Baring PE Asia (BPEA) is all set to acquire specialist BPO firm IGT Solutions, formerly InterGlobe Technologies, from an affiliate of Apollo Global Management in what would be its third Indian tech sector scalp in the past eight months, people aware of the development told ET.

BPEA narrowly trumped Teleperformance SE, the world’s largest BPO, in the last leg to emerge the highest bidder.

BPEA, an Asia-focused buyout specialist, has valued IGT at $800 million (Rs 6,000 crore). It will first acquire an 85% stake from Aion Capital Partners, which was formed as a joint venture between Apollo Global and ICICI Venture but subsequently dissolved.

After a year, Aion will transfer the residual 15% stake in the company to BPEA as per the agreement signed between the two this weekend.

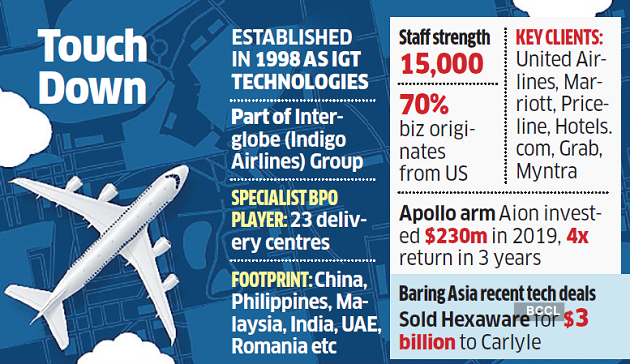

Once completed, this also would mark the biggest payday for Apollo in India – a 4x return in just 3 years. In 2019, Aion had acquired IGT Solutions for $230 million, from InterGlobe Enterprises – the owner of Indigo Airlines. Apollo can further capture the upside in the next one year.

Apollo Global and Baring PE Asia declined to comment.

Late last year, riding on the upswing in technology sector valuations, Apollo decided to sell IGT and mandated JP Morgan and Barclays to run a formal process that also saw funds like Carlyle and KKR compete with NYSE listed WNS and Webhelp. In the final round, only three put in firm bids. Other than BPEA and Teleperformance, PAG was the third suitor in the fray.

Established in 1998, IGT Solutions (IGT) employs more than 15,000 customer experience and technology specialists providing services to 75 plus customers globally. IGT’s global footprint consists of 23 delivery centers in China, the Philippines, Malaysia, India, UAE, Romania, Indonesia, Spain, Colombia and the USA, according to the company website.

IGT provides integrated BPM, Technology and Digital Services & Solutions for clients across industries like land transportation, logistics and cargo.

Under Apollo, IGT transformed from a predominantly travel and hospitality centric BPO with clients like United Airlines, Marriott, Priceline, Hotels.com to offering a host of customer services for online retailers and startups like Flipkart, Myntra and Grab among others. About 70% of its business is in the US while the remaining is in Europe and Asia.

“IGT’s management had consistently delivered. As Covid wanes, the benefits will start reflecting in revenue growth. It has marque clients who are very sticky too. As it focuses on hi-tech user engagement using analytics, it has the potential to become a billion dollar plus niche player like Task US,” said a tech sector analyst.

Even though the travel segment, both legacy airlines and hotels and online, still constitutes the largest chunk with 80% of revenue, online retail segment has become a fast growing sector for the company. In FY22, the company is expected to post $250 million revenue and an EBITDA of $50 million, despite the headwinds in the travel sector in the aftermath of the pandemic.

“Three years ago, the company was struggling with $24 million EBITDA which has now grown 2.5 times despite the pandemic. It is also diversified beyond the core travel and hospitality offerings,” said an official aware of the transaction on condition of anonymity. “Baring Asia is familiar with the sector and in travel, its only exposure was NIIT Tech which is legacy tech services,” Avendus advised BPEA.

With $23 billion assets under management, Baring PE Asia has been an aggressive investor in the technology space across the region with portfolio companies like Coforge (NIIT Technologies) and Virtusa.

In August 2021, BPEA had acquired Straive (formerly SPi Global), a global provider of technology-driven content and data solutions, from Swiss private equity firm Partners Group in a deal close to $1 billion. The next month, it also scooped up the healthcare services vertical of Hinduja Global Solutions for an enterprise value of Rs 9,000 crore ($1.2 billion). Hinduja Global is the business process management entity of the Hinduja Group. Earlier in the year, it sold Hexaware to Carlyle for $3 billion, the biggest tech service sale in the country to date. In 2019, BPEA had acquired healthcare analytics company CitiusTech from PE firm General Atlantic (GA) and the founders in yet another billion dollar deal.

Apollo, through its various PE and real estate arms, invested over $3.5 billion since entering India in 2009.

The firm, now led by Utsav Baijal, has of late become much more active with three quick investments totalling $750 million in JSW Cement, Hero Fin Corp and Piramal Finance’s AIF.

Global private equity buyout funds have been aggressively investing in the outsourcing industry in the past 4-5 years, especially in Indian-origin companies with a global presence. In 2021 alone, $7.3 billion dollars of deals in services and BPOs took place in the country.