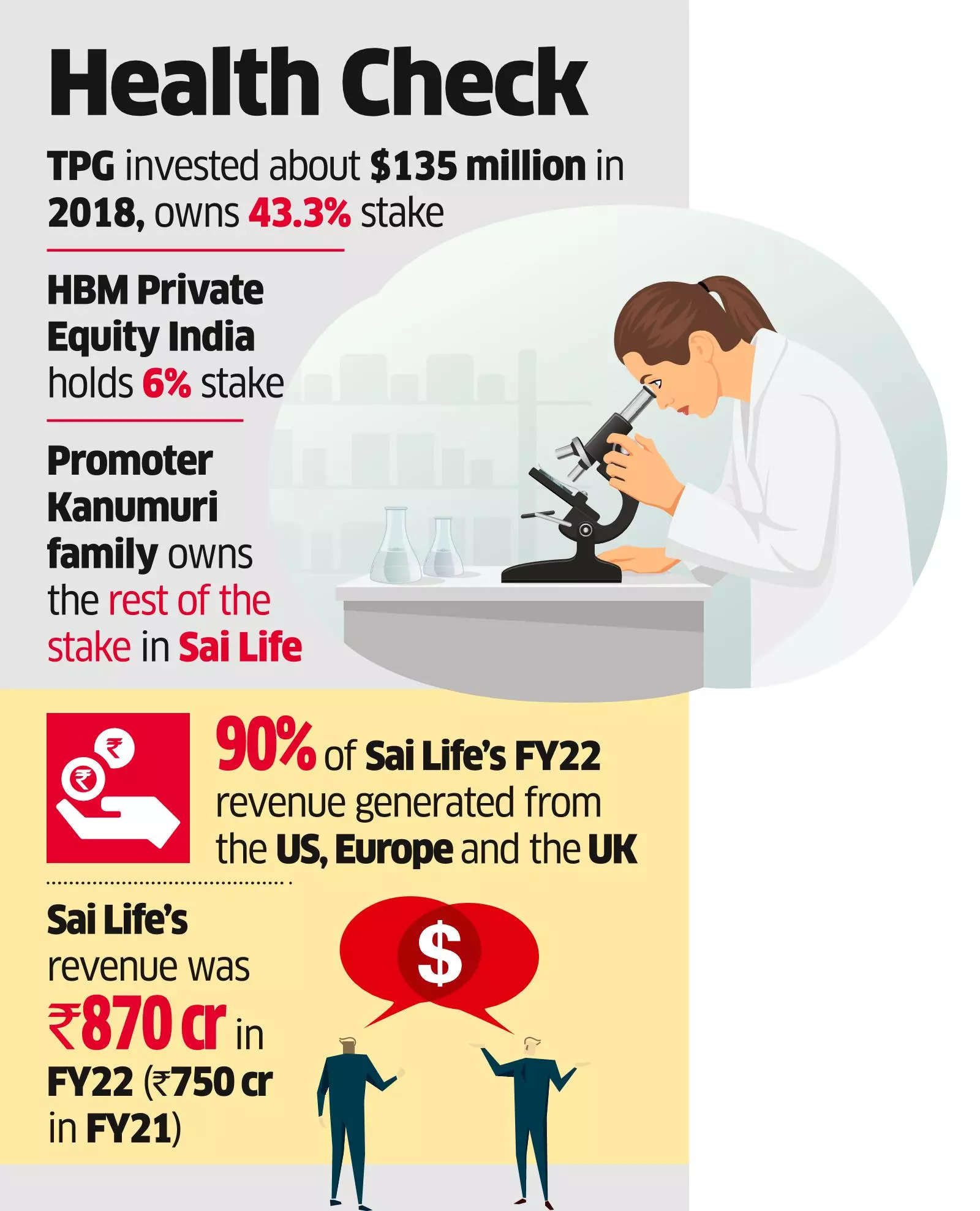

About half a dozen global funds, such as Blackstone, Carlyle, PAG, CVC Capital, BPEA EQT, Brookfield Asset Management and Apax Partners, have evinced interest in acquiring Hyderabad-based pharmaceutical company Sai Life Sciences, said multiple people aware of the development. At present, private equity investors TPG Capital holds about 43.3% stake and Swiss-healthcare fund HBM Private Equity India holds 6% stake, while promoter Kanumuri family owns the rest of the stake in Sai Life.

The promoter is looking for a valuation of $800 million (₹6,500 crore) for the company, said sources. However, the company is likely to be valued in the range of $500 million (₹4,000 crore), said a PE fund manager who is keen on the buyout.

Investment bank Jefferies is running the process. Non-binding bids are expected by September-end, said sources.

Sai Life is an integrated contract research & manufacturing services provider, and provides drug discovery, development, and manufacturing services to leading global pharmaceuticals & biotechnology companies. The company is also engaged in generic API (active pharmaceutical ingredients) and formulation supply upon the product going off-patent.

The company has manufacturing and research & development facilities in Telangana, Karnataka and Maharashtra.

Sai Life’s revenue was ₹870 crore in FY22 (₹750 crore- FY21), Ebitda was ₹120 crore (₹160 crore in FY21) with margins at 14.4% (21.5%). In 10MFY23, the revenue stood at ₹930 crore, according to India Ratings report. Sai Life expects an Ebitda of ₹300 crore in FY24, said sources.

Mails sent to Carlyle, TPG, Sai Life, CVC Capital, BPEA EQT did not elicit any responses while spokespersons at Blackstone, Apax Partners, Brookfield, PAG declined to comment.

Incorporated in 1999, Sai Life Sciences started with medicinal chemistry services and later in 2002 expanded its service offerings to include process research and development services. In 2005, the company entered into contract manufacturing services with the acquisition of Prasad Drugs, followed by acquisition of Merrifield Pharma in Karnataka in 2006 for expanding manufacturing capabilities, according to Care Ratings report.

Source: Economic Times