Nexus Malls, the Indian retail portfolio arm of the investment firm Blackstone group, is in talks to acquire Delhi’s premium mall Select Citywalk which generates the highest sales per square foot in the country, two people aware of the development said.

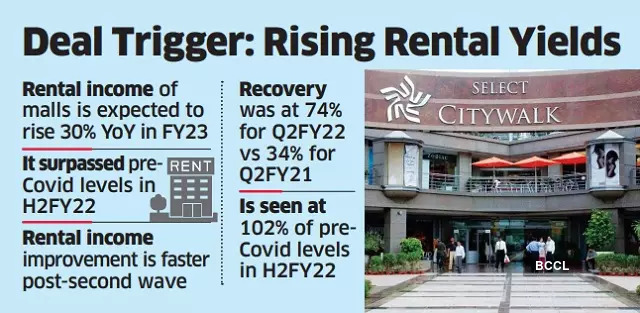

According to an executive who has knowledge of the development, the acquisition is part of Blackstone group’s broader strategy to launch retail REITs.

The promoter of Select group has not added any mall to the portfolio in the 15 years of operation of Select Citywalk and with no plan for expansion, the owners want it to be part of REIT. Real estate investment trust (REIT) is a public listed company that houses rent-generating commercial, residential or retail complex.

There are three REITs for office space in the country but none dedicated REIT for retail asset.

“The value of the transaction could be between ₹3,000 crore and ₹4,000 crore. The rental of the mall is about ₹1,200 per square feet per month, which is one of the highest in the country. Blackstone has been trying to enter NCR market through acquisition and has been in talks to acquire projects in Noida as well,” said one of the persons quoted above.

Select Citywalk was conceptualised by Yog Raj Arora, Neeraj Ghei and Arjun Sharma in 2003. When contacted, Arjun Sharma denied any talks with Blackstone group. Blackstone and Nexus mall declined to comment.

During Covid, lockdowns, a slump in demand along with realty developers’ inability to raise funds or clock profits forced investors and developers to look at newer avenues to generate revenue, including REIT.