Private equity Carlyle Group has emerged as the sole bidder to acquire Blackstone Group-owned Mphasis Ltd., in what would be the largest buyout in the Indian IT industry, said multiple people involved in the deal.

The offer to buy Blackstone’s controlling 56.12% stake is believed to be at Rs 1,450-1,500 a share—lower than Mphasis’ closing share price of Rs 1,701.70 on Wednesday. The transaction that will lead to a change of control will also trigger an open offer for an additional 26% shareholding of the company.

Tuesday was the deadline for submitting binding offers.

The Economic Times had on Feb. 23 reported that Carlyle was negotiating with nearly half a dozen banks and financial institutions—Deutsche Bank, Barclays, Standard Chartered Bank, Nomura and Canada Pension Plan Investment Board—for acquisition financing. JP Morgan, which is advising the private equity fund, may also join consortium. An arm of the Canadian pension fund may offer mezzanine debt, while the other firms are likely to come on board as senior lenders.

At the higher end of Carlyle’s bid, Blackstone will receive Rs 15,730 crore (more than $2 billion) for its stake in Mphasis—a 12% discount to its current holding valued at Rs 17,838 crore. Depending on the success of the open offer, Carlyle might have to shell out another Rs 7,400 crore based on the 60-day average price of Rs 1,538 a share.

Carlyle is planning to lever up to 6.5 times Mphasis’s FY21 expected Ebitda of Rs 1,821.7 crore to bankroll the transaction.

Blackstone had paid $1 billion at Rs 430 a share to snap up Mphasis from Hewlett Packard Enterprise in 2016. The mandatory open offer for the purchase of the additional 26% shares from the public was at Rs 457.54 apiece.

Blackstone was expecting competing offers from Bain Capital, Brookfield and Goldman Sachs but they never came, said people directly involved. The world’s largest private equity fund wanted to capitalise on the current bull run that had seen an 90% plus appreciation in the Mphasis stock in the last 12 months and 11% year to date, to cash out. But the high valuation involving a listed company in India proved to be a damper for many. Blackstone had also considered block trades in the secondary market but the size of its holding discouraged it from such a move, said one of the persons aware of the discussions.

Carlyle declined to comment. Blackstone and Mphasis did not respond to ET’s queries.

