American Tower Corp (ATC) has said it is exploring the sale of an equity stake in its India operations to one or more private investors amid a challenging business environment in the country.

The Boston-based tower company, in a recent filing to the US Securities and Exchange Commission (SEC), said a possible stake sale is part of its broader efforts to reduce its exposure in India.

This comes after its largest customer in the country, Vodafone Idea (Vi) in early 2023 said it won’t be able to resume payments in full of its contractual obligations owed to ATC.

ATC, which recently took a $411.6 million (about Rs 3,374 crore) impairment charge due to cash-strapped Vi’s partial payments, has further warned that it would be forced to take more similar charges amidst the India telco’s financial woes.

“We are sensitive to adverse changes in the creditworthiness and financial strength of our customers…we are exploring various strategic alternatives, including the sale of an equity interest in our India operations to one or more private investors, (though), any such proposed transaction would be subject to conditions, including regulatory approvals in India,” ATC said in an SEC filing dated February 23.

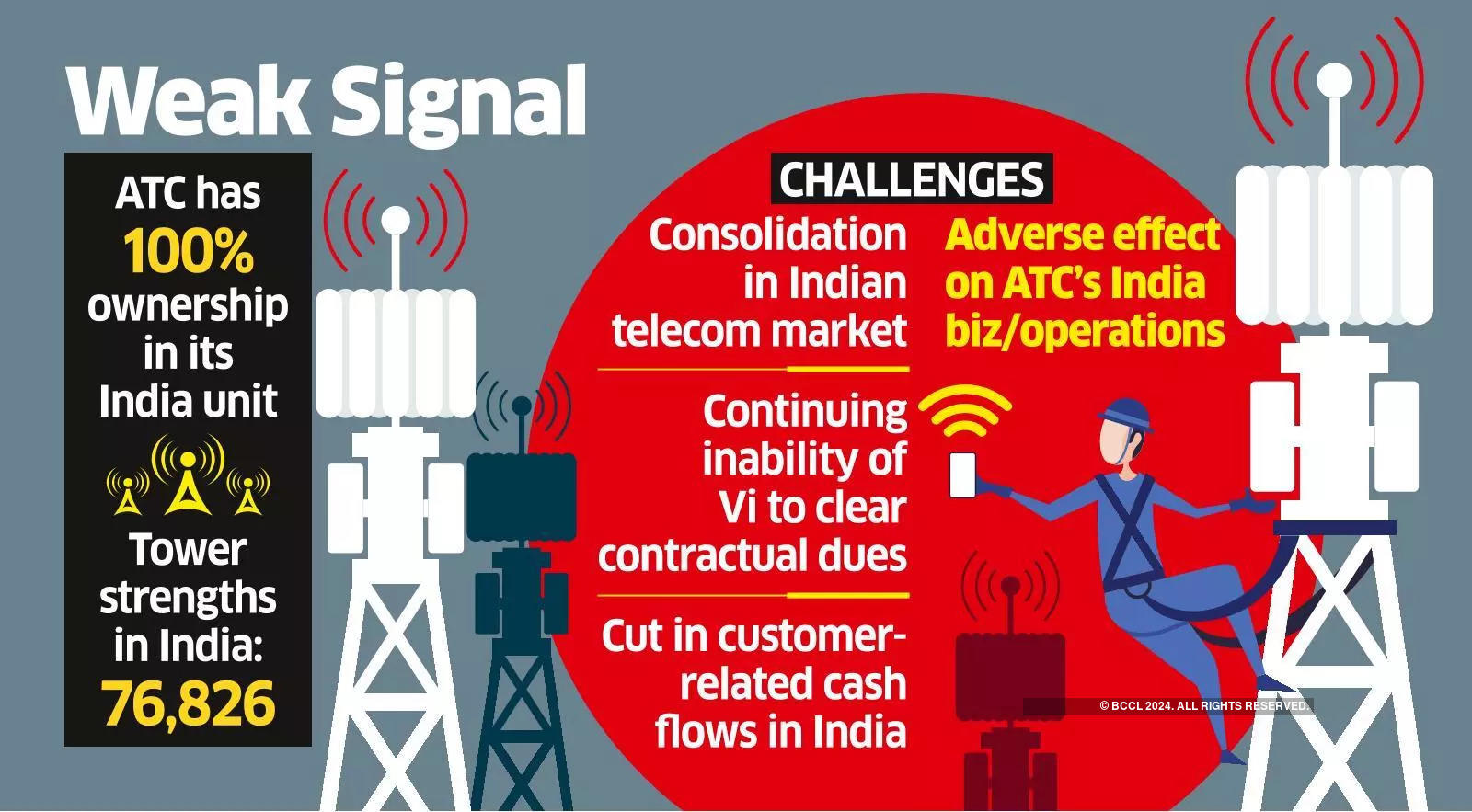

At present, ATC has 100% ownership in its India unit, ATC Telecom Infrastructure Pvt Ltd (ATC TIPL), which holds an Infrastructure Provider Category-I (IP-I) registration certificate issued by the communications ministry.

Over the years, ATC had made huge bets in India, expanding its towers portfolio aggressively through acquisitions to 76,826, as of end-December 2022. But a combination of rapid consolidation in the Indian telecom market and the continuing inability of Vi to clear its contractual dues have posed business challenges for ATC.

The US tower company did not reply to ET’s queries on the status of its planned stake sale in India as of press time Tuesday.

In its SEC filing, ATC said Vi may not be able to meet its operating obligations, including future payments, which may result in ATC incurring additional impairment expenses, hurting its business and results of operations.

Late February, Vi had allotted optionally convertible debentures (OCDs) worth Rs 1,600 crore to ATC TIPL. The proceeds are being used to clear the US tower firm’s dues. Vi owes ATC an estimated Rs 2,000 crore.

At Vi’s fiscal third quarter earnings call, chief executive Akshaya Moondra said the loss-making telco needed to first get its long-pending external funding to be able to make investments and improve its operational cash flows before addressing vendor payments. Vi has also been having trouble clearing dues of over Rs 7,000 crore of another tower company, Indus Towers. Its cash balance was a paltry Rs 160 crore at December 31, 2022, while net debt stood at around Rs 2.22 lakh crore.

Without directly naming Vi, ATC said in its international operations, many customers are subsidiaries of global telecom companies, and that these subsidiaries may not have the explicit or implied financial support of their parent entities.

“…if our customers are unable to raise adequate capital to fund their business plans or face capital constraints, they may reduce their spending, file for bankruptcy or reduce or terminate operations, which could materially and adversely affect demand for our communications infrastructure and our services business,” ATC said.

The US tower company has also warned that any significant cut in its customer-related cash flows in India could also impact its tower portfolio and network location intangible assets in the country.

The carrying values of ATC’s tower portfolio and network location intangible assets in India were at $905.8 million and $266.7 million, respectively, as of December 31, 2022, representing 10% and 8% of its consolidated balances of $8.8 billion and $3.5 billion, respectively, the US company said in its filing.

Source: Economic Times