Centrum Capital, the financial services business led by Jaspal Bindra, is exploring a possible sale of its stake in its mortgage financing business – Centrum Housing Finance, two people aware of the development told ET.

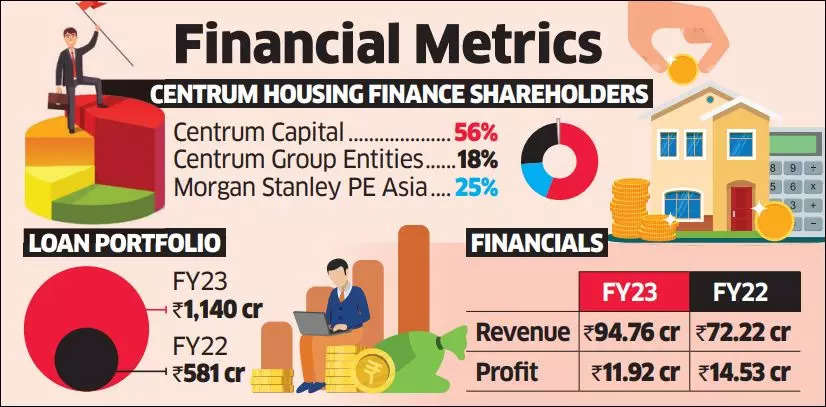

Mumbai-headquartered Centrum group holds a 74% stake in Centrum Housing Finance. Private equity investor Morgan Stanley PE Asia holds around 25%, having invested ₹190 crore in the business in 2020.

“Centrum is working on a plan to explore the sale of its stake in its housing finance business,” said one of the persons cited earlier. “A formal process is expected to be launched soon.”

The housing finance business could fetch a valuation of about ₹1,500 crore, the person said.

“The stake sale process is being driven by RBI directives following the acquisition of PMC Bank (now called Unity Small Finance Bank) by Centrum group and BharatPe consortium in 2021, which require that if Centrum continues to hold a majority stake in the housing finance business, then the bank cannot do the business of mortgage financing,” the source said.

The sources said that the deal process is in very early stages and deal contours are still being finalised. It is possible that Centrum may choose to continue to hold a minority stake in the business, they added.

The group has previously merged some of its other lending businesses, such as MSME and microfinance lending into Unity Small Finance Bank.

“The option to merge the housing finance business with the bank is also there. The eventual decision will be based on the valuation the business fetches,” said one of the people cited earlier.

An email sent to Morgan Stanley PE Asia remained unanswered till press time. A spokesperson for Centrum declined to comment.

Centrum Housing Finance’s loan portfolio stood at ₹1,140 crore on March 31, 2023, up from ₹581 crore a year ago, marking a 96% year-on-year increase, according to a report by credit rating agency Care Ratings.

Source: Economic Times