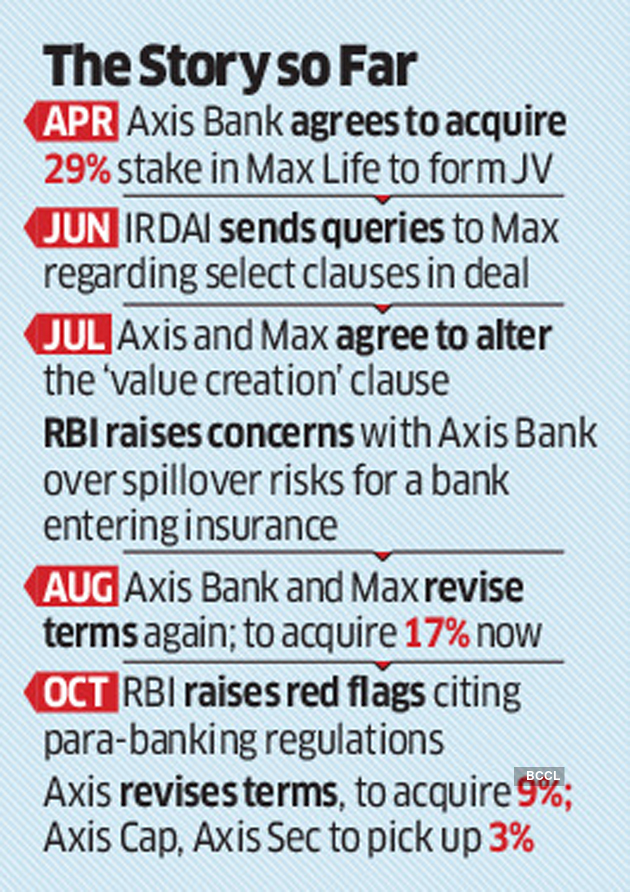

Axis Bank has yet again revised the terms of its deal with Max Financial to form a joint venture involving the latter’s life insurance entity after the previous agreement was deemed not in line with existing laws by the Reserve Bank of India.

As per the revised deal, Axis Bank now plans to acquire up to 9% as opposed to the earlier agreed-upon 17% of the equity share capital of Max Life while its subsidiaries Axis Capital and Axis Securities will together acquire up to 3%, the private lender said in a regulatory filing on Friday.

Furthermore, the Axis entities part of the revised deal will also hold a right to further acquire an additional stake of up to 7% in Max Life in tranches. This deal, however, is subject to approvals from the regulatory authorities including RBI and Irdai.

As reported first by ET on July 27, the share purchase agreement between Axis Bank and Max Financial didn’t get RBI nod as it flouted the para banking guidelines of the central bank.

“In response to Axis Bank’s application to the Reserve Bank of India for directly acquiring 17.002% of the equity share capital of Max Life, the Reserve Bank of India has advised Axis Bank that the application for direct acquisition…not been considered,” the private lender said in a stock exchange filing on Friday.

“However, Axis Bank has been advised to be guided by Para 5(b) of Master Direction- Reserve Bank of India (Financial Services provided by Banks) Directions, 2016 dated May 26, 2016 as updated from time to time (“Para 5(b). )”),” the disclosure stated.

Banks in India are not allowed to hold more than 10 % of the paid-up equity capital in any deposit-taking NBFC, as per the cited section of banking regulation. The revised agreement has now been drafted keeping in cognizance these rules, as directed by the central bank, according to the disclosure.

“The Revised Agreements will supersede the previous agreements entered into between the parties. The transaction is subject to conditions precedent, including regulatory approvals,” it said.

The proposed deal between Axis and Max has been subject to intense regulatory scrutiny resulting in the parties already having to revise terms of the deal thrice.

Axis Bank had to bring its proposed stake purchase to 17% from the earlier agreed upon 29%. Even before that, the Insurance Regulatory and Development Authority of India (IRDAI) had sought clarifications from Analjit Singh led Max Financials on several clauses of the deal such including a “value creation options.”

Subsequently, the parties had to revise the clause in the proposed deal that allowed the lender to exit the JV at a fixed price if the said options are not consummated within 63 months of closing the deal.

To be sure, Axis Bank in April had first announced its plans to raise its stake in Max Life to 30% from 1% for a deal worth Rs. 1,592 crore at an agreed price of Rs. 28.61 per share. Japanese insurer Mitsui Sumitomo holds 25.5% share in Max Life.

This is the second time that a deal pertaining to Max Financial Services has faced difficulties with the regulator. In 2016, Max Financial and HDFC Life entered into a definitive share purchase agreement. However, the same was terminated in 2017 as the insurance regulator expressed several concerns over it. Subsequently, HDFC Life went ahead with a public listing on its own.

As envisaged originally by the two parties, the proposed Joint Venture on the hook will help Max Life compete with leading insurers such as SBI Life, ICICI Prudential and HDFC Life who have bancassurance tie-ups with top banks to cross sell policies at branches. While Axis Bank has been Max Life’s Banca partner till now, the deal will also help Axis Bank shore up its commission and fee revenue as well.

Source: Economic Times