Baring Private Equity Asia (BPEA) EQT is set to acquire Credila Financial Services, the educational loan arm of Housing Development Finance Corp (HDFC), for $1.3-1.5 billion (Rs 10,000 crore-12,000 crore), trumping private equity rivals Carlyle, TA Associates, Blackstone and CVC Capital, among others, said people in the know.

The buyout fund will be buying 90% of the company, with the housing finance company retaining a 10% stake that it may sell over a two-year period. A formal announcement is expected by June end, ahead of the mega merger between HDFC Bank and HDFC to create the world’s fourth-largest bank. Both sides are finalising legal documentation, said the people cited above.

HDFC appointed Jefferies to launch a formal sale process earlier this year. In the past, it tried to sell a minority 10-15% stake in Credila at least thrice but those bids did not succeed.

Baring has formed a consortium with ChrysCapital for the transaction, said the people cited above. BPEA EQT couldn’t be reached for comment. HDFC didn’t respond to queries.

Following a $7.5-billion merger in 2022, BPEA EQT has become the world’s third-largest private equity fund group. In the same year, BPEA raised $11.2 billion for its latest fund, BPEA Fund VIII, with a focus on Asia buyouts.

MoneyControl reported on May 22 that BPEA EQT had emerged as the frontrunner.

Credila was founded by Anil and Ajay Bohora in 2006.

Headroom for Growth

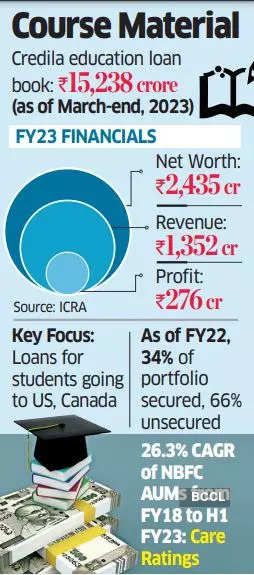

Credila is one of India’s largest education finance companies and had a loan book of Rs 15,238 crore at the end of the March quarter.

DSP Merrill Lynch took a 40% stake in the company in 2007. HDFC bought that holding when DSP Merrill Lynch was acquired by Bank of America in 2009.

The Bohoras exited in December 2019, with HDFC buying their 9.12% for Rs 395 crore ($56 million), valuing Credila at Rs 4,331 crore ($524.5 million,), making it a wholly-owned subsidiary.

Business Lines

The company has two main product categories — secured and unsecured education loans. As of FY22, 34% of its education loans portfolio was secured and 66% was unsecured, as per the lender’s annual report.

Student loans for US education contribute the biggest chunk of its business. Credila has diversified its portfolio and reduced the contribution of US disbursements from 65% of the total in FY20 to 51% in FY22. Canada’s contribution to total disbursements increased from 14% in FY20 to 23% in FY22. UK disbursals posted the largest increase, increasing from 1% in FY20 to 10% in FY22.

In FY22, disbursements to students pursuing their studies in India rose to Rs 301 crore, an increase of 107% over FY21.

“Baring has had its eyes on the asset for years, and in the past scoped it out multiple times,” said a person familiar with the development. “Given that India has over 30 million students in tertiary education and over 250 million students in K-12, the demand for education loans continues to be extremely strong.”

The sector has headroom for growth, given the low gross enrolment ratio of 28.6% in India, compared with countries such as the US (87.90%), the UK (65.80%) and China (53.80%).

While India’s education loan market has traditionally been dominated by state-owned banks, specialised non-banking finance companies have seen a steady increase in market share over the past five years.

Since 1998, BPEA EQT has deployed $5.5 billion in India. Especially aggressive on technology and financial services, it has backed or bought into companies such as Mphasis, Hexaware, CitiusTech, VFS and RBL Bank, among others. Of this, $4-5 billion was deployed in the last five years.

Stockholm’s EQT also has a $1-billion commitment in renewable and data centre platforms in India, and has already deployed 50% of that. In a recent interaction with ET, its chief executive Jean Salata said the buyout group may invest $4.5-$5 billion.