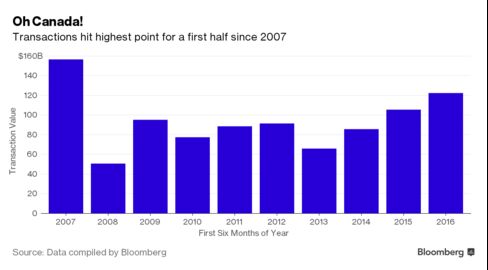

Mergers and acquisitions involving Canadian firms slid in the second quarter as market volatility, the U.S. election, and the U.K.’s Brexit vote disrupted dealmaking, which reached a nine-year high of nearly $123 billion in the first half of the year.

Deals involving Canadian firms were struck in a broad range of industries, including industrials, consumer, and in infrastructure and power, said Peter Enns, Goldman Sachs Group Inc.’s Canadian chief executive officer.

“Activity has also picked up recently in the natural resource space, both oil and gas and metals and mining, with the uptick in some commodity prices,” he said in an e-mail. “We will need to wait a month or two to know how the volatility over the last couple of days impacts the pace of deals.”

About $122.8 billion worth of transactions involving Canadian firms were announced in the year through June 29, 2016, up almost 20 percent from the same period last year, according to data compiled by Bloomberg. About $86.4 billion of those were announced in the first three months of 2016, or 71 percent of the total value, the data show.

M&A Advisers

Goldman Sachs was the leading financial adviser on deals involving Canadian companies in the first half, followed by JPMorgan Chase & Co., Barclays Plc., Lazard Ltd., and Wells Fargo & Co. Canadian Imperial Bank of Commerce topped the Canadian banks at seventh in the rankings, the data show.

| Financial Adviser | Value of Canadian M&A |

| Goldman Sachs | $47.5 billion |

| JPMorgan | $29 billion |

| Barclays | $25.5 billion |

| Lazard | $25.1 billion |

| Wells Fargo | $22.7 billion |

| Morgan Stanley | $22 billion |

| CIBC | $17.9 billion |

Concerns around the U.S. election in November, the fallout from Britain’s decision to leave the European Union, fears about a slowing Chinese economy and whipsawing capital markets are a risk for deal activity over the summer and into the fall, according to Bruce Rothney, chief executive officer of Barclays in Canada.

“There’s going to be a period of uncertainty in the fall. There’re no two ways about it. I think the market is quite happy to take a bit of a summer break, and recharge their batteries given the activity levels we’ve had,” Rothney said.

Lasting Impact

However, he doesn’t expect the U.K.’s out vote or the U.S. election to have a lasting impact on commerce between Europe and the U.S. and Canada. Long-term investors, like the Canadian pension funds and Brookfield Asset Management Inc., might find opportunities in the current chaotic markets, he said.

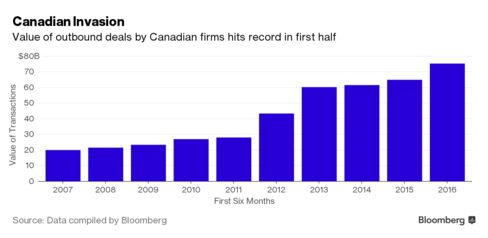

The first half of this year continued 2015’s trend of Canadian companies and money managers being the aggressors, looking for targets abroad to fuel expansion in a low-growth environment. Corporate Canada spent a record $75.3 billion abroad, up about 15 percent from the same period last year. That includes CIBC’s decision this week to acquire PrivateBancorp Inc. for $3.8 billion.

The first half also saw the highest number of Canadian companies doing deals valued at more than $1 billion since 2007. There were $89.6 billion of these jumbo deals but almost 80 percent came in the first quarter, the figures show.

The largest transaction to date was TransCanada Corp.’s $12 billion acquisition, including debt, of Columbia Pipeline Group Inc. in March.

Canadian companies, rather than pension funds or other investors, have led the charge because they finally have regained enough confidence since the financial crisis to leverage their balance sheets and diversify their revenue streams abroad, said David Rawlings, Canada senior country officer for JPMorgan.

“It’s true for utilities. It’s true for the banks, and it’s true for some other sectors,” he said. “You come out of the financial crisis in a much better relative position and you don’t necessarily act in 2011 because it’s still a more complicated market environment. But as the market stabilizes, you can do some interesting things.”

Those types of outbound deals also tend to favor the big global banks that can work on either side of the transaction, he said.

Manny Pressman, a partner at Osler, Hoskins & Harcourt Inc. who specializes in M&A, said he was surprised there weren’t more inbound transactions in 2016 given low-interest rates, the strong U.S. economy, and a relatively weak loonie.

“I do think that inbound, cross-border M&A has been complicated by the U.S. political climate and the European political climate,” he said. “Anything that was in the pipeline as far as that’s concerned has been delayed,” he said.

There are interesting, attractive Canadian targets for European companies but “we’re in a real holding pattern as far as that’s concerned.” Transactions in Alberta’s energy market could boom in the second half because of the number of distressed companies there.

Osler was the top legal adviser year to date on Canadian M&A, according to data compiled by Bloomberg.

Source: Bloomberg.com