Brookfield Asset Management has joined the fray to buy Vodafone India and Idea Cellular’s combined 53.15% shareholding in Indus Towersthough Bharti Infratel leads the race, three people aware of the development said.

The Canadian alternative asset management fund held meetings with the shareholders and senior management of India’s biggest tower company last week as it intensified its efforts to lock in tower assets in a fast consolidating market, they said.

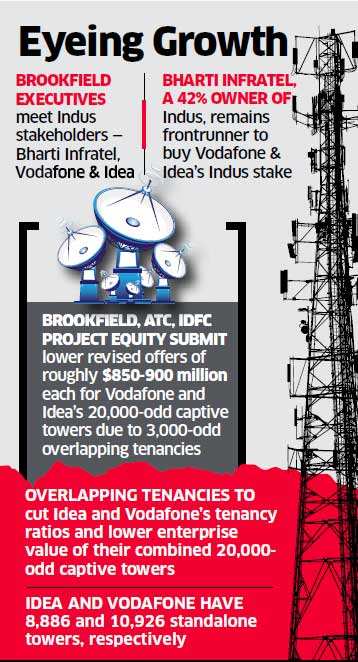

But Bharti Infratel, which holds 42% stake in Indus, remains the likely entity to buy out the Vodafone-Idea stake and consolidate Indus under the listed tower company currently controlled by the country’s leading telecom service provider Bharti Airtel, the sources said.

Vodafone India and Idea, the country’s second and third largest telcos, are in the process of merging their businesses to create the largest telco. They are looking to sell off their stakes in Indus and their standalone towers to strengthen their combined balance sheet to better take on competition from Airtel and newcomer Reliance Jio Infocomm.

Brookfield’s moves on Indus comes even as its Rs 11,000-crore tower deal with Anil Ambani-led Reliance Communications (RCom) is believed to have run into difficulties.

The challenges are around the number of tenancies that will come post sale of RCom’s tower arm to Brookfield, two people aware of the matter told ET.

“This deal isn’t progressing at the pace at which the parties would have liked, but both are very keen on it,” said one of them. The proposed deal has run into difficulties days before the National Company Law Tribunal’s final hearing on the proposed merger between Aircel and RCom’s wireless businesses and the latter’s sale of its tower arm to Brookfield.

Brookfield’s options of expanding its towers portfolio in India could narrow down significantly if its deal with RCom does not go through. Its earlier bid to buy into Bharti Infratel didn’t materialise as US private equity firm KKR and Canada Pension Plan Investment Board (CPPIB) picked up 10.3% in Bharti’s tower arm.

Separately, Brookfield, Boston-based American Tower Corp (ATC) and local infrastructure fund IDFC Project Equity Infra have submitted reduced revised offers of between $800-900 million for Vodafone India and Idea’s near 20,000-strong combined standalone towers due to some 3,000-odd overlapping tenancies, an industry executive aware of the development said.

“The 3,000-odd overlapping tenancies on either side would significantly reduce Vodafone and Idea’s tenancy ratios on their captive towers from their present levels, which in turn, would lower the enterprise valuation of the 20,000-odd towers from the earlier estimated $1.1-1.2 billion to $850-900 million,” the person said.

Idea had 15,418 tenants on its 8,886 standalone towers at a tenancy ratio of 1.7 while Vodafone India had 15,846 tenants on its 10,926 captive towers at a tenancy ratio of 1.5, according to an investor presentation made by Idea on March 20 following its merger announcement with Vodafone.

Vodafone and Idea are expected to take a joint decision sometime next month on a combined sale of their standalone towers after another round of due diligence on the revised offers. But insiders familiar with the negotiations said deal closure could still take a while.

Brookfield, ATC and IDFC Project Equity are learnt to have indicated to the sellers that they are open to buying Vodafone and Idea’s combined captive towers portfolio provided they get a sizeable bulk discount.

Vodafone and Idea, on the contrary, are likely to demand a premium if they decide to sell their combined towers portfolio on grounds that the buyer would enjoy advantages of scale with a wider network of towers.

Brookfield, Vodafone India, Indus Towers and Bharti Airtel declined to comment on queries.

Source: Economic Times