PE Group Apax Partners is all set to acquire a significant minority stake in Quest Global Services, a leading engineering outsourcing firm, after outbidding the only other firm contender The Carlyle Group, said multiple people aware of the development.

Binding bids went in last week but TA Associates, the third party in the race, did not participate.

Apax is looking to acquire up to 40% stake primarily from the two existing investors -Advent International and Bain Capital – valuing the company at $2.1 billion. The two funds together own around 33% of the company. Singapore’s investment firm GIC, which also owns a small 2-3% stake in the company, may also tag along. Some of the co-founders and management, too, are open to dilution.

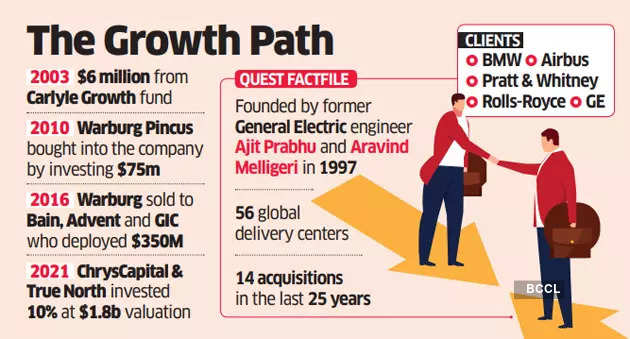

In 2021, Quest Global was valued at $1.8 billion when an investor consortium consisting of home-grown PE investors ChrysCapital and True North picked up below 10% stake in the company.

Quest, founded by former General Electric Co engineer Ajit Prabhu and Aravind Melligeri in 1997, considers Pratt &Whitney, Rolls Royce, BMW, Airbus and GE among its clients. However, in recent years, two of its key clients Rolls Royce and Apple have ceased to do business with the company.

With operations spread across 17 countries and 56 global delivery centers, the company specialises in aerospace & defense, automotive, energy, hi-tech, healthcare, medical devices, rail and semiconductor industries.

Ajit Prabhu remains the largest and controlling shareholder, with close to 50% stake in the company.

“Investments by private equity firms are an integral part of our overall growth strategy and are part of the normal course of business. Investments and exits by private equity firms fluctuate and are prudently planned,” said a Quest Global spokesperson.

Apax Partners and Advent declined to comment. Mails to Carlyle and Bain Capital remained unanswered.

Based in Singapore, Quest Global has posted revenue of $598 million in FY21, down from $699.5 million in FY20. It posted a PAT of $52.4 million in FY21 against $81.2 million in FY20, Tracxn data showed. Earnings before interest and taxes (EBIT) for FY21 were $87.9 million against $107.6 million a year ago. By the end of FY22, the company witnessed almost 50% growth in the engineering team for the medical devices vertical.

The company expects revenue of $800 million and an EBITDA of $140 million in FY23, said industry observers, with 15-20% growth expected in FY24.

Quest has made 14 acquisitions in the last 25 years. It started out doing mechanical work for clients – aerospace, auto designs etc but then diversified into electronic design services for healthcare and medical devices companies by acquiring Trivandrum-based Nest Software. Afterwards, it also added the software aspect of product designing by buying Exilant Technologies, helping clinch clients such as Apple. The company even had a manufacturing arm that was hived off early on in order to focus on tech services.

Apax, Carlyle and TA Associates are in the final race to acquire a significant minority stake in Quest Global Services, ET first reported in November last year. These three were shortlisted from the non-binding offers submitted in the second round of negotiations, and the proposed deal is expected to value Quest at $2.3-2.5 billion, ET reported.

Investment banks JP Morgan and Barclays are advising the investors.

Bain, Advent and GIC acquired the stakes from Warburg Pincus for $350 million. Warburg had deployed $75 million in Quest in 2010. Carlyle was an early-stage investor in Quest with an investment of $6 million in 2003, which was bought back by the promoters later.

Apax Partners, which owns several outsourcing businesses globally, has been an aggressive investor in the Indian IT/ITES space.

In 2021, it had acquired digital and software services provider Infogain Co from Chryscapital. Apax had also bought 3i Infotech’s software products business in 2020 for around $136 million. It also partially owns a quarter (25% stake) in artificial intelligence & analytics solutions provider Fractal Analytics, after investing $200 million (Rs 1,400 crore) in 2019.

Apax was also one among the contenders for the healthcare business of outsourcing company Hinduja Global Solutions, which was sold in 2021 to Baring Private Equity Asia.

Apax Partners, which also owned half of outsourced product development firm GlobalLogic, had sold its stake to private equity firm Partners Group, valuing the company at over $ 2 billion in 2018. Apax invested in leading companies such as ThoughtWorks, Zensar and EVRY.

At $54.2 billion, PE/VC investments in 2022 are down by 29% on a y-o-y basis despite a modest 4.6% decline in the deal volume, according to an EY report. The decline was precipitated by a sharp fall in large deals in the buyout and start-up deal segments of the pure play PE asset class, it said.

Technology and e-commerce, which were the favourite sectors in 2021 recorded $5.2 billion and $5.1 billion in PE/VC investments respectively, both recording a 68% decline y-o-y.