US private equity major Blackstone Group is set to acquire Anand Jain-promoted Urban Infrastructure Opportunities Fund (UIOF) that also counts Reliance Industries as a key investor for nearly Rs 800 crore, said three persons familiar with the development.

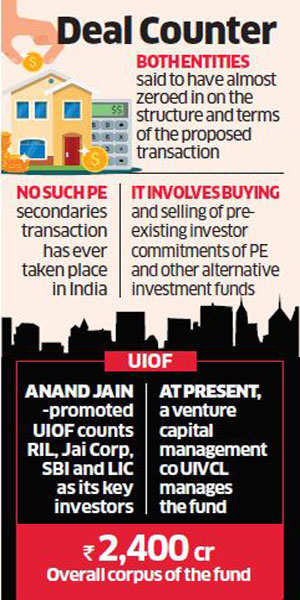

This will be a landmark deal as no such private equity secondaries transaction, which involves buying and selling of pre-existing investor commitments of private equity and other alternative investment funds, has ever taken place in India.

Blackstone Group is the most aggressive institutional investor in Indian real estate and it has been investing heavily in the country’s growing commercial property market.

While it owns the largest office portfolio in India, this transaction will help the New York-headquartered investor gain foothold in the country’s residential real estate as well. Blackstone is roping in Anuj Puri’s recently formed Anarock Property Consultants as a strategic partner to manage the fund.

“Both the entities have almost zeroed in on the structure and terms of the proposed transaction. A final term sheet for the same will be signed with the asset management company. Following this, Blackstone will make an offer to the fund’s investors,” said one of the persons mentioned above.

Apart from Reliance Industries, the fund also counts Anand Jain’s Jai Corp, State Bank of India and Life Insurance Corporation of India and several other institutions as its investors, the fund’s website showed. Urban Infrastructure Venture Capital Ltd (UIVCL) is a venture capital management company.

It currently manages Urban Infrastructure Opportunities Fund (UIOF) and is acting as the Indian advisor for the offshore fund Urban Infrastructure Real Estate Fund (UIREF).

Urban Infrastructure Opportunities Fund had earlier informed its investors that it is in talks with a prospective investor for a takeover of this fund and once finalised, the new investor is likely to make an offer to them to offload their units.

The deal would go through if the response to this offer is good and crosses a certain majority threshold.

Once Blackstone becomes a major unitholder of the fund, it would also be looking at managing the fund by taking over the asset management company. Anarock Property Consultants, as a strategic partner of Blackstone, would manage the fund along with the existing team of the asset management company.

While Blackstone declined to comment on the story, email queries to Urban Infrastructure and Anarock Property Consultant did not elicit any response till press time.

Urban Infrastructure Opportunities Fund was launched in 2006 and it had raised about Rs 2,200 crore. The fund was launched with investments focused on residential development and had a tenure of 9 years, including two extensions of 1 year each. It raised an additional Rs 200 crore through a rights issue to existing unitholders.

In 2015, the fund, backed with consent of 75% of its investors, sought the Securities & Exchange Board of India’s approval for a further extension of 18 months. The overall corpus of the fund now stands at around Rs 2,400 crore and it is one of the largest domestic venture capital fund scheme in the real estate sector in India. “The fund has so far exited nearly half its investments.

However, weak market conditions hampered both returns as well as the possibility of exit from entire portfolio of assets,” said the second person mentioned above. A few of its investments are currently under litigation for an exit, while some are being negotiated for an out-of-court settlement. The fund’s investments span across of real estate developers’ Special Purpose Vehicles (SPVs), mainly developing residential projects in the Mumbai suburbs, Bengaluru, Nagpur, Hyderabad, Chandigarh, Nashik, Raipur and Chennai.

Blackstone established its India office in August 2005 and since then has committed a total $6 billion to companies here. Of this, $2 billion have been invested since 2015.

In the real estate portfolio, Blackstone counts 19 companies that own 31million sq ft across 18 operating office parks and it has invested $2.7 billion in these assets alone.

It also has additional 11 million sq ft commercial space under development across the country. It has formed investment platforms with developers including Bengaluru-based Embassy Group and Pune’s Panchsheel Group.

In the backdrop of an ongoing transformation in business environment, Indian real estate is witnessing a robust rise in investment inflow as both foreign and domestic institutional investors are infusing more funds into the sector.

Last month, in the biggest foreign direct investment deal ever in India’s real estate space, Singapore sovereign wealth fund GIC struck a deal to acquire a 33.34% stake in developer DLF’s rental arm DLF Cyber City Developers (DCCDL) for $1.39 billion (Rs 8,900 crore).