Investors in Ayana Renewable Power plan to offload a part of their stake to raise as much as $800 million (Rs 6,650 crore), with a portion of it to be used for funding the expansion plans of the renewable energy platform, people aware of the development said. The investors are in discussions to hire an investment bank to run the sale process, they said.

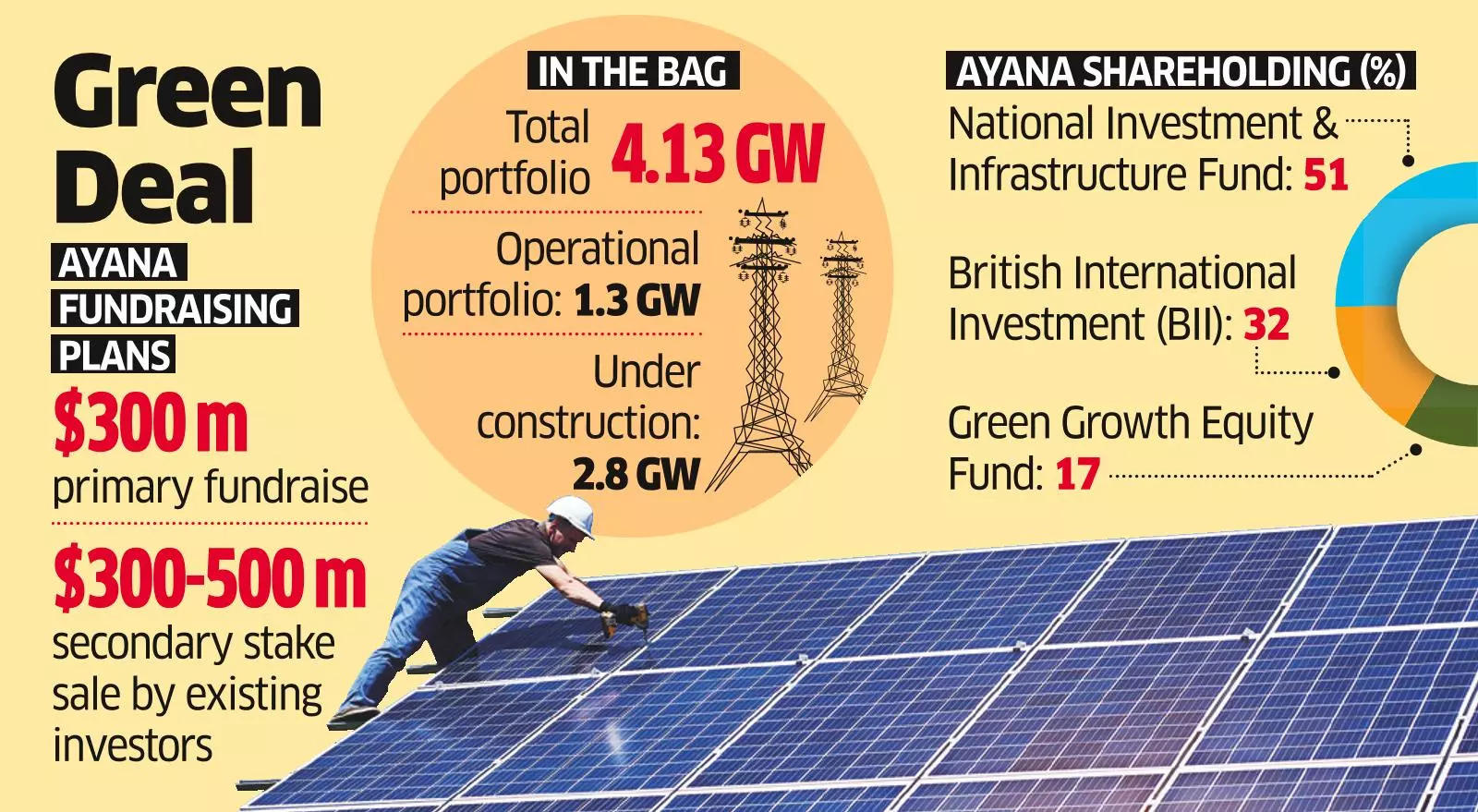

The National Investment & Infrastructure Fund (NIIF) owns a 51% stake in Ayana, while British International Investment (formerly CDC Group) holds 32% and Eversource Capital-managed Green Growth Equity Fund has the remaining 17% stake.

This round will involve a secondary sale of shares worth $300-500 million by the three investors, and an issue of fresh shares for $300 million, the people said. The current shareholders will sell part of their stake on a pro-rata basis and are at this stage not looking at a complete exit from the platform, they added. The quantum of the secondary stake sale and valuation details are not yet finalised.

Ayana is currently involved in the development and management of more than 4 GW of solar, wind and hybrid power projects in several Indian states. It has an operational capacity of 1.3 GW of renewable energy projects in Andhra Pradesh, Karnataka and Rajasthan.

Founded in 2018 and headquartered in Bengaluru, Ayana develops utility-scale solar, wind and hybrid projects.

Till date, the investors – NIIF, British International Investment and Green Growth – have made a capital commitment of $721 million in the company.

A British International Investment spokesperson declined to comment, while emails sent to NIIF and Eversource did not elicit any responses till press time on Thursday.

Ayana’s underdevelopment projects of 2.8 GW comprise 2 GW of solar, wind and hybrid assets with firm power purchase agreements (PPAs). For the remaining, which it won through the bidding route, PPAs are pending to be signed. Of this, the group expects to commission a 300-MW wind power asset in the ongoing FY24 and the balance through FY25 and FY26, subject to the timely signing of PPAs.

The company has another 350 MW projects in the pipeline currently, said an ICRA report.

Of its total portfolio of over 4 GW, it has signed long-term PPAs for 3.2 GW at fixed tariffs, providing revenue visibility. The tariffs offered by the group’s projects, with a weighted average tariff of ‘2.73 per unit, is highly competitive and are likely to remain competitive in the long run, given the average power purchase cost for the utilities remains relatively high at more than ‘4 a unit, said the report.