A bankruptcy court in Indore has rejected a revival plan for Ujaas Energy, adding the observation that the Committee of Creditors (CoC) cannot extinguish the rights of a secured creditor to proceed against the listed borrower’s personal guarantor.

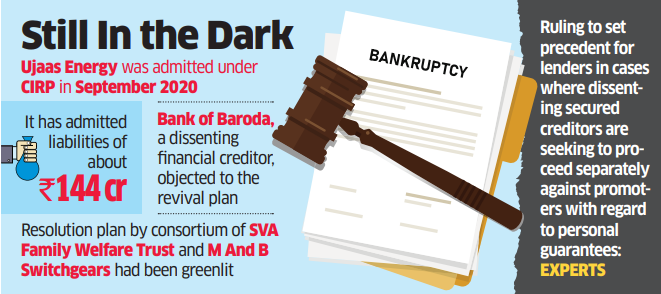

The ruling will likely set a precedent for lenders in other cases where dissenting secured creditors are seeking to proceed separately against the promoters with regard to personal guarantees.

“The CoC can take any commercial decision relating to insolvency of the corporate debtor only; the CoC cannot extinguish the rights of the particular secured creditor to proceed against the personal guarantor of the corporate debtor under the garb of its commercial wisdom,” observed the division bench of Madan Gosavi and Kaushalendra Singh. The bench also rejected a resolution plan for the company.

Ujaas Energy was admitted under the corporate insolvency resolution process (CIRP) in September 2020 and it has admitted liabilities of about Rs 144 crore.

The lenders had approved the resolution plan submitted by the consortium of SVA Family Welfare Trust and M&B Switchgears with 78.04% votes in August 2021. The consortium had proposed to pay Rs 74.81 crore to acquire the company through the resolution process.

The proposal involved payment of Rs 68.81 crore to financial creditors, and that included Rs 28.81 crore toward the release of the personal guarantee.

However, advocate Nipun Singhvi, appearing for the Bank of Baroda, a dissenting financial creditor of the company with a 5.83% voting share in the CoC, objected to the plan with the arguments that the lenders can’t extinguish the right of the secured creditor to proceed against the personal guarantor.

According to Aparna Ravi, partner at law firm Samvad Partners, this case is likely to set an important precedent on the boundaries of the exercise of commercial wisdom by the CoC and the extent to which a resolution plan can deal with the treatment of guarantors.

Other members of the CoC, including Union Bank of India, State Bank of India, Axis Bank and RBL Bank, agreed to the proposal of the resolution plan to extinguish the personal guarantee.

“While rights of a creditor against the principal debtor (being the corporate debtor) can be settled under a resolution plan, however, rights of such creditor to proceed against third party sureties cannot be taken away in the resolution plan without its consent,” said Pooja Mahajan, managing partner of law firm Chandhiok & Mahajan Advocates. “To that extent, the order proceeds on sound legal footing.”

The tribunal, while rejecting this resolution plan, observed that the CoC by majority votes can not enforce its decision for extinguishment of the right of the dissenting creditor to proceed against the personal guarantor.