UK-based healthcare services and insurance provider Bupa is in talks with domestic private equity firm True North to pick a part of the PE firm’s stake in Niva Bupa Health Insurance Co, a joint venture between the two, sources aware of the development told ET.

Bupa is likely to pick up as much as 15-20% stake from True North, at a valuation of ₹11,000-12,000 crore, the sources said.

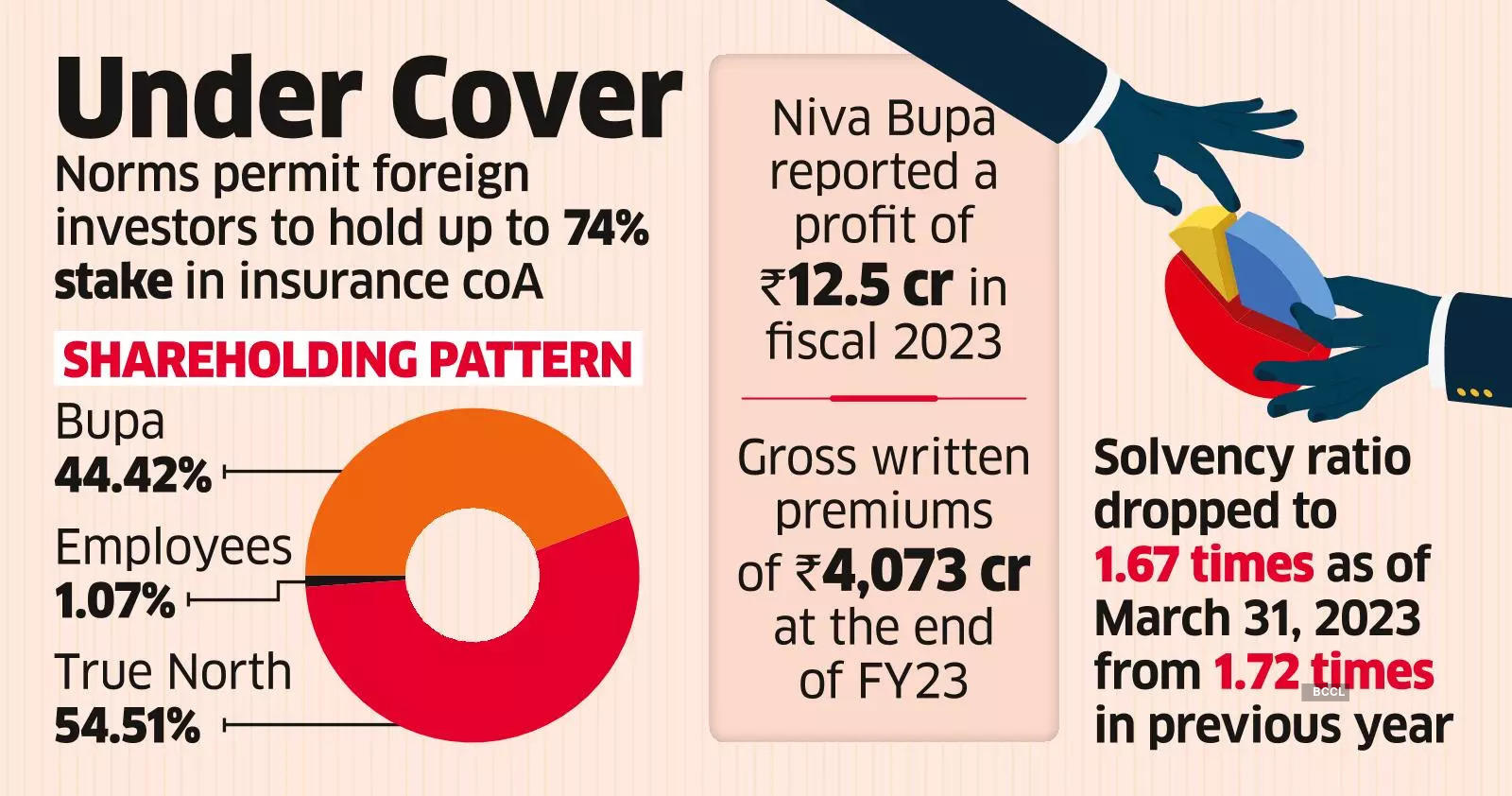

Bupa currently holds a 44.42% stake in the health insurer. Indian insurance sector regulations permit foreign investors to hold up to 74% stake in an insurance company.

True North, acquired a 51% stake held by Analjit Singh’s Max India in the insurer for ₹511 crore in 2019, then known as Max Bupa Health Insurance, for an enterprise valuation of ₹1,001 crore. True North currently owns a 54.51% stake in the health insurer. Rest of the shareholding is owned by employees.

The talks between Bupa and True North are running parallel to the talks with Temasek, which is looking to invest around $120-130 million in the insurer, as reported by ET on May 4. Temasek is in talks to pick up some stake from True North while also investing some fresh capital into the insurance company.

True North declined to comment. A Bupa Group spokesperson said: “While we are unable to comment on speculation, we remain fully committed to our successful and fast-growing business in India.”

The company recorded gross written premiums of ₹4,073 crore at the end of the financial year 2022-23, registering growth of 45% over last fiscal’s gross written premium of ₹2,809 crore, as per its latest annual report.

Claims incurred by the company stood at ₹1,439 crore for the period ending December 31, increasing from ₹1,088 crore in the previous year.

Niva Bupa’s solvency ratio dropped to 1.67 times as of March 31, 2023, from 1.72 times in the previous year. IRDAI mandates a minimum solvency ratio of 1.5 times. Solvency ratio is an indicator of an insurance firm’s financial stability and its ability to pay claims.

Niva Bupa reported a profit of ₹12.5 crore in fiscal 2023, as compared to a loss of ₹196.5 crore in the previous fiscal.

As per a January 4 credit rating report by Care Ratings, the promoters of the company have been supporting the company’s growth with regular funding and have invested ₹695 crore in the last three fiscals.