Private equity investors Blackstone Group and Temasek Holdings are in separate discussions to acquire 15-20% in Wonder Cement, part of Rajasthan-based RK Group, for Rs 1,000 crore. Wonder Cement is one of the largest cement makers in north-western India.

The deal is expected to value the company at $800-900 million (Rs 6,000-6,600 crore). Investment bank JP Morgan has been hired to run the process.

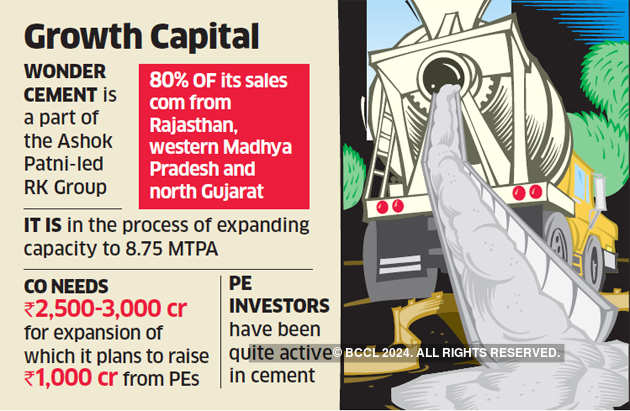

The proposed fund infusion will be used to increase the capacity from 6.75 million tonnes per annum (mtpa) to 11mtpa by FY19. Wonder Cement, part of Ashok Patni-led RK Group, is in the process of expanding capacity to 8.75 mtpa by setting up a grinding unit in Maharashtra with a capacity of 2 mtpa. Currently, markets like Rajasthan, western Madhya Pradesh and north Gujarat contribute about 80% sales revenue of Wonder Cement.

Group companies of RK Group include RK Marble and Jaipur-based home financing company Wonder Home Finance.

Jagdish Chandra Toshniwal, managing director, Wonder Cements, did not respond to queries.

Blackstone and JP Morgan spokespersons declined comment. Mails sent to the Temasek spokesperson did not elicit any response till press time Tuesday.

Besides the unit in Maharashtra, the company plans to set up an additional unit in Madhya Pradesh. Wonder Cement, which requires Rs 2,500-3,000 crore for expansions, plans to raise Rs 1,000 crore from PE investors and the rest through internal accruals, said one of the persons cited above.

According to analysts, cement prices, which were flat-to-marginally lower in September, are expected to move up in the coming months, setting a clean field for any new investor.

“Rising capacity utilisation will lend pricing power to the industry. This along with moderating cost inflation gives us comfort on margin outlook. Historical analysis suggests that cement price hikes are higher than WPI (Wholesale Price Index) in periods of rising utilisation,” Morgan Stanley analysts Ashish Jain and Mukund Sarawogi wrote in a research note on September 20. “We stay constructive amid strong demand growth and slowing capacity addition resulting in rising utilisation. Pace of cost inflation will ease in the second half of the fiscal, which, coupled with rising utilisation, led price hike will drive solid earnings growth.”

In FY19 and FY20, the demand growth is estimated at 6-7% and 7% respectively, which will be bolstered by a pick-up in the housing— primarily affordable housing— and infrastructure segments— mainly road and irrigation projects. Increased budgetary allocation for the rural economy, agricultural and allied sectors, coupled with relatively better monsoons during 2018, are also expected to support demand, said a September report by ICRA.

PE investors have been quite active in cement as the beaten down sector has provided better risk reward for financial investors.

Baring Private Equity Asia, which invested $250 million in Lafarge’s India unit in 2013, exited within 18 months with 22% IRR. Meanwhile, global major KKR, which invested in Dalmia Bharat, monetised investment with a 150% return in a span of 14 months.

The likes of KKR, Temasek, Carlyle and Blackstone have been looking at potential investments in the cement sector. Many of them have looked at Jaiprakash Associates’ cement assets, which were eventually bought out by Ultratech. KKR has also invested in south-based Bhavya Cements through a structured credit deal.

Source: Economic Times