Baring PE Asia EQT, Blackstone, Bain Capital, Advent International and TPG Capital have submitted non-binding bids to acquire a majority stake in India’s largest fertility clinic chain, Indira IVF, said people with knowledge of the matter. The deal is expected to value the chain at ₹8,000-10,000 crore ($1-1.2 billion).

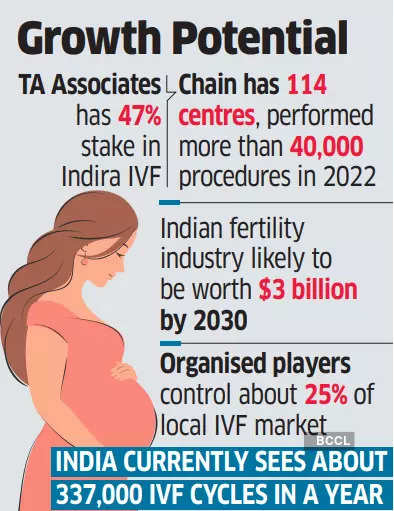

The new investor is likely to end up owning about 60% stake, with existing investor TA Associates selling its 47% holding and the promoters diluting additional stakes.

The non-binding bids were submitted last week, said the people cited above. Goldman Sachs and JP Morgan are advising TA.

Indira IVF chairman Ajay Murdia, as well as spokespersons for Blackstone, Bain and BPEA EQT, declined to comment. TA Associates, Advent and TPG didn’t respond to queries.

Founded in 2011 by Murdia, Indira IVF is India’s largest fertility clinic chain, with 114 centres, supported by a workforce of over 2,400. It performed more than 40,000 in vitro fertilisation procedures in 2022. The clinic chain posted revenue of ₹1,250 crore in FY23 at an ebitda of ₹375-410 crore, said people aware of the matter.

The Indian IVF industry is a potential $12-billion market expanding at 20% CAGR, according to industry estimates.

TA Associates acquired about 35% in Indira IVF in 2019 for ₹1,100 crore, and an additional 12% later. It is said to be looking for a four-fold return on its investment.

Demand for IVF is seen rising owing to the increase in marital age and the growing number of women working outside home, according to experts. Greater alcohol and tobacco consumption are seen as key risk factors to fertility.

One in six people – or around 17.5% of the adult population globally – is affected by infertility in their lifetime, according to a World Health Organization (WHO) report published last month. This proportion is similar across high-, middle- and low-income countries, indicating that it’s a global health challenge.

In India, 10-15% of couples are said to have fertility issues, as per a study conducted by the All India Institute of Medical Sciences (AIIMS) last year. The country is adding one new clinic every week.

Domestic Opportunity

The Assisted Reproductive Technology (Regulation) Act that came into effect recently has made the field more attractive to corporate investors. The law is designed to ensure patient safety through accrediting clinics and setting minimum equipment standards. It provides an ethical framework for practising assisted reproductive technology, lays down minimum qualifications for specialists, and brings in legal clarity, as well as transparency and accountability. Private equity (PE) investors are therefore making a beeline for such opportunities.

“Given the declining fertility rate, fragmented market and increasing regulatory oversight, organised IVF players are bound to witness significant growth in revenues over the next five to seven years,” said VP Rajan, director at investment bank Veda Corporate Advisors. “As larger players are expanding across the country and regulatory restriction on donor programmes is being considered, smaller players are facing strong headwinds. More PE investors would like to bet on larger players, which may lead to consolidation of smaller IVF players.”

Homegrown PE fund Kedaara Capital owns a minority stake in Oasis Fertility, another leading fertility chain, with an investment of $50 million, while Brussels-based fund Verlinvest owns a controlling stake in Ferty9 Fertility Center.

TPG Growth, the growth equity investment arm of TPG Capital, owns Nova IVI Fertility, the second-largest fertility chain, through its healthcare platform Asia Healthcare Holdings.

The top IVF service providers in India are Indira IVF, Nova IVI, Oasis Fertility, Bloom Fertility, Bengaluru-based Milann, Morpheus IVF, Ridge IVF, Akanksha IVF and Bourn Hall Clinic. The organised sector controls about 25% of India’s in vitro fertilisation market; the rest is in the unorganised sector.

The country currently sees about 337,000 IVF cycles in a year, with cost of each pegged at ₹1.5-2 lakh.