Canadian investor Brookfield has entered into exclusive negotiations to invest as much as ₹3,000 crore ($363 million) to buy a controlling stake in CleanMax Solar, which provides renewable energy to commercial and industrial establishments, said two people sources in the know, speaking on the condition of anonymity.

CleanMax is a major supplier of renewable energy to the commercial and industrial (C&I) sector with 1 GW of operating renewable assets including over 600 MW of large-scale solar and wind farms for supplying clean energy to its corporate customers and over 600 installed rooftop solar projects for corporates, with a total rooftop solar operating capacity of more than 350 MW across India, UAE, and Thailand.

Investment bank Rothschild is advising CleanMax on the fundraise, the second person said. “The funds, largely primary equity infusion into the company, will be used to expand its business in India as well as south east Asia and Gulf countries and to retire some debt,” he added.

In 2021, US investment firm Augment Infrastructure acquired a majority stake in CleanMax for ₹1,650 crore. This involved a purchase of the stakes held by Warburg Pincus and International Finance Corporation.

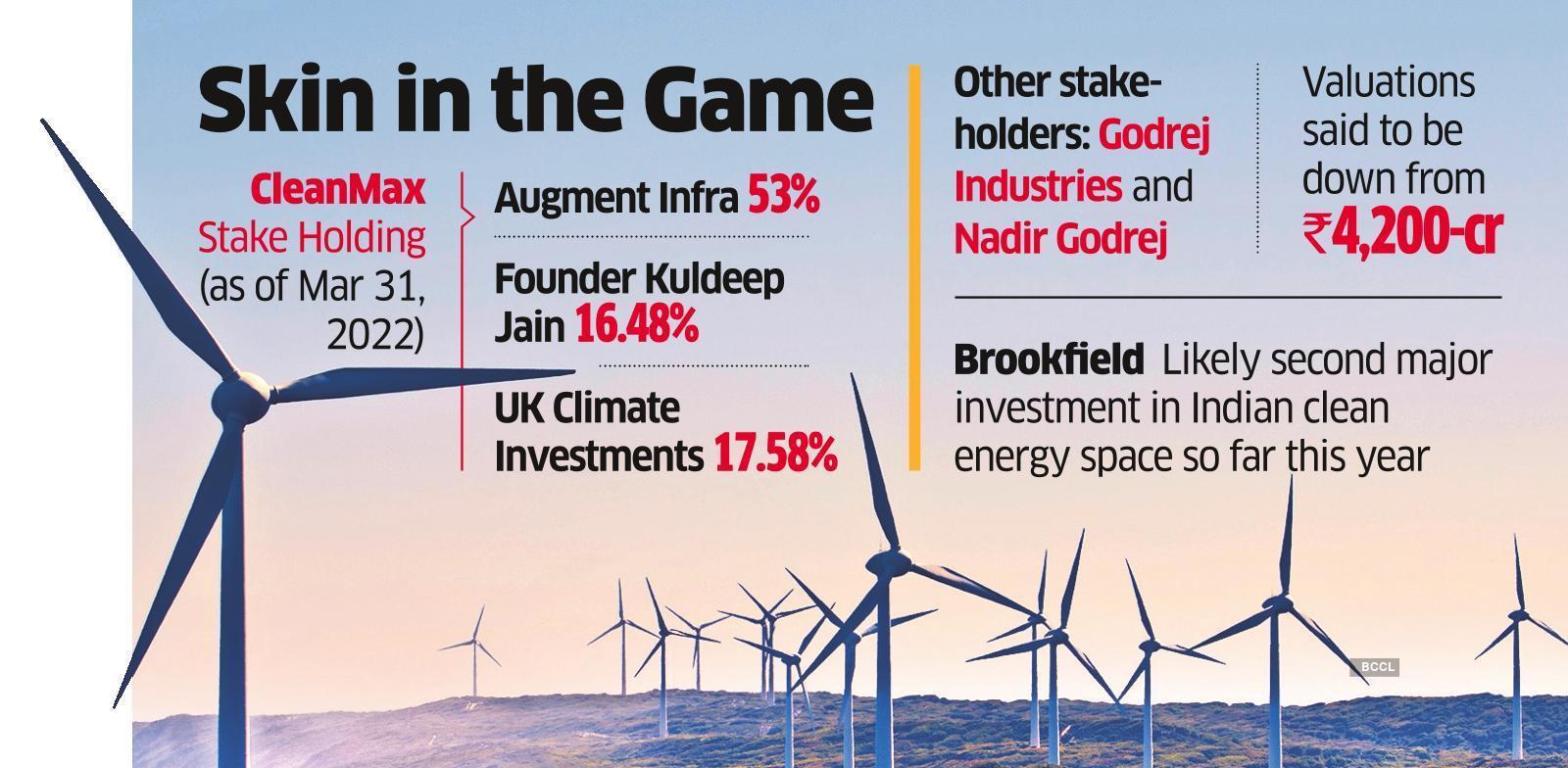

Augment held a 53% stake in the company as of March 31, 2022, while founder Kuldeep Jain held 16.48% and UK Climate Investments held 17.58%, with a few other shareholders such as Godrej Industries and Nadir Godrej holding small amounts of the company’s shares.

CleanMax recorded a revenue of ₹701.7 crore in FY22, as compared to a revenue of ₹621.2 crore in the previous fiscal, as per the company’s filings with the registrar of companies. The company reported a profit of ₹29.8 crore in FY22, as against a profit of ₹25.3 crore in FY21.

Brookfield declined to comment on the deal, while CleanMax founder Kuldeep Jain did not respond to calls and text messages seeking a comment on the development.

Sources said valuations have come off from the initial ₹4,200-crore mark that was talked about when non-binding bids went in.

If the deal goes through, it will be Brookfield’s second major investment in the Indian clean energy space so far in this calendar year. ET reported on March 13 that Brookfield is in advanced discussions with Vineet Mittal’s Avaada Venture for an investment of up to $1 billion, with the first tranche of $400-500 million expected to come in the coming weeks. Brookfield’s investment will help Avaada expand its solar generation capacity while also expanding into other sectors such as green ammonia and solar cell and module manufacturing.

Source: Economic Times