ArcelorMittal, the world’s biggest steel maker is making a play for Sprng Energy, Indian renewable platform of Actis, as the steelmaker looks at cleaner energy sources to decarbonise production around the world and in India, said people aware of the development.

This arguably is the first time in India a steel producer is looking at such large M&A opportunities in green energy. Steel production is source of up to a tenth of global carbon-dioxide emissions.

ArcelorMittal joins the buyout race to compete with Royal Dutch Shell, Adani Group, Singapore’s Sembcorp Energy, and Canadian pension fund CPPIB after Macquarie, another initial contender chose to opt out of this potentially $2 billion transaction (enterprise value) which saw 17 initial contenders, the sources mentioned above added.

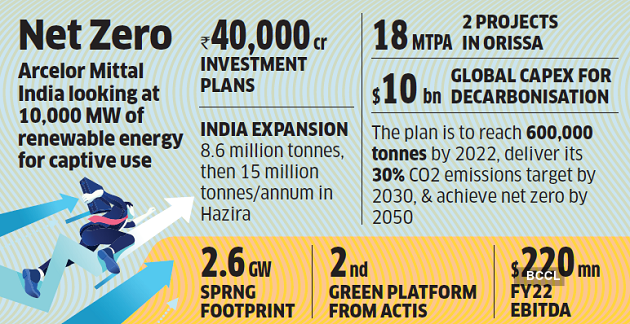

Last year, Actis had mandated Bank of America to officially launch the sale process for Sprng Energy. This is the second platform that Actis had created after it sold Ostro Energy, its original green power platform, to ReNew Power Ventures in 2018 at an enterprise value of $1.5 billion. Sprng Energy has signed power purchase agreements (PPAs) for 2.6 gigawatts (GW), of which 2.1 GW will be operational by March 2022, while another 600 MW is expected to be operational by March 2023. The FY22 ebitda for all the contracted assets is pegged at $220 million.

The acquisition is part of a $10 billion global green transformation strategy that kicked off in 2020 and is spearheaded by Group CEO, Aditya Mittal (46) who took charge last year, from his father Laxmi Mittal, of the sprawling empire that stretches across Europe, Asia, Americas and Africa. Steel companies, much like fossil fuel behemoths are under pressure from policy makers, climate activists and Wall Street to shun legacy practices of carbon emission. Goldman Sachs is advising the company.

Arcelor Mittal’s India operations are centred around Essar Steel India, located in Hazira, Gujarat, which it acquired in 2019, for ₹42,000 crore – the largest asset sale through the country’s bankruptcy courts – with its 40% joint venture partner Nippon Steel Corporation of Japan. The technical diligence is ongoing to be followed by management meetings and final bids by mid-March.

Arcelor Mittal, Actis declined to comment.

Clean, green steel

The company has already created global renewable subsidiary to build a strategy around carbon capture, production of green hydrogen – both as a fuel and a reductant, energy storage that will help convert many of their coal burning blast furnaces, the carbon-heaviest of steelmaking technologies, and slash emissions. The plan is to reach 600,000 tonnes by 2022, deliver its 30% CO2 emissions target by 2030, and achieve net zero by 2050 using hydrogen in the more advanced direct-reduced-iron (DRI) and electric-arc-furnace (eaf) plants, instead of the prevailing fuel — natural gas. European steelmaking has been traditionally led by coking coal fired blast furnaces that are used to soak up oxygen from oron ore but are doubly carbon-intensive as well as generate ‘dirty’ energy to fire up the furnaces. Arcelor Mittal is also keen to use smart carbon with lower carbon footprint, again utilising hydrogen.

In India alone, AMNS India is looking at 10,000 MW of renewable energy, in phases, to meet the own requirement starting with an initial 500 MW. According to the company, it is looking at Rs 40,000 crore to set up solar, wind and hybrid power generation facilities in India as it looks to expand the Hazira operations to 8.6 million tonnes and then to 15 million tonnes/annum while also expand in the east coast in Orissa with two projects of 18 million tonnes. “Acquisitions are a faster way to ramp up. ArcelorMittal is spending $10 billion to cut emissions. The need to turn green is acute for carbon-intensive sector like steel and to mitigate green field risks like land acquisitions,” said a UK-based consultant privy to the company’s plans, on condition of anonymity. “The green transformation is still expensive and might push costs up by 30% as per estimates.”

McKinsey reckons decarbonising steel requires investment of $145bn a year on average for the next 30 years. “The company has already announced decarbonisation investment plans for European countries such as Belgium, Germany and Spain. We believe that this will largely depend on the level of government support in building out the hydrogen infrastructure and supplying competitively priced clean electricity,” argued Alain Gabriel, analyst with Morgan Stanley.

The Actis platform was set up by Actis Fund IV with an equity commitment of $475 million in March 2017. Sprng Energy expanded its portfolio by buying out assets with a capacity of 600 MW from Acme Cleantech last year and the 194 MW solar energy portfolio of the Shapoorji Pallonji Group in 2019.

Adani Green, CPPIB have both been doubling down on India investment with investments and buyouts ranging from Softbank’s India portfolio SB Energy to bankrolling Renew Power among others. Singapore government backed Semcorp however has not made any acquisitions after it took over assets of Green Infra in 2015 but aims to have a gross installed renewable energy capacity of 10 Gw by 2025.

CPPIB, Sembcorp declined comment. Mails to Adani did not generate a response.

Since February 2021, Shell has detailed its strategy to achieve its target to be a net-zero emissions energy business by 2050. Last December, it acquired US-based solar and energy storage developer Savion from Macquarie’s Green Investment Group, to expand its global solar portfolio as part of the push to move to net-zero emissions. However, Shell does not have any major presence in the Indian clean energy space and only holds about 49% of solar power producer Cleantech Solar Energy.