Blackstone, the world’s largest private equity group, is the only contender left in the race to acquire Care Hospitals for ₹7,800-8,000 crore in what would be one of the biggest healthcare buyouts in the country. Blackstone’s offer trumps a competing bid from Temasek’s Singapore-based hospitals platform, Sheares Healthcare.

The two had made the final shortlist, but Sheares eventually opted out, sources told ET. The 2,400-bed hospital chain is owned by a TPG Growth platform, Evercare. Investment banks Rothschild and Barclays are advising TPG on the sale process. ET in its November 7 edition was the first to report about Blackstone and Sheares emerging as frontrunners in a keenly contested bidding process that had also drawn CVC, Ahmedabad-based Torrent Group and Carlyle, among others. As the sole bidder, Blackstone has now raised some concerns during its diligence over Care’s Bangladesh assets.

Most see this move as Blackstone’s strategy to negotiate a better value for itself.

“This is classic negotiation. It is not that Blackstone did not know about the footprint but now that it’s the only contender, it would love to bring the price down,” said a person involved in the negotiations, on the condition of anonymity. “The question is to what extent the seller will budge. Such considerations always have commercial underpinnings.”

1st Hospital Deal

This will be the first hospital deal for Blackstone, which has been scouting for healthcare assets for a while now. Once done, this would be the second largest hospital buyout in India after the IHH-Fortis transaction in 2018. This transaction will also give a presence in the South Asia healthcare market for Blackstone.

Blackstone Inc. has amassed $11 billion to buy companies in Asia after raising its second private-equity fund for the region, nearly tripling its previous pool of capital raised in 2018.

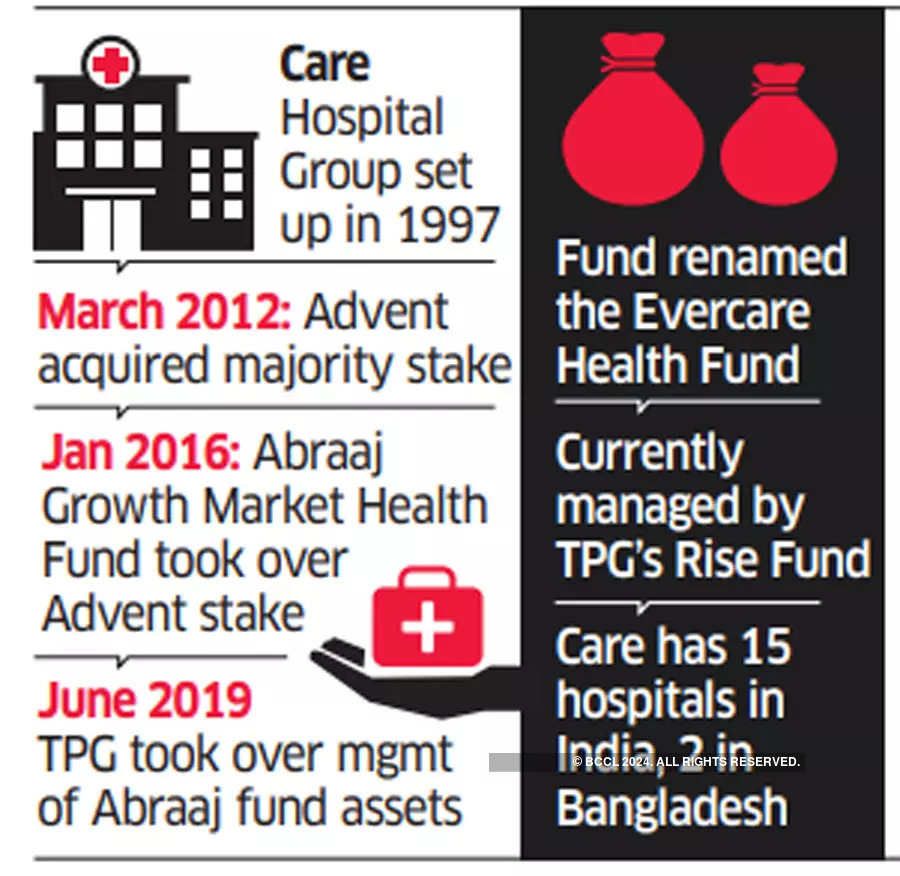

Among the largest hospital chains in India, Care has 15 hospitals in the country and two in Bangladesh. Care Hospitals is expected to post revenue of $340 million in FY23 with an Ebitda of $75 million, against $211 million revenue and $47 million Ebitda in FY22, said a source cited above.

