BPEA EQT, formerly Baring PE Asia, is in advanced negotiations to buy into Shriram Housing Finance Ltd (SHFL), a mortgage subsidiary of Shriram Finance, people familiar with the matter said.

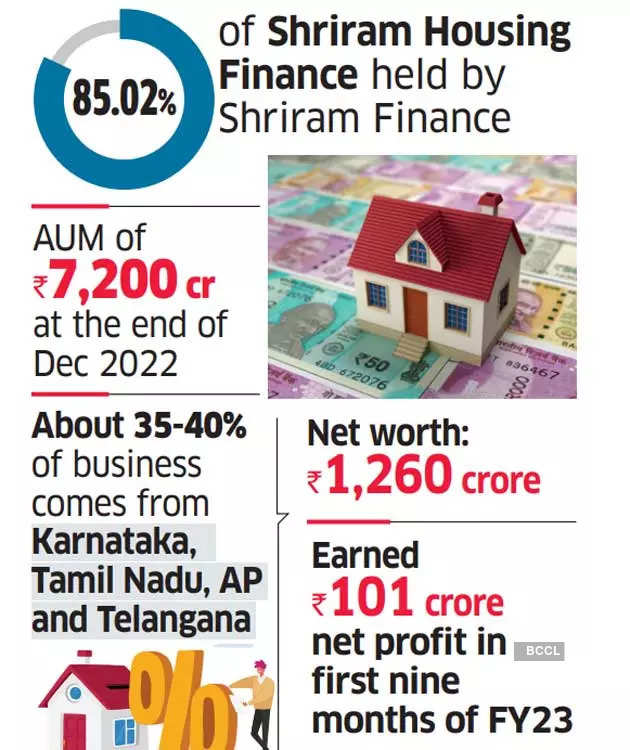

Shriram Housing Finance had assets under management (AUM) of Rs 7,200 crore at the end of December. Baring PE Asia had previously been among the major contenders to acquire ICICI Home Finance, a deal that didn’t materialise.

While some people say BPEA could be eyeing a controlling stake in the company, a senior Shriram Housing Finance executive denied any buyout rumour. He said discussions are on with prospective investors for fundraising and the Shriram Group remained committed to the housing finance business.

Shriram Finance holds 85% of the housing finance subsidiary while the rest is with Valiant Mauritius (P) Ltd. The group will take a final call on the quantum of the stake sale after firm offers come in, said the people cited above.

‘Deal Expected Within Q1, FY24’

A BPEA EQT spokesperson declined to comment.

“We deny any buyout rumour. Shriram Housing Finance is in the process of raising capital to the extent of $100 million and to that extent there will be a dilution,” Shriram Housing Finance managing director Ravi Subramanian said. “The Shriram Group is firmly committed to the housing finance business. As one of the top-performing housing finance companies, Shriram Housing Finance is a focus area for the group.”

Subramanian said that discussions are still on with prospective investors for fund raising. “Multiple people are in the fray,” he said, expecting to close the deal within the first quarter of the next fiscal year.

The mortgage lender with a focus on the affordable housing segment has risen fast in the past few years from an AUM of Rs 1,000 crore at the end of September 2015. It started operations in November 2010, getting registered as a housing finance company with the National Housing Bank in August next year. Last year, it received a total equity infusion of Rs 500 crore from the parent.

“By virtue of the strong parentage, SHFL also stands to benefit from the established track record of the group in lending to the self-employed segment in tier-II and smaller towns, which is the customer profile for SHFL as well,” said a recent Care Rating report. “The ratings take note of the significant growth in AUM over the last 3.5 years.”

About 35-40% of Shriram Housing’s business comes from the southern states – Karnataka, Tamil Nadu, Andhra Pradesh and Telangana. It also has a presence in Gujarat. With a network of 94 branches, it has an average loan size of Rs 16.6 lakh.

Last year, European buyout fund EQT acquired Baring Private Equity Asia for $7.5 billion. It closed its eighth private equity fund – the Baring Asia Private Equity Fund VIII – with total capital commitments of $11.2 billion. BPEA also owns a 9.98% stake in RBL Bank through its vehicle Maple II BV.

BPEA EQT has a strong presence in India through buyouts such as Hinduja Global Solutions Limited (HGS) as well as CitiusTech, AGS Healthcare and Coforge Ltd (formerly NIIT Technologies).

In the past few months, the housing finance sector has become active in terms of M&A deals. Poonawalla Fincorp sold its subsidiary Poonawalla Housing Finance to Perseus SG Pte Ltd, an entity affiliated with TPG Global LLC, for Rs 3,900 crore, while Centrum Housing Finance entered into a binding business transfer agreement with the National Trust Housing Finance (Natrust) to acquire its housing finance business, branches and employees.