Canadian investment firm Brookfield has picked up a 51% stake in CleanMax Enviro (CleanMax Solar), which supplies renewable energy to commercial and industrial establishments, said two sources aware of the development. The equity value of the company is between ₹3,500 crore and ₹4,000 crore, they added.

The investment will largely be a secondary sale of shares by existing shareholders with a small tranche of primary infusion into the company.

This will be Brookfield’s second renewable deal in as many months, having agreeing to invest $1 billion in serial Avaada Ventures, run by serial entrepreneur Vineet Mittal.

ET first reported on March 20 that Brookfield has started exclusive discussions with CleanMax for a deal that will see it become the biggest shareholder of the company.

The residual 49% stake will be largely held by US-based investor Augment Infrastructure and CleanMax founder Kuldeep Jain. In all, across the primary infusion and secondary stake purchase, Brookfield is investing around ₹2,500 crore in the transaction.

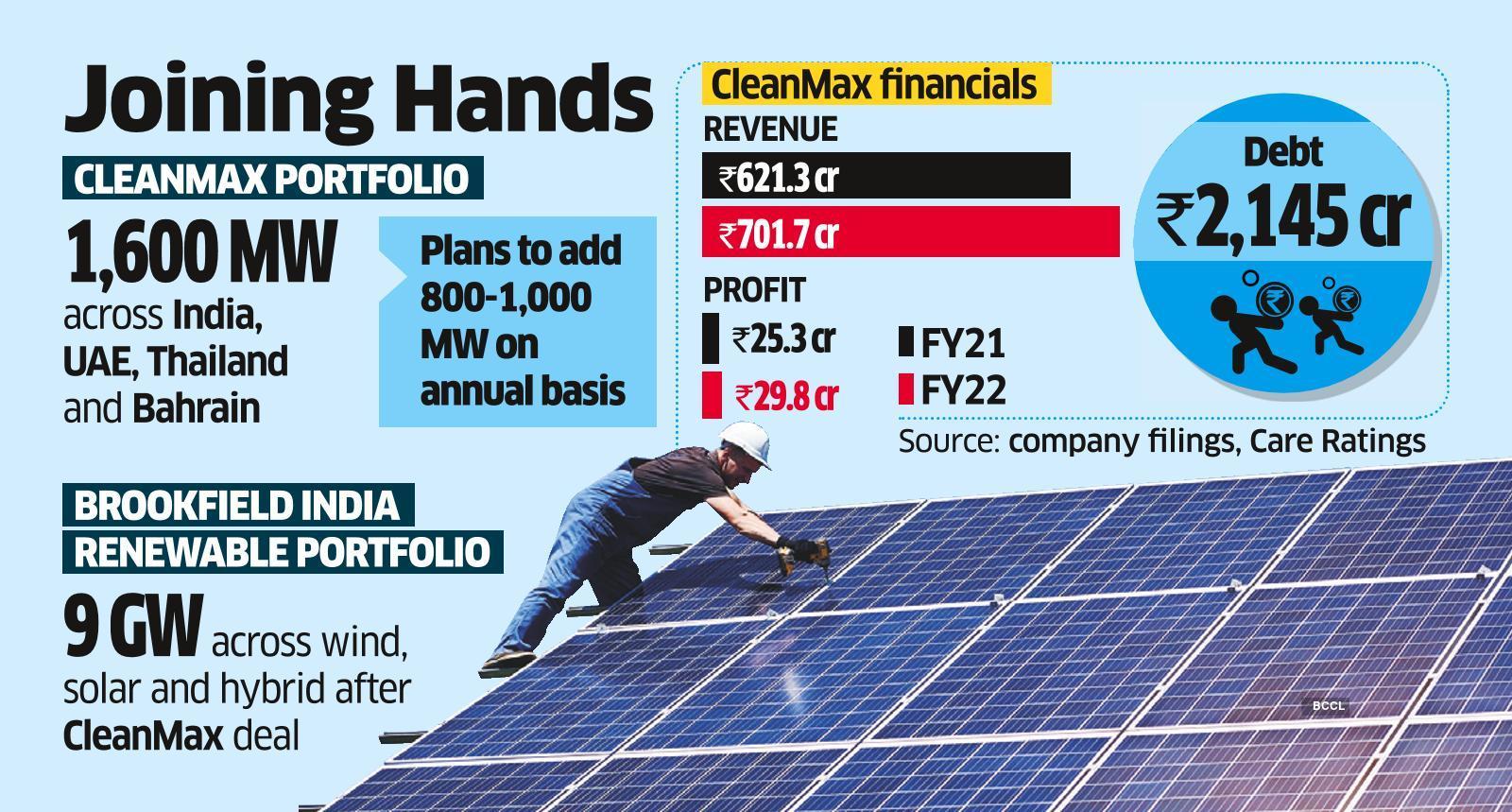

“The deal has been signed recently and a formal announcement is expected soon. This puts Brookfield in a controlling position in the company, which is India’s largest C&I (commercial and industrial) player. CleanMax has over 1,600 MW of operational capacity, including about 350 MW of wind power. CleanMax has also expanded its operations across emerging markets with a presence in UAE, Thailand and Bahrain,” said one of the sources

With this deal Brookfield will have over 9 GW of diversified renewable energy assets across wind, solar and hybrid assets in various stages of operations and development across seven different states, in India, the person added.

CleanMax was founded by Kuldeep Jain in 2011. Its clientele includes leading technology companies such as NTT, Cisco, Facebook, Singapore Telemedia as well as large industrial clients like Ultratech, UPL, Tata Motors, Welspun, Sansera.

Brookfield declined to comment on the deal, while CleanMax founder Kuldeep Jain did not respond to emails and text messages seeking a comment on the development.

Brookfield has already disbursed a first tranche of $400 million in Avaada. Funds from Brookfield will help Avaada set up its solar cell/module manufacturing business, green ammonia as well as its solar power business. Bank of America is the advisor in the trade.

Prior to the Brookfield deal, US-based Augment Infrastructure held a 53% stake in the company as of 31 March 2022, while founder Kuldeep Jain held 16.48% and UK Climate Investments held 17.58%, with a few other shareholders such as Godrej Industries and Nadir Godrej holding small amounts of the company’s shares. In 2021, Augment acquired its 53% stake in CleanMax for ₹1,650 crore. This involved a purchase of the stakes held by Warburg Pincus and International Finance Corporation.

CleanMax recorded a revenue of ₹701.72 crore in FY22, as compared to a revenue of ₹621.26 crore in the previous fiscal, as per the company’s filings with the registrar of companies. The company reported a profit of ₹29.85 crore in FY22, as against a profit of ₹25.3 crore in FY21.

CleanMax has a debt of ₹2,145 crore on its books as per a March 28 report by credit rating agency Care Ratings, comprising NCDs worth ₹599 crore, long term bank facilities of ₹531 crore and short term bank facilities of ₹1,015 crore.

Apart from CleanMax, another C&I renewable energy company – Fourth Partner Energy – is also in the market for a fundraise, involving the sale of its private equity shareholder TPG’s 52% stake.