Revenue is expected to expand 15-29% this financial year.

Blackstone did not respond to ET’s mail. A TPG spokesperson declined to comment.

Started in 1997 as a 100-bed cardiac hospital in Hyderabad by cardiologists Dr B Soma Raju and Dr N Krishna Reddy and their associates, Care has expanded into a network of 17 healthcare facilities in six states with more than 2,400 beds offering 30 clinical specialties in India and Bangladesh. It has two hospitals in Dhaka with 1,000 beds.

Through the acquisition of Indore-based CHL Hospitals, Care had added 250 beds in July. In the same month, it took a ‘significant majority’ stake in Aurangabad-based United Ciigma Hospital, its third such deal since April, to consolidate and deepen its presence in fast-growing tier-2 markets.

In 2018, TPG Growth-backed Evercare acquired the healthcare portfolio of UAE’s Abraaj Growth Markets Health Fund, which owned a majority stake in Care Hospitals. Dubai-based Abraaj collapsed following allegations of mismanagement of its $1 billion healthcare fund. Abraaj had purchased 72% in Care Hospitals from Advent Capital for Rs 2,000 crore in January 2016.

Multiple Change of Hands

Over the years, equity infusion by the private equity players had led to the founder promoters’ holding becoming zero by April 2019. Subsequently in November 2019, the ex-founder group of cardiologists (40 doctors in total) decided to split ways and consequent to this decision, Dr B Somaraju and a team of 10 other doctors exited the company. The new cardiology team brought in by the group has ramped up well and that has benefited performance in this specialty.

Blackstone, which has interest in pharma & healthcare space in India, was also a frontrunner to acquire the wholly owned injectables arm of Aurobindo Pharma, valuing the business at around Rs 26,000-30,000 crore ($3.4-4 billion). However, the deal was called off due to a valuation mismatch. It is now competing with Advent for Suven Life Sciences. Globally, Blackstone owns TeamHealth, a medical staffing firm which was acquired in 2016 for $6.1 billion.

TPG is also selling its 20% stake in Ranjan Pai-led Manipal Hospitals and in talks with PE fund KKR. The PE group also has a controlling stake in Motherhood Hospitals, a network of women and children’s hospitals in India.

India’s healthcare sector has seen huge interest from global private equity funds. KKR, which acquired a majority stake in Max Healthcare along with Mumbai-based Radiant Life Care in 2018, made a full exit in August with a 5X return. US-based Carlyle Group owns about 27% stake in Medanta Medicity Hospital, which was partly sold in the recently launched IPO.

Recently, Ontario Teachers’ Pension Plan Board (OTPP) had acquired a significant majority stake in the Sahyadri Hospitals Group at a valuation of Rs 2,500 crore and Baring PE Asia acquired a minority stake in Hyderabad-based AIG Hospitals.

India’s healthcare industry has been expanding at a compounded annual growth rate (CAGR) of about 22% since 2016. At this rate, it is expected to reach $372 billion in 2022, said a 2021 Niti Ayog report. India has a vast potential for investment in the under-penetrated hospitals sector, experts say.

A 2020 Human Development Report showed that India ranked 155th in bed availability with five beds and 8.6 doctors per 10,000 people.

The hospital industry will require an investment of around $245 billion over the next 20 years, according to a recent PwC report. India needs to add 3.6 million beds, 3 million doctors and 6 million nurses over the next 20 years, it added.