US private equity buyout group Bain Capital is looking to join hands with Sunil Munjal’s Hero Corporate Services to buy a controlling stake in Max Financial Services from Analjit Singh, said multiple people aware of the talks.

Munjal, along with Bain, may buy 28.3% from Singh and make an open offer to minority shareholders. If successful, the consortium could end up holding 54.3% in Max Financial.

The acquirers are also considering the option of buying just below 26% stake to avoid triggering the mandatory open offer, and replacing Singh as the promoter.

Munjal and Max are engaged in ‘exclusive’ negotiations to thrash out the deal contours. Exclusivity bars the seller from having parallel negotiations with other potential buyers for a pre-agreed time period. One of the sources said Hero Corp aims to complete the transaction by the end of this month or early February.

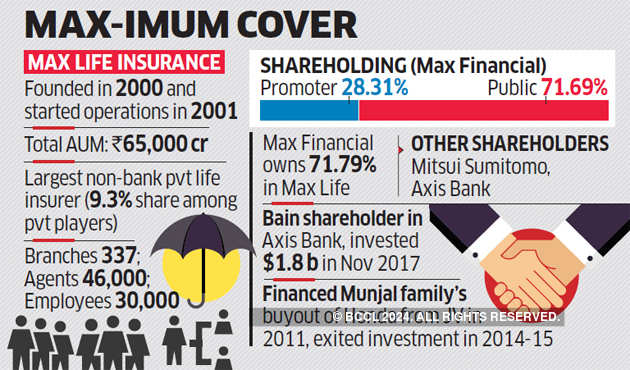

The listed Max Financial, Analjit Singh’s flagship venture, owns 71.79% stake in Max Life Insurance, India’s largest nonbank private life insurer.

Munjal eyeing financial services

While Singh has been trying to exit most of his ventures to deleverage his balance sheet, Munjal has been eyeing opportunities in the financial services space since his exit from Hero MotoCorp.

The spokespersons for Max, Bain and Apax declined to comment. Mails sent to Hero Corp did not elicit a response till press time Thursday.

Sources close to Analjit Singh said that ideally he would like to retain a small stake to enjoy any future upside. If the deal is successful, representatives from Hero Corp and Bain are expected to join the board of Max Financial, which has a market capitalisation of about Rs 14,250 crore. In case Singh exits fully, he will be able to raise around Rs 4,033 crore at current market price.

Max Financial shares have risen 30.57% in the past three months, compared with a 8.65% gain in the Sensex during the same period. The share closed 3.46% higher at Rs 528.75 on the BSE on Thursday.

Bain has been an investor in Axis Bank since 2017, the bancassurance partner of Max. Axis Bank accounted for over half of the insurer’s revenue till recently.

A Munjal-Bain combo would help negotiate terms better when the Axis Bank-Max Life long-term agreement comes up for renewal in 2021. Last year, Axis Bank tried to acquire Max Life, but the proposal was shot down by the regulators who are reluctant to let lenders have a big exposure in insurance.

Bancassurance deals are struck with banks in a way that cash is set off in the form of future commission income that banks will earn. It is the most sought-after distribution channel for insurance companies as it is low-cost.

Max Life is a joint venture between Max Financial Services and a clutch of other investors — Japan’s Sumitomo, Axis Bank and other small shareholders — who together own the residual 28.21% stake in the insurer. In 2011, Axis bought 4% stake in Max Life from Max India for an undisclosed value.

Boston-headquartered Bain and the Munjal family have worked together earlier. In 2011, the Hero Group, with the help of Bain Capital, bought out Honda from their two-wheeler joint venture Hero Honda for about Rs 3,842 crore. Bain later exited Hero in 2014-15 and pocketed near-three-fold returns on a four-year investment.

Munjal has been trying to expand his financial services business and at one point considered buying a stake in Yes BankNSE -2.25 %.

Pledged pains

Analjit Singh, who has pledged more than 71.5% of his stake in Max Financial, is raising funds to deleverage his balance sheet to shore up the listed company’s stock. After exiting the hospitals business, he recently sold an overseas hotel property for about Rs 800 crore.

Max Bupa, the health insurance company, was sold to PE firm True North last year for Rs 510 crore. It is believed that Singh will also divest Max Group’s residual stake of around 7.5% in hospital chain Max Healthcare, which is getting merged with Radiant Life Care.

Max Financial and Max Life had entered into an agreement for a three-way merger with HDFC Life in June 2016. The deal was vetoed by the regulator a year later.

Max’s life insurance business saw gross written premiums increase 14.6% year-on-year in FY19, driven by a 24.5% rise in first-year premium.

Total premium for FY19 stands at Rs 14,575 crore. Max Life had a market share of 9% (in the private life insurance segment) and 6% overall in Q2 of FY20. In the first half of FY20, Max Life grew at 23% year-on-year while the overall industry grew 11%.