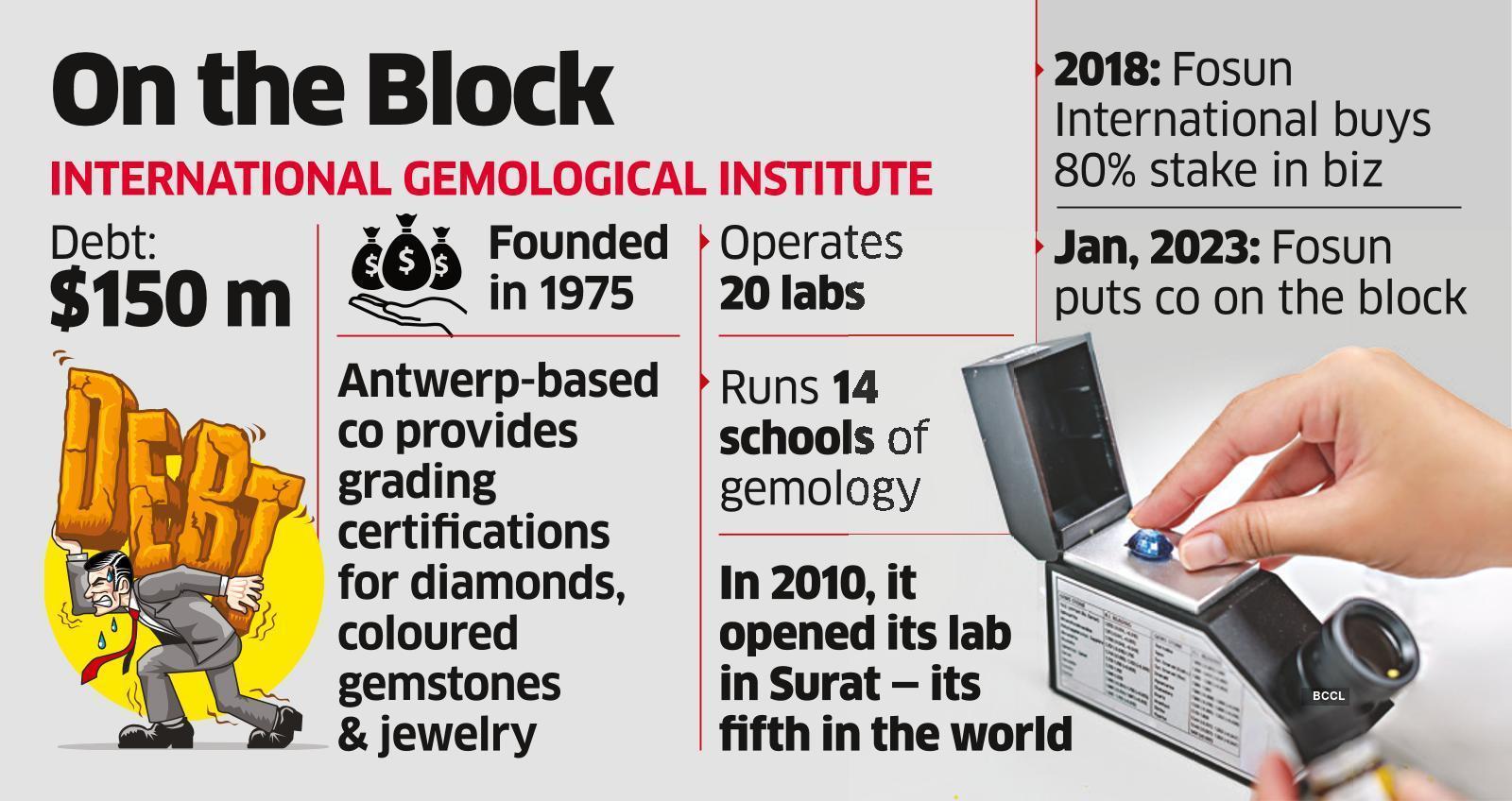

Blackstone is set to buy out International Gemological Institute (IGI), the world’s biggest independent diamond-grading firm, from China’s Fosun International, founders Lorie family and other small shareholders at an enterprise value of $500-$550 million, two people directly aware of the development said. IGI has $150 million of debt. The world’s largest private equity firm is expected to sign a binding agreement with Fosun and IGI’s other shareholders in Europe soon, maybe as early as this weekend.

Founded in 1975, the Antwerp-based IGI provides grading certifications for diamonds, coloured gemstones and jewellery for clients worldwide. IGI certifications are internationally accepted for both mined and lab-grown diamonds. India is the world’s biggest diamond cutting and polishing hub, accounting for nine out of ten stones sold worldwide, predominantly from Surat. US is the world’s largest market for finished diamonds.

Diamonds, especially those mined in Russia, are at the centre stage of potential G7 sanctions as NATO allies look to block diamond exports from Russia in an effort to squeeze funding for the ongoing Ukraine war.

Emails sent to Fosun International remained unanswered until press time on Wednesday. Blackstone declined to comment.

ET had first reported on March 10 that three private equity suitors – Blackstone, Goldman Sachs private equity and CVC Capital – were in the fray to acquire IGI, which has a large part of its operations based in India. India is also one of its biggest markets.

Globally, IGI operates 20 laboratories that grade finished jewellery, natural diamonds, lab-grown diamonds, and gemstones. It also runs 14 schools of gemology that train professionals in the diamond industry.

IGI provides its services to the public through diamond dealers, and jewellery manufacturers. It provides independent grading reports, coloured stone reports, identification and appraisal reports, diamond authentication and attestations of origin, and laser inscription services.

It also offers diamond and coloured stone courses through its Schools of Gemology. The IGI school was the first to offer the practical rough diamond course. It opened its fifth lab in the world in Surat in 2010.

In 2018, China’s Fosun International acquired 80% stake in the business, taking control of the company from its founders, the Lorie family of Belgium. China is the world’s second-largest diamond market after the US.

Fosun put the company on the block in January this year and Deutsche Bank was appointed as the sell-side advisor.

One of China’s largest conglomerates, Fosun is currently shrinking its balance sheet by slashing costs to bolster its finances.

Chinese billionaire Guo Guangchang’s Fosun conglomerate has been a poster boy of overleveraged companies. The owner of French resort group Club Med and English football club Wolverhampton Wanderers has been on a divestment spree to tackle his $36-billion debt pile. Fosun told analysts in October that it is seeking to sell as much as $11 billion of assets within 12 months as part of that process.

After the sale of its majority shareholding in Shanghai-listed Nanjing Nangang Iron & Steel United, Fosun’s asset sales hit $4.8 billion in 2022, according to Dealogic data.