Edelweiss Infrastructure backed Sekura Roads Ltd., Cube Highways & Infrastructure and Caisse de dépôt et placement du Québec (CDPQ) are in early stages of negotiations to acquire Ashoka Concessions for an enterprise value of Rs 5,000-6,000 crore as revenue-generating highway assets continue to get investor traction.

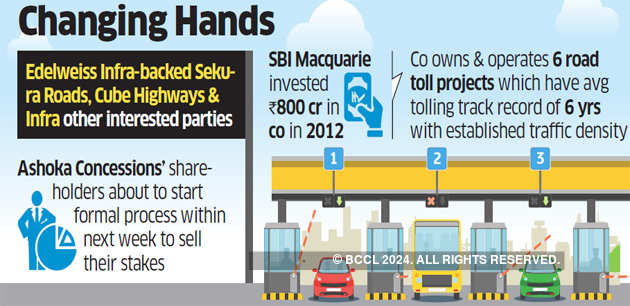

Ashoka’s shareholders — a private equity fund jointly managed by Australia’s Macquarie Group, State Bank of India and listed entity Ashoka Buildcon NSE 0.47 % – are about to start a formal process to sell their stakes, people aware of the negotiations told ET.

SBI Macquarie Infrastructure Investment Fund holds 34% in Ashoka Concessions, which owns a portfolio of toll-road assets across the country. Ashoka Buildcon has 66%.

“Talks with some of the likely contenders have already started. We will formally launch a stake-sale process within next week and hopefully conclude it within a couple of quarters,” said one person.

Edelweiss, Cube, CDPQ and Macquarie declined to comment. Mails sent to Ashoka did not elicit an immediate response.

SBI Macquarie invested Rs 800 crore in Ashoka Concessions in 2012. Ashoka Concessions owns and operates six toll road projects — the Belgaum-Dharwad, Dhankuni-Kharagpur, Durg Bypass, Chhattisgarh-Maharashtra border, Bhandara Road, Maharashtra-Chhattisgarh border, Jaora-Nayagaon and Sambalpur-Baragarh highways.

A successful deal would help Macquarie to reap almost double the money it invested about seven years ago and help Ashoka Buildcon, an infrastructure and construction company, to strengthen its balance sheet. The group had consolidated debt of Rs 5,790 crore in FY19, according to an investor presentation on its website.

Ashoka Concessions reported operating income of Rs 131.7 crore in FY18 compared with Rs 113.1 crore a year earlier. Net profit fell 77% to Rs 11.6 crore in this period. All six road projects have an average tolling track record of six years with established traffic density. Cumulative toll collections during the first quarter of FY19 grew 11.2% on year, aided by an upward revision in toll rates and healthy traffic, ICRA said in a note on October 8.

In February, Ashoka Concessions won a Rs 1,382 crore contract from the National Highways Authority of India to build a section of the Tumkur-Shivamogga section in Karnataka.

The company received an order worth Rs 443 crore from Rail Vikas Nigam Ltd. in Ambala division of the Northern Railway in Punjab and an order from Jharkhand Bijli Vitran Nigam Ltd. worth? 169 crore for rural electrification work.

Cube and CDPQ were also in discussions with Essel Infraprojects Ltd to buy three of its road projects for Rs 1,500 crore. CDPQ, Canada’s second-largest pension fund manager, has already deployed Rs 32,000 crore across various projects in the country.

Sekura Roads plans to own and run high-quality operating assets across roads and transportation. It is backed by Edelweiss Infrastructure Yield Plus, a Category I alternative investment fund that focuses on investing in power transmission, renewable power and roads and highways, besides other infrastructure assets. Edelweiss Alternative Asset Advisors (manager of the infra fund) had marked the first close of the infra fund in May, raising about Rs 2,000 crore. The fund is raising Rs 6,500 crore in total for the infrastructure fund.

Cube, backed by I Squared Capital, an infrastructure focused fund set up by former Morgan Stanley executives, has been an aggressive investor in operational road assets. It agreed earlier this month to acquire the Delhi-Agra toll road from Reliance Infrastructure NSE -0.78 % for an enterprise value of Rs 3,600 crore. In February, it bought two road projects from KNR Constructions.