Apollo Global Management is doubling down on Sajjan Jindal led JSW Group, joining Synergy Metals Investments for a Rs 1500 crore capital raise in the conglomerate’s cement business run by his son Parth, to fund its growth plans to become a 25 million tonnes scaled operations, said people in the know.

The capital raise coincides with an uptick in demand from real estate and construction after lockdown resulting in most cement stocks outperform the Nifty over the past month and past year.

Dubai-based Synergy Fund, spearheaded by Sudhir Maheshwari, a long time Arcelor Mittal executive, had already sought clearance from the Competition Commission of India for acquiring an equity stake in JSW Cement and got its clearance under green channel route on July 15th. Apollo is expected to sign its final agreement this coming week.

JSW Cement will be issuing compulsorily convertible preference shares (CCPS) to the two investors who are each putting in Rs 750 crores at a post money valuation of around Rs 8500-Rs 8750 crore. The CCPS have a 5 year maturity or can be converted into equity shares earlier at the time of the company’s planned listing, scheduled in the next 18-24 months. Upon conversion, the investors can own up to 19% of the company. They also get a board seat each.

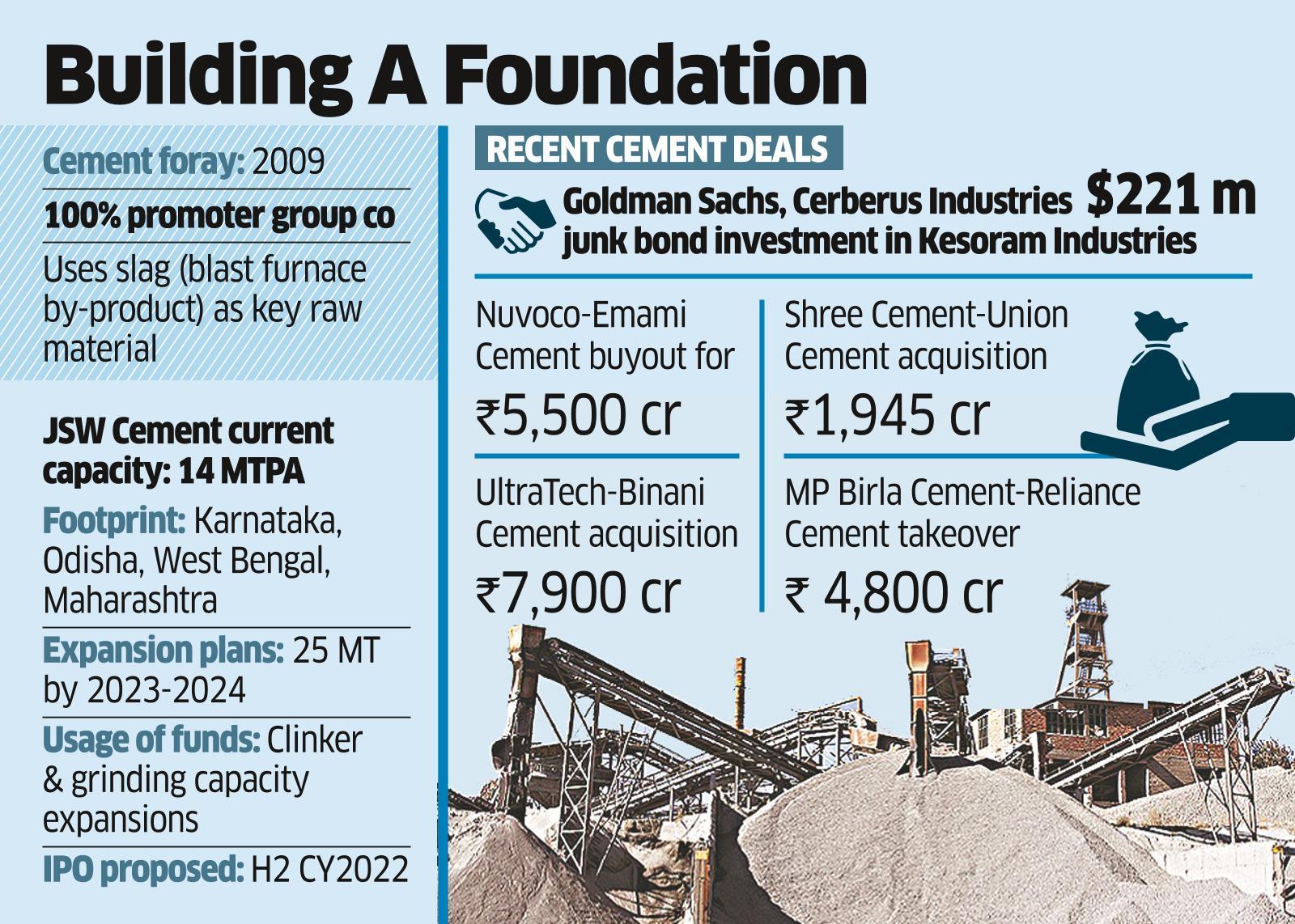

JSW Cement is wholly owned by the Jindal family. The investments are seen as a precursor to the company’s initial public listing that was originally planned for last year but got pushed due to the pandemic to the second half of 2022.

In an earlier interaction, Parth Jindal, Managing Director of JSW Cement had said that the JSW Group was seeking growth equity from external sources to fund its latest round of expansions before the two businesses go public. The growth plans were to be equally funded through a combination of debt and internal accruals of Rs 2000 crore and Rs 1500 crore of private equity investments.

“Currently we are in the market for a capital raise for our paints and cement businesses,” Parth Jindal, managing director of the two companies, told ET. “Citibank has been appointed as the lead banker for JSW Cement and O3 Capital, a boutique investment bank, has been mandated with the fundraising for JSW Paints,” he told ET in November last year.

In FY21, the company is expected to generate Rs 850-880 crore EBITDA on the back of Rs 4000-Rs 4500 crore of revenues.

JSW and Apollo declined to comment.

This will be the second investment for Apollo in JSW Group, one of the largest alternative asset managers in the world. In 2018, Apollo had teamed up with Jindal to acquire

through the bankruptcy process. Apollo has already monetised 20% of its Rs 500 crore investment in Monnet at a 3.5X return.

The funds are expected to be used to expand JSW Cement’s grinder and clinker capacity in east and south that will almost double its current 14 MTPA capacity.

