Promoters of Aster DM Healthcare led by Azad Moopen have initiated stake-sale talks with private equity groups such as Blackstone and KKR among others, said people aware of the matter. The promoters may even be open to selling a controlling stake in their India-listed hospital chain to capitalise on the ongoing sectoral consolidation, the people said.

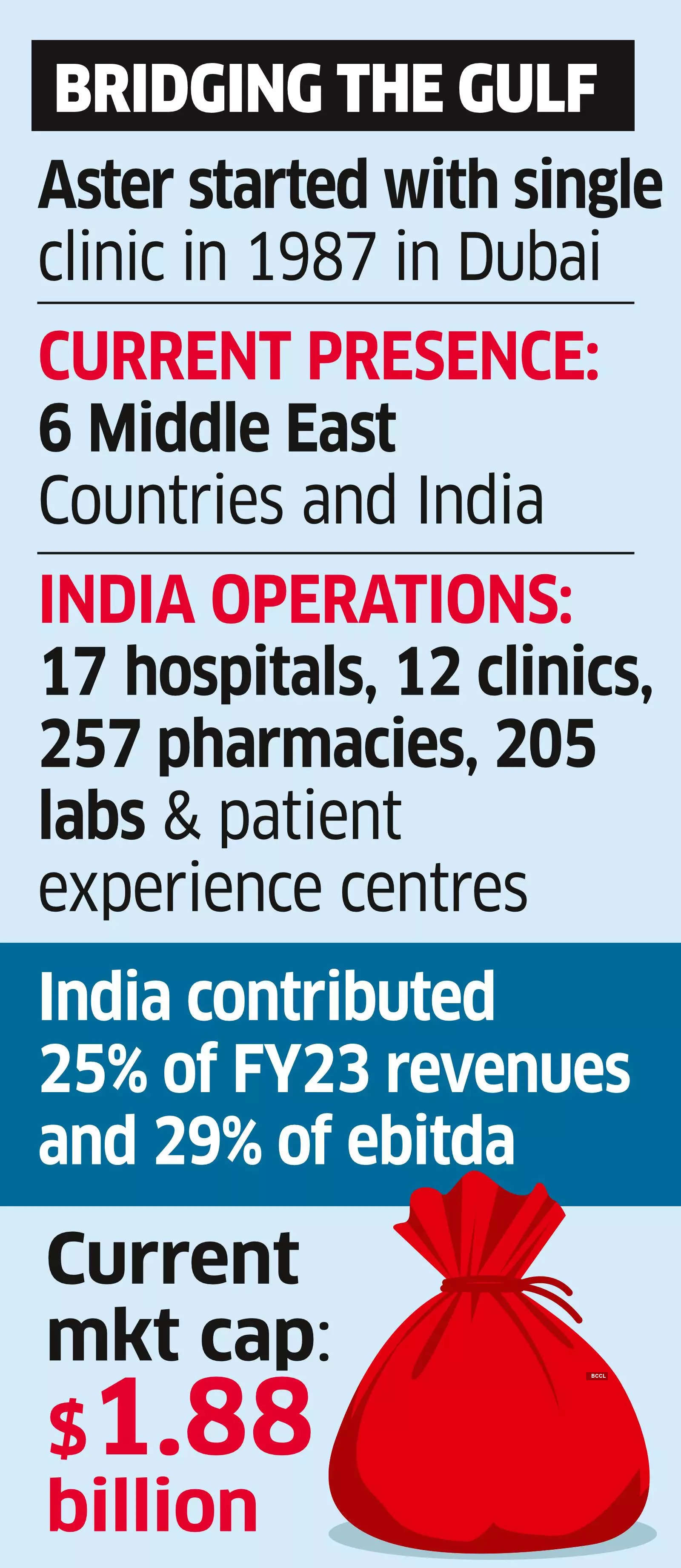

Aster Healthcare operates 32 hospitals, 127 clinics, 521 pharmacies, 16 laboratories and 189 patient experience centres in seven countries in West Asia and India. It expanded facilities from 300 in 2017 to over 885 in FY23, including hospitals, clinics, pharmacies and labs, estimates HSBC. India contributes 25% of FY23 revenues and 29% of ebitda.

The talks, preliminary in nature, are expected to gather pace once the Gulf business is separated from the India parent and 65% of that is sold to a consortium led by Dubai-based PE firm Fajr Capital at a $500 million valuation, as per reports.

Max too might be interested

Those discussions are at an advanced stage.

Aster is “exploring a potential restructuring for segregation of the company’s business in Gulf Co-operation Council (GCC) region from its business in India”, it said in an exchange filing on July 5. “The company has engaged in discussions with various potential counterparties, including Fajr Capital. Such discussions continue to be ongoing.”

Reuters broke the Fajr Capital story earlier this week.

Once the money for the Gulf transaction gets transferred, assets are separated and regulatory approvals come through, industry observers believe the deal for the India piece will gather momentum.

Early discussions between Blackstone and Dr Moopen for example have been centred around the possibility of reverse merging the India portfolio of Care Hospitals with the listed India business of Aster. Since May, Care has been under Bombay High Court-directed private arbitration. Max Healthcare sued a TPG-owned entity that owns Care Chain of Hospitals for alleged breach of contracts and term sheet agreements. As of now, it’s unlikely Blackstone will use another platform or invest in Aster directly.

“Blackstone is not a party to the private arbitration process,” said a person with knowledge of the matter. “They feel they have a better deal in place for Care that includes buying 75% of the entire company and TPG retaining a quarter. They feel their valuation and binding agreement with TPG is far more compelling but the ongoing litigation is certainly a risk nobody can discount for.”

Similar discussions have also taken place with KKR, till recently the biggest backer of Max Healthcare. Both funds are keen on a controlling stake or at least a clear path to control that’s previously agreed. The Moopen family is expected to retain a 35% post-sale stake in the Gulf business.

There is no formal sale process yet and people in the know said these are early-stage discussions that may or may not lead to a transaction. Strategic players like Max too might be interested in entering the fray once the situation becomes clearer, industry watchers said. Healthcare is a prime target for most buyout funds.

Aster DM declined to comment as did Blackstone, KKR and Max.

In the past, advisers had approached Ranjan Pai of Manipal Hospitals as well but differences over board positions, chairmanship and brand usage scuppered those talks, said people aware of the matter.

Shares of Aster DM Healthcare ended 16% higher on Tuesday, marking the biggest single-day gain since its 2018 listing. It touched an all-time high in the day in anticipation of the Gulf deal and the resultant reorganisation. Since then it’s dropped almost 5%, ending Thursday at Rs 310.80. The company’s current market value is Rs 15,524.87 crore ($1.88 billion) with the promoter family owning 41.9%.

Any transaction will trigger an open offer for an additional 26%. Deal details haven’t yet been finalised. The Moopen family might retain a small stake even after giving up control for value maximisation.

“Key trigger for the stock includes the proposed restructuring of the business. Recent correction in the stock price (~9% in last 3 months) makes valuations reasonable,” said Rohan John of ICICI Securities.