Bain Capital has pipped private equity rival Apax Partners and Fujitsu of Japan to emerge as the frontrunner to buy a 40% stake in CitiusTech for $960 million to $1 billion, as Baring Private Equity Asia (BPEA) is selling half its stake in the healthcare analytics company, said people aware of the matter.

The two sides have signed an exclusivity agreement earlier this week for just 48 hours, as competition for the asset has been immense and has drawn interests from multiple suitors including Carlyle, TPG Capital among others. The offer values Mumbai-based CitiusTech at around $2.4-2.5 billion.

If successful, this would be the second investment by the Boston-headquartered PE group in as many months in India, after having bought into IIFL Wealth end-March. In the last fiscal year, it missed out on as many as five transactions, coming in a close second, as per PE industry executives.

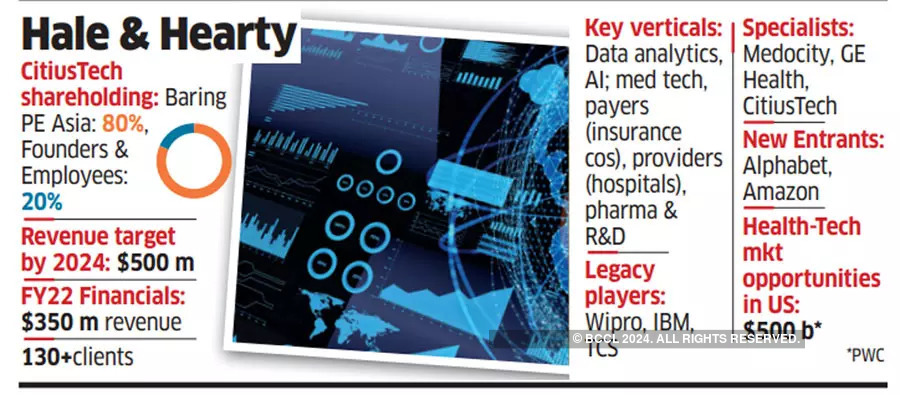

In 2019, BPEA bought an 80% stake in CitiusTech from General Atlantic for about $750 million. The remaining stake is held by the two founders, serial tech entrepreneur Rizwan Koita and his fellow Indian Institute of Technology alumnus Jagdish Moorjani, as well as employees.

$3.9b Across 12 Cos in India

The founders are unlikely to sell any stake now.

Koita was also the founder and CEO of Transworks BPO, which was sold to the Aditya Birla Group in 2003. He set up CitiusTech in 2005 with Moorjani.

Baring Asia declined to comment while an email sent to Bain Capital remained unanswered at press time Tuesday. Koita did not respond to messages.

ET in its March 16 edition reported that Baring was contemplating selling the company after scrapping its earlier plans of a SPAC listing in the US. JP Morgan was mandated to run a stake sale or listing exercise.

Bloomberg on March 28 reported that the company had filed confidentially for a US initial public offering. But in the same month, BPEA itself got sold to Swedish PE major EQT AB for $7.5 billion in the biggest-ever takeover of a private equity firm by a rival. This led to a mid-course revision in strategy and, instead of selling out fully, Baring chose to only part sell.

CitiusTech provides technology services and solutions to more than 130 organisations across the payer, provider, medical technology and life sciences markets. With more than 5,000 technology professionals worldwide, it focuses on healthcare interoperability & data management, connected health, virtual care coordination & delivery, personalised medicine and population health management. Its clients include US-based Geisinger Health, DaVita and Centra Health.