The group entered the cement market in 2009 as it saw synergies with its core steel operations. It uses slag, a by product from the blast furnace, from steel plants to produce portland slag cement. Its plants therefore are co-located in Vijayanagar, Karnataka, Nandyal in Andhra Pradesh; Salboni in West Bengal and Dolvi in Maharashtra, adjoining steel units.

Parth Jindal has charted an ambitious plan to achieve 50 million tonnes/yr acapacity and has been expanding its footprint both organically or through acquisitions and a pan-India player by the end of FY 25 -26. It had very aggressively pursued Lafarge-Holcim to buy its 11 MTPA Indian operation in 2016 and bulk up, but was outbidded by Nirma (since renamed Nuvoco Vista), the eventual winners.

The company, which was only into portland slag cement (PSC), entered the ready mix concrete (RMC) business in 2021 with its first commercial unit in Chembur, Mumbai to capitalise on the Rs 18,750 crore addressable market that is slated to grow at a 9% CAGR till 2025, driven by housing and construction sector boom. It is also aggressively foraying into ground granulated blast furnance slag (GGBS), a variant that are becoming popular as a building material. It also has higher margins of 300 bps compared to other varieties.

“The cement operations have huge synergies with JSW steel in distribution, access to raw materials which makes it uniquely poised. A 20 million tonnes plus capacity helps one to break into the top 5 club and in this business scale helps improve operating leverage, branding and marketing which further adds to valuation,” said an official privy to the discussions, on condition of anonymity. Last year it announced a Rs 1500 crore capex for a 1.36 mtpa clinker unit in its Orissa operations.

Ultratech and Lafarge Holcim are the two largest players in the country, with 24-30% of the 545 MTPA total cement capacity. Several players Dalmia Bharat, Shree, Nuvoco Vista, India Cement, Ramco, Birla Cement are bunched up in the 15-25 MTPA range and has been looking at consolidation opportunities which has picked up in recent years with the sale of Emami, Reliance Group, Binani among others.

The industry is expected to post approximately 45% YoY growth in volumes despite rising input costs with pan-India utilisation at ~70% in west and south seeing a maximum upswing.

“Demand is picking up again June onwards. Good demand and increased consolidation is helping the industry to pass on cost inflation,” said Rajesh Ravi, a cement analyst with HDFC Securities. “Fuel cost continues to rise unabated – pet coke prices are up 11% QoQ and ~85% YoY. Imported coal prices are up 15- 22% QoQ (~75% YoY). Even diesel prices have shot up 6/28% QoQ/YoY. Thus, we expect unitary EBITDA to cool off to approximately Rs 100/MT in FY22E.”