Telecom major Bharti Group’s talks with SBI Life Insurance to sell its life insurance venture is said to have collapsed due to disagreements over valuations, delaying the Mittal family’s planned exit from the financial services domain but simultaneously opening a window for private equity investors to buy the firm, said people familiar with the matter.

Bharti AXA Life, the life insurer now wholly owned by the Bharti Group of the Mittals, has been available for sale as the family seeks to focus on its core telecom business and exit non-core revenue streams, said those people who did not want to be identified.

“The negotiations fell through due to Bharti Group’s higher asking price, which SBI Life was reluctant to meet given the declining business of Bharti AXA,” said a source.

Spokespersons at both SBI Life and Bharti Group did not respond to requests for comment until the publication of this report.

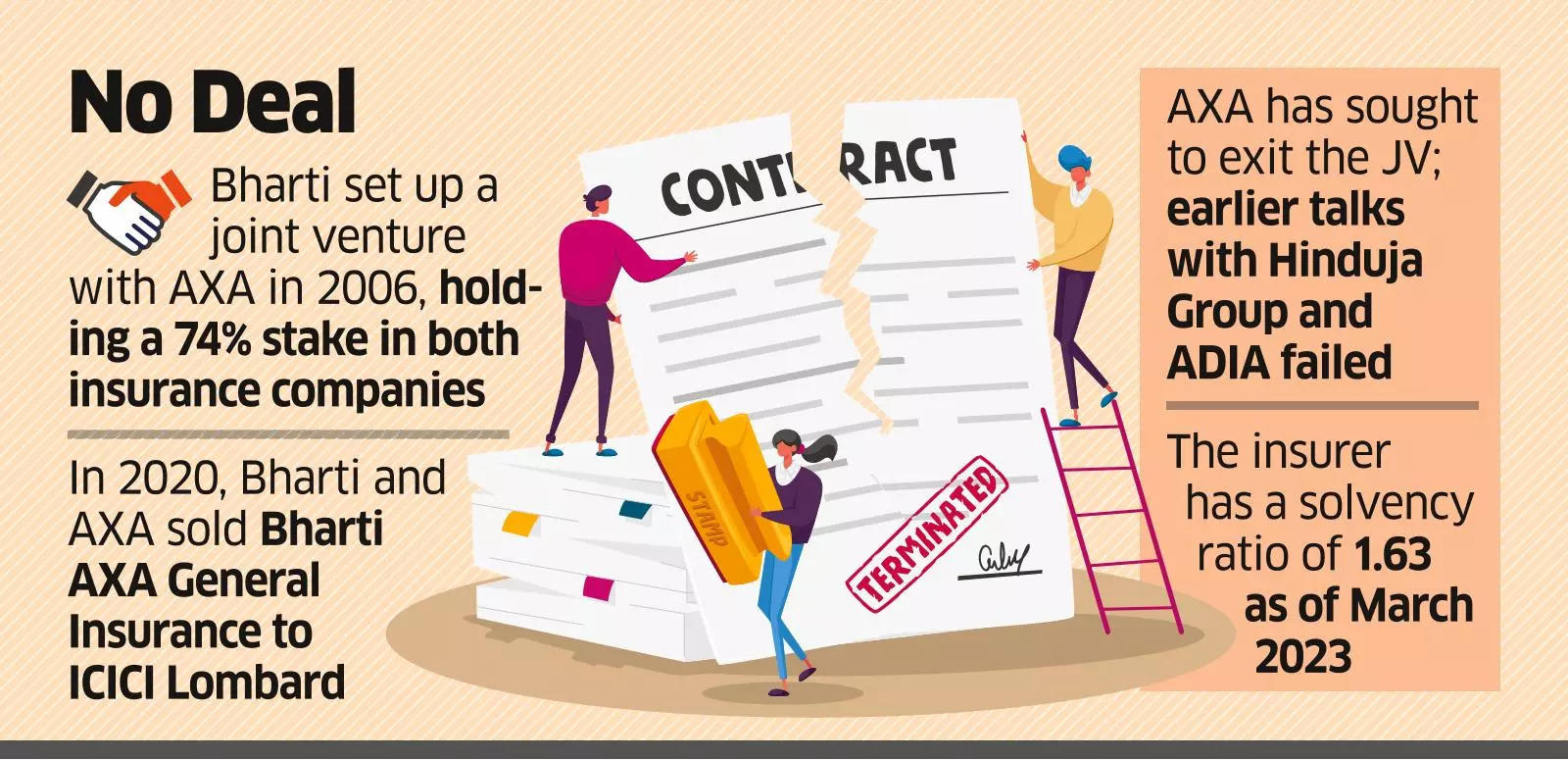

In 2006, Bharti and France’s AXA formed two joint ventures for insurance businesses – one for general insurance and the other to cover lives. The partners decided to exit and sold their general insurance venture to ICICI Lombard. Subsequently, in October 2023, AXA sold its holding in the life venture to the Bharti Group, making the Indian conglomerate the sole owner.

Bharti Life has struggled financially for many years, with only a brief period of profitability. The insurer reported a 23% decline in premium income to ₹780 crore in FY24, compared with ₹1,016 crore in FY23. This decline occurred while the private sector reported a 12% growth and overall industry growth was at 2%. The company’s market share was 0.21% in FY24.

Bharti AXA Life, which is poised to change its name, is now seeking private equity investment, as the promoter is no longer interested in the finance business.

“The company will rebrand, dropping the AXA name,” the source said. “The company has been looking to complete the exit before the rebranding, which could happen in the next six months.”

In October 2023, Bharti Group said it would buy the remaining 49% of Bharti AXA Life Insurance Co. from AXA India Holdings.

Bharti AXA Life Insurance had an investment book of ₹12,009 crore as of March 2023 and reported a solvency ratio of 1.63 times, above the regulatory requirement of 1.5 times.