Big on Tech

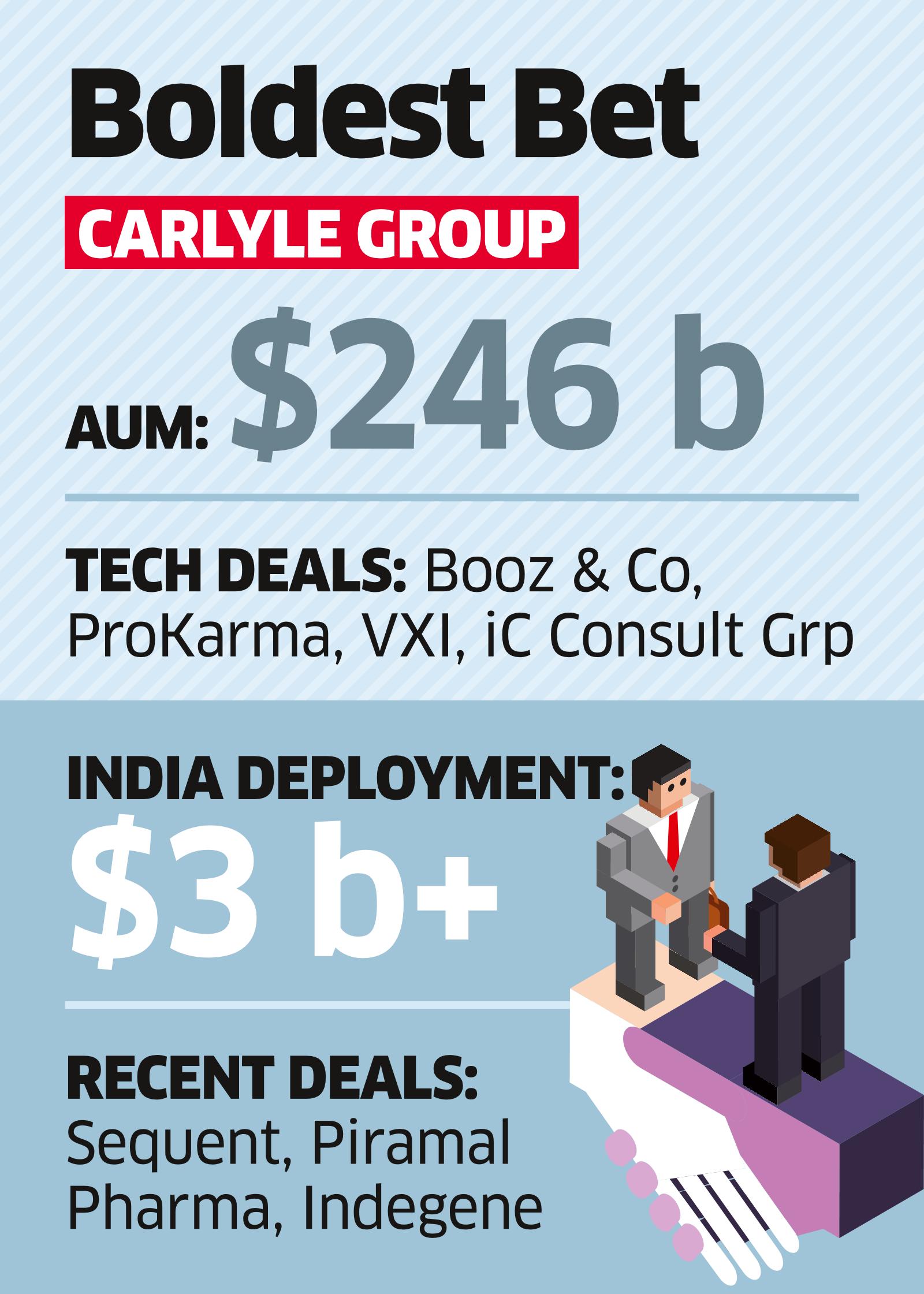

The Washington DC-headquartered Carlyle has had mixed successes worldwide in its tech/IT services investments. Its US company ProKarma had to change the CEO after disappointing performances. Even VXI, a China/Philippines company that it bought from Bain, is struggling after the five-year-old deal was marked below cost. However, Carlyle made bumper profits in Booz Allen—the defence contractor that served the US government and its military establishment.

In India, it is among the most aggressive PE fund, having deployed over $3 billion in the country, a fourth of it in 2020. It has roped in former Mindtree CEO Rostow Ravanan as an operating adviser to help in technology transactions.

Earlier last year, four private equity funds – Bain Capital, Brookfield and Permira, apart from Carlyle, were shortlisted by Blackstone and its advisor Morgan Stanley for due diligence. However, these funds did not make binding offers until Tuesday.

“Given the current share price Mphasis is trading at, Blackstone would not see a significant upside in the bid price. Also, Blackstone sold an 8% stake in Mphasis in 2018 at a 20X valuation then and last April, bought back a 4% stake in Mphasis at a 13X valuation. So, even going by prior exit valuations, it will not be a very ambitious exit price,” said an analyst on the condition of anonymity.

Despite the company’s elevated share price, if Carlyle and Blackstone achieve a deal, the former could expect a significant return in the next five years from Mphasis, others believe.

“It may not be as great a deal as the one Blackstone got in 2016. But the acquirer will get a decent return in Mphasis over a five-year timeframe of 10-15% compounded growth. Considering the positive market cycle, and the whole digital wave that is playing out, growth for Mphasis is not going to be very challenging. The existing management at Mphasis has fared well,” said another analyst.

Mphasis has two streams of business – the direct channel, which consists of its digital, new gen services and older, legacy technology business. The direct business accounts for 85% of its revenue. The indirect business where DXC (spinoff from former parent Hewlett Packard), accounts for 13% of overall revenue. The company is now focussed on increasingly larger sized, cloud and AI based deals.

Aniket Pande of Prabhudas Lilladher in a recent note said Mphasis is the only IT company whose core business (direct core) continues to grow at over 20% on a year-on-year basis. DXC shrank by 37% year to date in FY21.

“With this sharp decline, the share of DXC reduced to mere 13%, further de-risking the business profile. This is in-line with management’s commentary that the centre of gravity will continue to tilt towards the faster-growing direct channel, and the impact on overall growth from DXC’s exposure will continue to lessen,” Pande said.

Source: Economic Times