Private equity firm Carlyle has emerged as the frontrunner to partner SBI in its credit cards business and replace long-term partner GE Capital, said multiple sources aware of the matter.

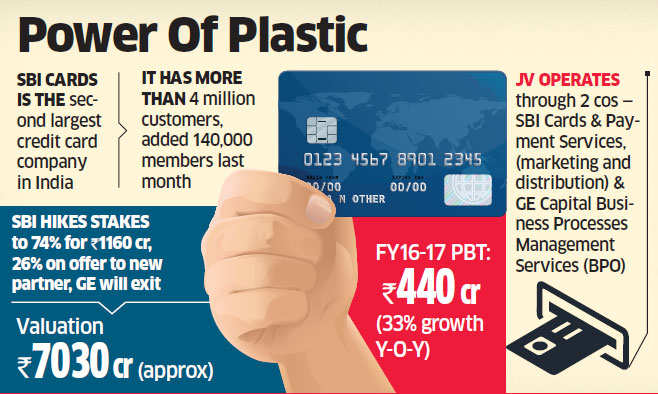

Ending months of negotiations, the preferred partner was shortlisted late last week, ahead of Japanese financial services firm Credit Saison and US private equity group Warburg Pincus for the 26% stakes in each of the 2 joint venture entities that together form the SBI Cards business, valuing India’s second -largest credit card player at close to Rs 7,030 crore.

Carlyle had tied up with Cognizant Technologies. The US-headquartered IT giant will however not bring in any equity but only provide technology support as a preferred vendor, added sources mentioned above.

A formal announcement is due in the next few days.

“It has been proposed that State Bank of India will increase its shareholding to 74% in both the joint ventures, namely SBI Cards & Payments Services Limited and GE Capital Business Processes Management Services Limited while the balance 26% will be held by the new partner, subject to regulatory clearance. This is a shareholder matter and GE will decide who buys the rest of the stake. We are not in a position to share further information,” an SBI Cards spokesperson told ET.

“GE Capital’s exit from SBI Card Joint Venture entities is in line with GE’s global strategy with respect to GE Capital. The process is still ongoing and we will share details when the process concludes,” said a GE spokesperson.

Carlyle and Cognizant declined to comment.

Financial services also happens to be a core area for Carlyle, which had invested in HDFC, the country’s top mortgage lender, and exited in 2014 with more than 3x returns. It has a dedicated $1-bn fund for financial services investments and owns a significant minority stake in RushCard, a US-based card operator. However, the SBI Card investment will come from its Asia buyout fund. Its current India investments include a 49% stake in PNB Housing Finance and Edelweiss Capital.

The SBI Cards JV operates through two companies — SBI Cards & Payment Services, which focusses on marketing and distribution of SBI credit cards; and GE Capital Business Processes Management Services, which handles the tech and processing needs of the business as its captive BPO (business process outsourcing) unit.

Originally, GE Cap owned 40% in SBI Cards & Payment Services while it had the controlling 60% stake in GE Capital Business Processes Management Services. SBI owned the residual stakes in both.

But earlier this month SBI said it will hike its stake in both the ventures to 74 per cent. Its board had given the approval to infuse Rs 1,160 crore through purchase of equity shares from GE Capital to increase the bank’s stake in both the companies to 74 per cent. That left a 26% stake in each of the 2 JV units for a new partner.

The stake hike by SBI also set a benchmark, valuring the 26% stake at Rs 1827 crore-Rs 2000 crore.

In April of 2015, GE had taken a call to sell the bulk of its worldwide assets under GE Capital as part of a decision to exit financial services and concentrate on traditional industrial businesses. It had mandated investment bank, Morgan Stanley, to help find a buyer. State Bank of India had roped in Barclays as adviser.

TALKING PLASTIC

SBI, the nation’s largest lender, entered the credit cards business in 1998 by partnering with GE Capital India, the consumer finance arm of GE Capital.

SBI Cards currently has emerged as the 2nd largest credit cards player with a 15% market share after overtaking second placed ICICI Bank. HDFC Bank remains the number one player with 30% share of the market.

SBI Cards with 4 million user base has seen a PBT growth of 33% year on year to close FY16-17 at Rs 440 crore. After wiping out accumulated losses in 2014, the JV declared its maiden dividend in 2014. It posted pre-tax profit of Rs 438 crore in FY16, up 62% from Rs 271 crore in the year-ago period.

“We were adding upwards of 1.3-1.4 lakh cards last few months. One year back, the addition was in the range of 60,000-65,000 a month. We are pursuing an aggressive strategy to emerge as the top player in the country,” Vijay Jasuja, CEO SBI Cards said recently. “Demonitisation has seen activation of dormant cards but has not necessarily been a trigger for new issuances.

Currently, 42-43% of its base comes from the open market, 37% from SBI’s own customer base, 10% from co-branded initiatives with various partners like Future Group, Capital First, IRCTC, Air India and the rest from corporate cards. SBI has been aiming to double its share of co-branded credit cards to 30-33% by 2020.