Bain Capital is in talks to acquire a controlling stake in Manappuram Finance, betting on the country’s gold loan sector, said people with knowledge of the matter. This comes as the founding family of the Kerala-based non-bank lender and leading gold loan provider is revisiting plans to exit partially or fully, they said.

Manappuram and others in the segment have been battling heightened regulatory scrutiny and falling valuations as mixed success in diversification has intensified near-term headwinds.

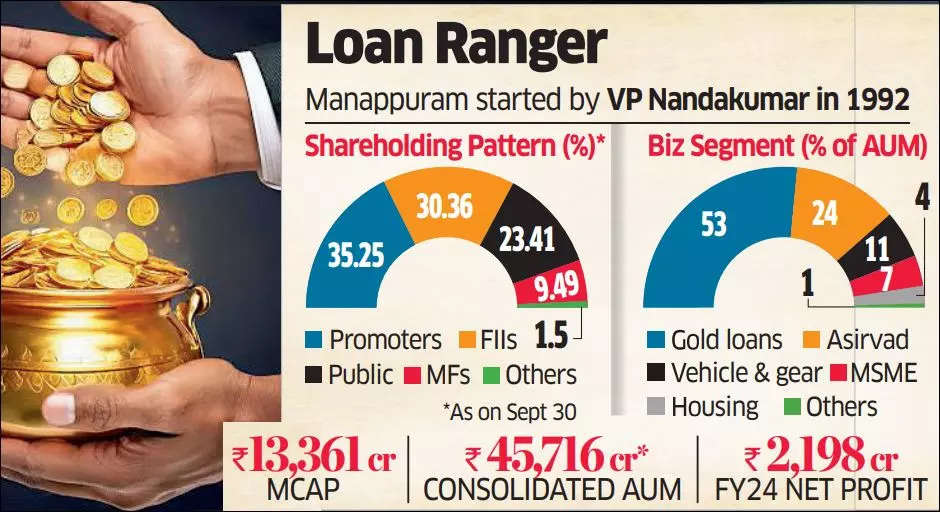

MD and CEO VP Nandakumar, who owns 35.25% of the company with his family members as the promoter group, dismissed talk of divestment.

“No plans to sell my stake. It’s denied,” he told ET.

Nandakumar took over the family gold loan business from his late father and set up the company in 1992.

Bain is said to have shown interest in buying a 10-11% stake from Nandakumar’s family and simultaneously infusing Rs 2,000 crore of primary capital into the shadow lender via a preferential allotment. It will then make a voluntary open offer for an additional 25% of the company which, if fully subscribed, will take its economic interest to 45-47%, making it the single largest shareholder. Bain is keen on controlling rights to ensure the company is professionally run. Bain is said to have offered a premium of 20-25% to the current market price. However, this could not be independently verified. At the present market value, a 47% stake would cost Rs 6,289.46 crore.

Nandakumar is trying to retain control and only dilute a smaller 5-10% to bring in “confidence capital,” said one of the persons. But the Boston-headquartered private equity (PE) group has made clear that a minority stake is of no interest.

The PE firm declined to comment.

“Bain knows the space and can scale the business further under a new team. It’s a great annuity business that throws up cash and has a running portfolio and distribution,” said an executive aware of the discussions. “By retaining a smaller stake, the promoter family can enjoy the economic upside. They are important for business continuity but a change in ownership will ensure a re-rating.”

Bain has always had a strong focus on financial services–banks, non-banking finance companies (NBFCs) and insurers. It acquired Adani Capital–a retail and wholesale lending platform–from billionaire Gautam Adani in July 2023,. Prior to that, it backed 360 One (formerly IIFL Wealth), L&T Finance Holdings and Axis Bank

Succession Challenges

Industry sources said the Reserve Bank of India (RBI) has not been enthused by the addition of Nandakumar’s daughter Sumitha Jayasankar to the board as executive director. A gynaecologist by profession, she has been groomed to take over the reins at the company from her father.

“Coming under pressure from the regulator on the issue of succession planning and realising that RBI may prefer an out-and-out finance professional rather than anybody in the family taking the leadership, Nandakumar started thinking of divesting his stake,” a person aware of the development said.

He has engaged previously with strategic and financial investors including IDFC and Poonawalla Finance as well as PE funds such as Carlyle to explore a buy-in, business carve-out or even a merger of operations, said the people cited. Those negotiations didn’t work out and there is no guarantee that the current discussions will end in a transaction, they said.

Regulatory Shock

Manappuram got a regulatory jolt last month when the RBI barred its IPO-bound subsidiary Asirvad Microfinance from fresh loan disbursements pointing out deficiencies in the pricing policy and the assessment of income and debt of microfinance borrowers, among others. The regulatory intervention triggered a 37.5% fall in the share price from its 52-week high. Within four trading days, the stock was pulled down to its 52-week low of Rs 136.50 on October 22.

The Manappuram stock ended Tuesday at Rs 157.85, up 1.15%, for a market value of Rs 13,360.97 crore. Year to date, it has lost 8.7% compared with a 9% appreciation of the Sensex and a 9.80% gain by peers in the BSE Financial Services Index. It currently trades at a price-to-book ratio of 1.07x, a key valuation metric for NBFCs and banks and a PE ratio of 5.9, trailing 12 months–the lowest among the top 25 NBFCs, making it a great value buy even with a significant control premium.

Microfinance alone is a quarter of the consolidated assets under management (AUM) of the company that started out as a legacy gold loan provider and diversified into housing, vehicle and even MSME lending but with patchy outcomes.

But the diversification strategy has helped derisk the loan book. The share of the non-gold loan businesses is 46.7% of the consolidated AUM.

Right after the RBI ban, analysts had calculated that 25-27% of Manappuram’s consolidated loan book amounting to Rs 11,235 crore was vulnerable. This was a blow as the segment had accounted for 20.8% of FY24 profit. That could plummet to a negligible contribution to FY25 earnings.

The company’s consolidated book value at the end of the September quarter was Rs 11,557.4 crore, against Rs 12,002 crore at the end of the previous quarter.

“While the gold loan growth was healthy, we will watch out for the developments in its microfinance business amid asset quality headwinds and the RBI ban on Asirvad,” said Abhijit Tibberwal of Motilal Oswal after the company announced its second-quarter earnings last week.

Source: Economic Times