Reliance Industries Ltd, in partnership with Assets Care & Reconstruction Enterprise Ltd (ACRE), Varde Capital-backed Aditya Birla Asset Reconstruction Company, a Welspun Group entity and foreign fund CarVal Investors, among others, have submitted expressions of interest (EoI) for bankrupt Sintex Industries Ltd, said two people with knowledge of the matter. ACRE is majority-owned by Ares SSG Capital, which describes itself as an alternative investment manager.

The other EoI applicants include Edelweiss Alternative Assets Advisors Ltd, Asset Reconstruction Company of India, Prudent ARC, Ludhiana based Trident Ltd, Bangalore based Himaksinka Ventures, Punjab based Lotus Hometextile, Mumbai based Indocount Industries, Nitin Spinners, and GHCL Ltd. In all, the resolution professional has received 16 EoIs for the textile company.

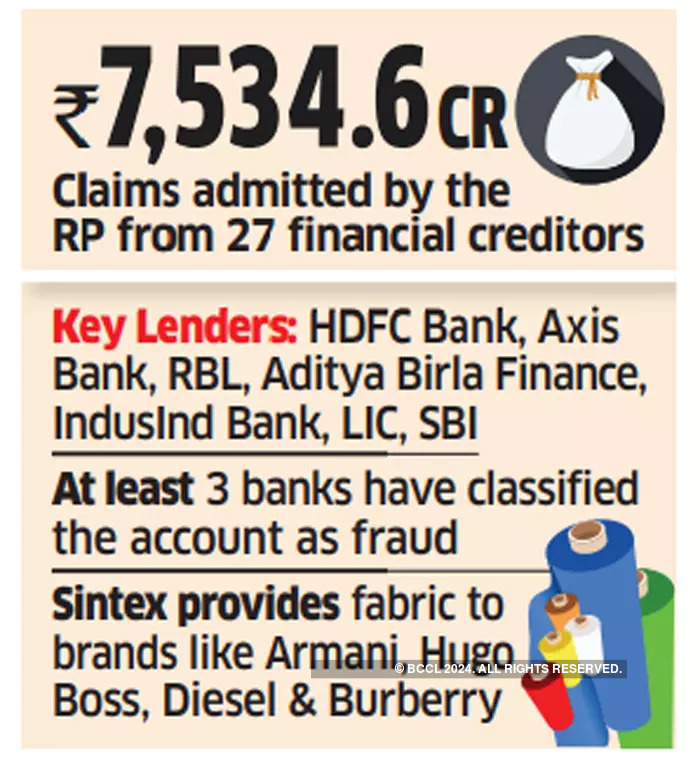

Sintex Industries provides fabric to global fashion brands such as Armani, Hugo Boss, Diesel and Burberry, according to the company’s website.

Admitted to NCLT in April

This is a rare instance where RIL has formally submitted an expression of interest for a bankrupt company that is undergoing the corporate insolvency and resolution process (CIRP), said a lender. The only other instance where it submitted a bid was for Alok Industries in partnership with JM Financial ARC. It subsequently acquired that company.

The Gujarat-based textile company was admitted into the insolvency process by the Ahmedabad bench of the National Company Law Tribunal in April this year at the behest of Invesco Asset Management (India) Pvt Ltd over a ₹15.4 crore default in payment of principal and interest of non-convertible bonds in September 2019. The resolution professional, (RP) Pinakin Shah, has admitted claims worth ₹7,534.6 crore from 27 financial creditors.

Its lenders include HDFC Bank, Axis Bank, RBL, Aditya Birla Finance, IndusInd Bank, Life Insurance Corporation and State Bank of India. At least three banks-Punjab National Bank, Punjab & Sind Bank and Karnataka Bank-have declared the account fraud, according to various stock exchange notices.

Early this calendar year, Welspun Group had offered ₹1,950 crore to settle all dues by way of an upfront cash payment but the negotiations did not progress because two large commercial banks found the offer very low, said one of the people quoted above.

Edelweiss Alternative Assets Advisors declined to comment. Reliance Industries, ACRE, CarVal, Welspun, Trident, Arcil, Aditya Birla ARC and the RP did not respond to requests for comment.

In 2017, Amit Patel promoted Sintex Plastics Technology Ltd, maker of water storage tanks, was demerged from Sintex Industries.