Hyderabad-based Megha Engineering and Infrastructures (MEIL), which is the second-biggest buyer of electoral bonds – at ₹966 crore – and is facing corruption allegations, has put its city gas distribution business on the block, according to four industry executives aware of the development.

Megha City Gas Distribution (MCGDPL), a wholly-owned subsidiary, has decided to consolidate operations and reached out to state-run Indian Oil Corp, Hindustan Petroleum Corp, Bharat Petroleum Corp and Indraprastha Gas, among other players.

“The companies are evaluating the proposal and studying numbers. No decision has been taken yet,” said an executive in the know. A senior industry executive whose company evaluated Megha City Gas’ assets said it had not done much work on the ground. He pegged valuation at ₹1,000-2,000 crore.

MEIL didn’t respond to queries. Neither did IOCL, BPCL, HPCL and IGL.

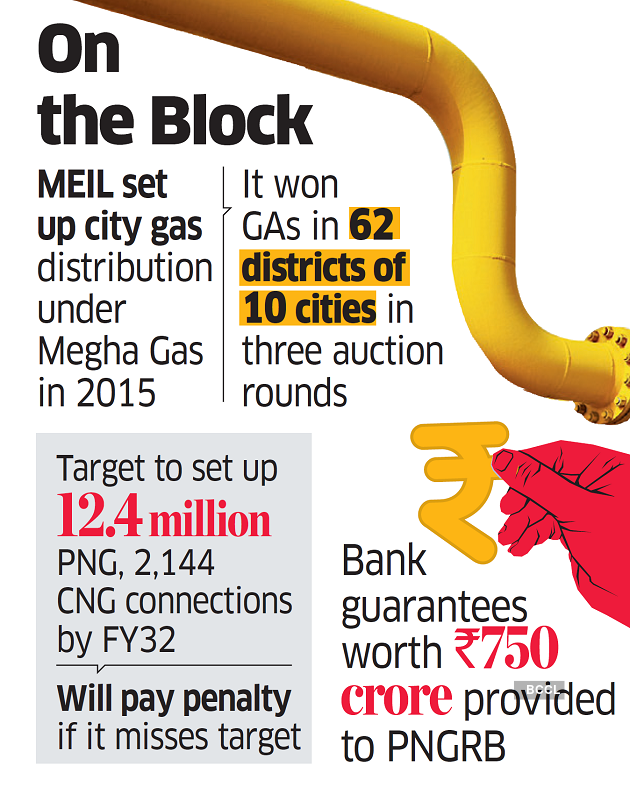

MEIL is a $5-billion infrastructure company with a footprint across hydrocarbons, electric buses, defence, power, transport and manufacturing. It ventured into city gas distribution under the brand name Megha Gas in 2015 and continued to operate as MEIL till FY22.

In September 2022, MEIL transferred the business to MCGDPL, which hold licences to set up city gas distribution networks in 62 districts of 10 states.

“Buoyed by the prospects of CGD, many companies had submitted aggressive bids,” said a senior executive at an energy company that evaluated the Megha City Gas proposal. “MCGDPL was one of them. But now they are finding it very capital-intensive to meet their minimum work programme.”

“Thus, (they are) planning to sell the business,” said the executive.

Ambitious targets

The Petroleum and Natural Gas Regulatory Board (PNGRB) auctions geographical areas (GAs) in various rounds for companies to transport or distribute natural gas to domestic, commercial, industrial and transport consumers through a network of pipelines.

According to the rules, city gas distribution companies are required to complete the minimum work programme in their GAs by the end of a designated period.

Megha City Gas had 98,920 domestic piped natural gas (PNG) connections and 146 compressed natural gas (CNG) stations, with a pipeline network of 9,514 km, by end of December 2023.

It needs to implement a cumulative work programme of 12.4 million domestic PNG connections, 2,144 CNG stations and 54,926 inch-km of pipelines across 22 GAs by FY32. A penalty will be applicable if the company misses its targets.

In a February 2024 note, India Ratings and Research (Ind-Ra) said any penalties would impact Ebitda and remain a key monitorable for cash flows and leverage at Megha City Gas.

It provided bank guarantees worth ₹750 crore to the PNGRB upon winning the GAs. “In the seven GAs won under the fifth and ninth rounds, the company is falling behind its minimum work programme targets… However, so far, no encashment of bank guarantees has happened for any of the GAs won under the fifth and ninth rounds,” Ind-Ra said.

According to the rating agency, MCGDPL intends to incur a cumulative capex of ₹6,400 crore till FY30 to meet the minimum work programme targets for the 11th city gas distribution round. “Of this, MEIL is likely to infuse ₹4,600 crore as equity/subordinated loans in MCGDPL, with ₹1,300 crore being funded through debt, and the balance ₹900 crore being generated through internal accruals of MCGDPL,” it said.

In the first nine months of FY24, MCGDPL incurred a capex of ₹5,500 crore with the support of its parent MEIL, Ind-Ra added.

Graft allegations

“We studied Megha Gas’ proposal. If we acquire it, we take on the penalties as well,” said an executive of an oil and gas company who did not wish to be identified. “But in light of their recent run-ins with the CBI, we have decided not to evaluate it further.”

MEIL had emerged as the second-biggest buyer of electoral bonds and donated the highest amount of about ₹966 crore to political parties, according to data released by the Election Commission on March 21.

The Supreme Court struck down electoral bonds as unconstitutional in February.

Last month, CBI also registered a case of alleged corruption against MEIL, eight officials of NMDC and NMDC Iron and Steel Plant (NISP), and two officials of Mecon, in connection with a work contract worth over ₹ 314.57 crore.

The executive director of an oil and gas company said many companies were unable to achieve targets despite bold bids.

“So, they are putting their licences and geographical areas on the block. This is leading to consolidation in the city gas sector. We are anticipating more such consolidation,” he said.

City gas distribution takes around seven years to break even.

ET reported in March that I-Squared Capital-backed city gas distribution companies in India — AG&P Pratham and Think Gas Distribution — are merging to create a $1.1-billion entity.

In February, Mahanagar Gas acquired 100% in Ashoka Buildcon’s Unison Enviro for Rs 526 crore, enabling it to expand to newer areas in Maharashtra (Ratnagiri, Latur, Osmanabad) and Karnataka (Chitradurga, Davanagere).