Three global private equity funds have submitted their final offers to acquire JB Chemicals, one of the oldest pharmaceutical companies in India. On Wednesday, US-based fund KKR, Apax Partners and Asia’s leading fund PAG submitted binding bids to acquire 56% stake held by JB Modi and family, promoters of JB Chemicals, according to multiple people aware of the development.

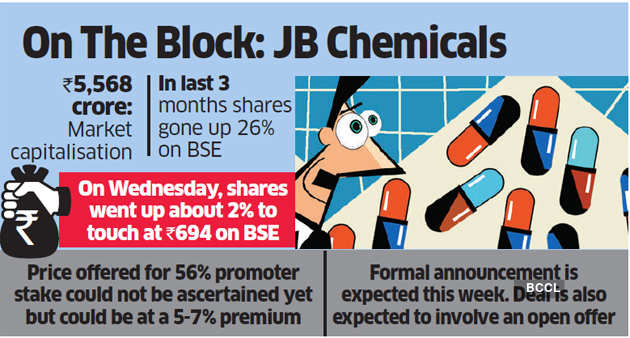

JB Chemicals has a market cap of Rs 5,568 crore. During the last three months, shares of JB Chemicals have gone up 26% on BSE. On Wednesday, JB Chemicals shares went up about 2% to touch at Rs 694 on BSE. The price offered for the stake could not be ascertained yet, but sources said it could be at a 5-7% premium but the final price negotiations will take place in the coming days.

A formal announcement is expected this week. The deal is also expected to involve an open offer. On May 6, ET had first reported that four funds including Carlyle are in talks to acquire JB Chemicals, valuing the company at Rs 5,000 crore ($650 million). Investment bank Avendus advises the promoters on the stake sale.

The US-based PE firm The Carlyle Group, which had acquired 74% stake in Bengaluru-based SeQuent Scientific Ltd, did not submit a final bid for JB Chemicals stake. Started as an API and formulations manufacturer in 1976, JB Chemicals ranks 36 in the Indian pharma market, with a sales revenue of Rs 1,501 crore and net profit of Rs 182 crore in FY19, according to pharma consultancy firm AWACS Spokespersons with KKR, Apax Partners and PAG declined to comment while mails sent to JB Chemicals did not elicit any responses till the press time.

Though a large number of sectors have seen a decline in PE investments in India during the Covid-19 induced lockdown, pharmaceuticals & healthcare has kept the momentum. In the last couple of months, a handful of global PE funds have announced their deals in the Indian pharma and healthcare sector, especially in listed entities.

In the near-term, PE/VC investors are expected to do more private investment in public equity (PIPE) deals relative to what was done in 2019, according to a recent EY report ‘Covid-19: Projected Impact on Indian PE/VC’. As valuations in the public markets have corrected significantly, PE funds should be able to move quickly as quality listed businesses attempt to shore up cash and as foreign portfolio investors (FPIs) look to reduce their positions as a result of redemption pressures in their home markets, it added.

Source: Economic Times