Brookfield Asset Management, the world’s second-biggest alternative assets manager, is in talks with lenders of debt-laden Jaiprakash Power Ventures to acquire the firm’s three power plants, two people with direct knowledge of the development said.

The discussions are in initial stages and there is no certainty that a transaction will take place. A deal, if it happens, could close at an equity value of Rs 4,500-5,000 crore, one of the two people said.

The transaction will mark Brookfield’s first investment in India’s power sector. The asset manager has already committed about $4.6 billion in the country in toll roads and telecom towers.

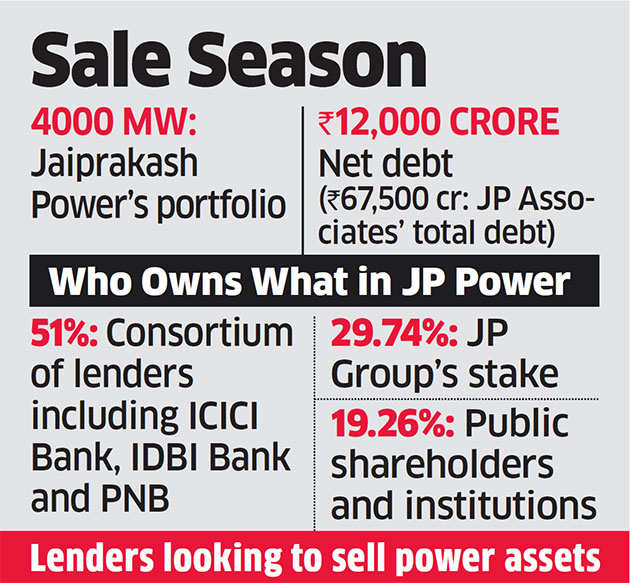

Jaiprakash PowerBSE 2.96 % Ventures’ major lenders such as ICICI BankBSE -0.24 %, IDBI BankBSE -0.19 % and Punjab National BankBSE -0.42 % took control after the firm failed to repay loans on time. Brookfield did not comment on the talks and Jaiprakash AssociatesBSE 0.33 % did not respond to an emailed questionnaire.

Last month, Jaiprakash Power VenturesBSE 2.96 % allotted 305.8 crore shares to its 23 lenders as part of a debt restructuring scheme. The allotment brought down Jaiprakash Associates’ holding in the company to 29.74%.

Toronto-based Brookfield is the world’s second-biggest manager of alternative assets such as real estate and private equity with $250 billion under management.

It acquired telecom tower assets of Reliance CommunicationsBSE -0.55 % for $1.6 billion in December in possibly the second-biggest PE transaction after Temasek’s $2-billion investment in Bharti Telecom in 2007.

Bulge bracket Canadian asset managers have been among the most aggressive financial investors in Indian infrastructure assets in the past two years.

Canada Pension Plan Investment Board, Caisse de dépôt et placement du Québec (CDPQ), Ontario Teachers’ Pension Plan, Brookfield, and Fairfax have jointly committed $7-8 billion across companies and funds so far, reveal industry estimates.

“Such a transaction is better for the company as it would bring down overall debt burden significantly,” said Rajesh Gupta, managing partner, SNG, and Partners, a Mumbai-based law firm. “The deal will also spell relief for lenders, especially the state-run banks, as it could help them improve asset quality.”