loan consolidation under a consortium financing arrangement comprising eight lenders became possible with the amalgamation of the six SPVs after the credit rating of Adani Power was enhanced to AA.