Biocon Biologics said it can close the transaction of $3.34 billion Viatris’ biosimilar business acquisition by as early as this quarter if it gets a nod from regulatory agencies.

Kiran Mazumdar-Shaw, chairperson of Biocon told ET that the components of financing the deal such as equity and debt were in place. “We have it all organised.. there is a huge interest, it is a very unique story, .. people are excited,” Mazumdar-Shaw said.

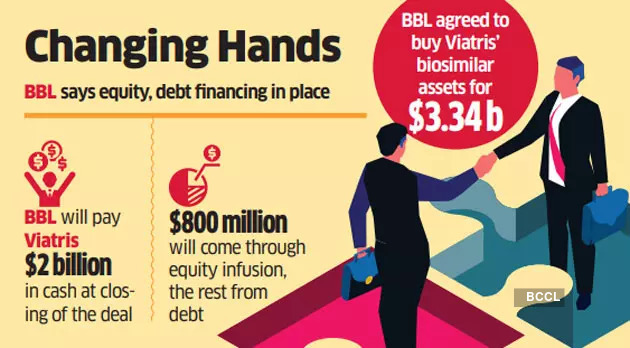

“We have said (closing of the transaction) in the second half (2022), if it can be done in the first quarter we will be very happy, .. with regulators we don’t know. it is the regulatory agencies in India that really have to speed up,” Mazumdar-Shaw said. In one of the largest outbound acquisitions by an Indian pharmaceutical company, Biocon Biologics (BBL) in March entered into a definitive agreement to acquire Viatris’ biosimilars assets for $3.34 billion. BBL will pay Viatris $2 billion in cash at the closing of the deal, and another $335 million in 2024.

Out of $2 billion, $800 million will come through equity infusion from existing investors including parent Biocon and others such as Serum Institute of India, Abu Dhabi-based ADQ. True North, Tata Capital Growth Fund and Goldman Sachs. BBL will also issue $1 billion of compulsorily convertible preference shares, which when converted will be equal to at least a 12.9% stake in the company at a valuation of $8 billion.

As part of the deal, BBL will get Viatris’ global commercial infrastructure in developed and emerging markets. Viatris’ global biosimilars business with an estimated revenue of $875 million and EBITDA of $200 million for the calendar year 2022, which is estimated to exceed $1 billion in revenue next year.

Adar Poonawalla, CEO of SII which has made a strategic investment in Biocon Biologics told ET, that his commitment towards equity has been worked out. SII has a 15% stake in Biocon Biologics. “We did a strategic investment, we may take little bit more (in Biocon Biologics),” Poonawalla said.

“I cannot confirm exactly how much and what, in a month and half that will be announced,” he added. ET reported last month quoting sources about Biocon Biologics raising $1.2 billion via an offshore loan with the pharmaceutical company likely appointing HSBC, MUFG and Standard Chartered Bank to underwrite the proposed five-year overseas loan.

The loan is likely to be priced after adding about 220 basis points over the Secured Overnight Financing Rate (SOFR), a global rate benchmark, the report said.