ChrysCapital is set to acquire about 20% stake in Bright Lifecare that runs omnichannel health products store HealthKart, valuing the business around $450 million (₹3,700 crore). The talks are in final stages and the deal will be signed shortly, said sources aware of the development.

ChrysCap will invest about $90 million in this round as the private equity group looks to aggressively scout for home-grown consumer brands to back or even buy.

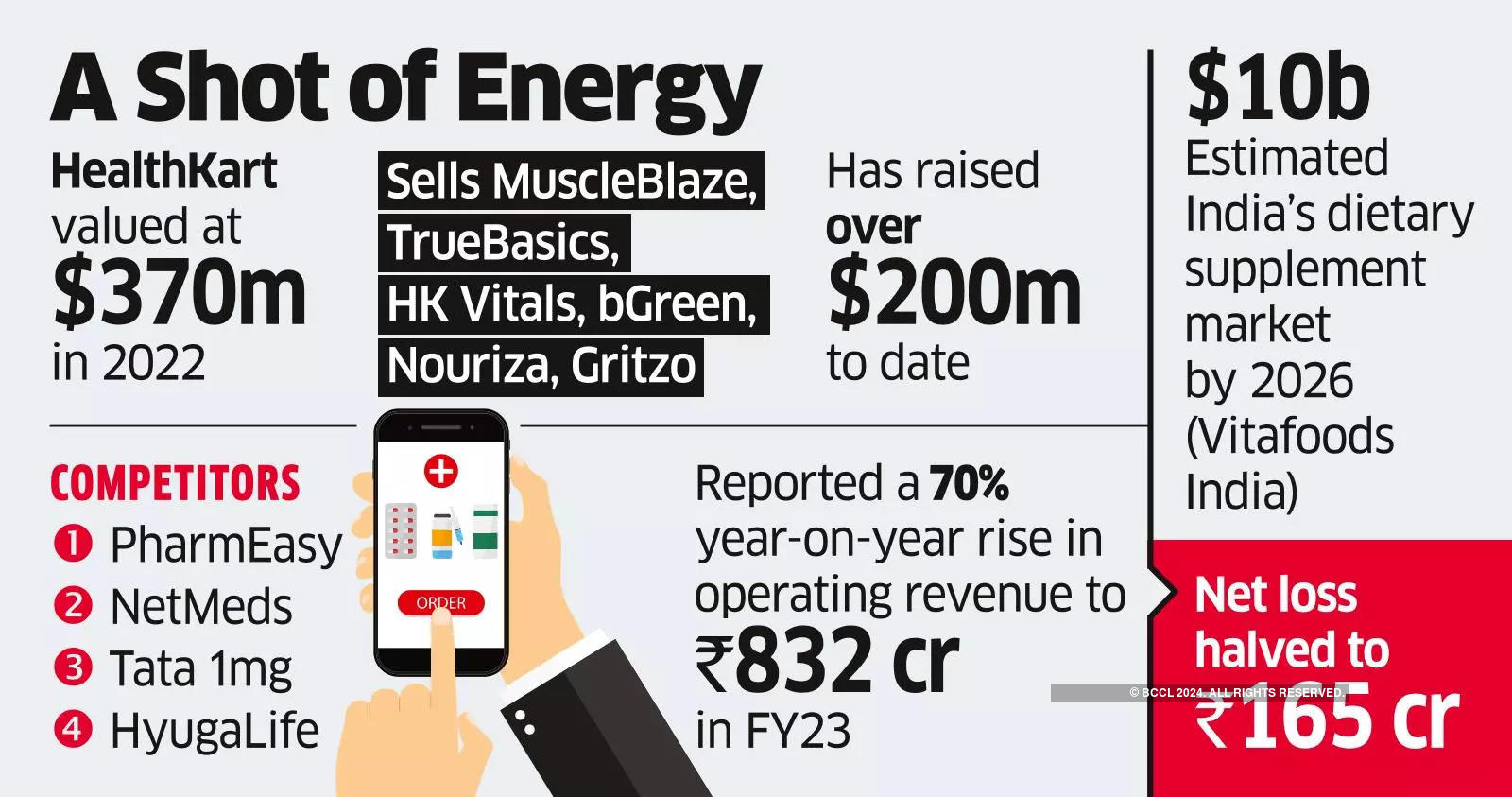

Sources told ET that the existing investor Peak XV (formerly Sequoia) will sell their stake in this round. In its latest round, HealthKart had raised $135 million (about ₹1,100 crore), led by Singapore’s sovereign fund Temasek at a valuation of $370 million in 2022.

ET had earlier reported in April about ChrysCapital’s interest to acquire HealthKart stake.

As India’s largest nutrition platform, HealthKart offers a wide range of supplements and nutraceuticals through in-house native brands such as MuscleBlaze, TrueBasics, HK Vitals, bGreen, Nouriza, Gritzo and The Protein Zone. It has 250 offline stores spread across 50 cities. The startup also counts Sofina, A91 Partners, Kae Capital, IIFL and Omidyar Network among its investors.

HealthKart was founded in 2011 by Harvard and Stanford graduates Sameer Maheshwari and Prashant Tandon. Both are also co-founders of online pharmacy 1mg, which was hived off as a separate entity in 2015 and sold to Tata Group in 2021. Mails sent to HealthKart, ChrysCapital did not elicit any responses while Peak XV declined to comment.

HealthKart has raised more than $200 million to date. In 2019, Bright Lifecare had raised ₹175 crore from Belgium-based investment company Sofina, ₹80 crore in a Series E round from Sequoia Capital, Kae Capital and Omidyar Network in 2016.

HealthKart’s top competitors include PharmEasy, Netmeds, Tata 1mg, HyugaLife, Nutrabay, Healthians. HealthKart reported a 70% year-on-year rise in operating revenue to ₹832 crore during the fiscal year 2023, while its net loss nearly halved to ₹165 crore. HealthKart’s advertising and promotional expenses climbed 56% year-on-year to ₹188.63 crore, as it spent heavily on brand-building and marketing during the year, after it secured fresh funding during FY23.

India’s dietary supplement market which was valued at $4 billion in 2020 is expected to reach $10 billion by 2026, according to Vitafoods India. The vitamins and minerals market is expected to surge, reaching a revenue of $2.63 billion by 2024, with an estimated annual growth rate of 7.71% from 2024 to 2028. After the Covid, consolidation was evident in the online pharmacy segment with the entry of both traditional conglomerates and ecommerce giants.

In 2021, Walmart-owned Flipkart entered into the pharmacy space by acquiring a majority stake in Kolkata-based SastaSundar Marketplace while Reliance Industries bought out 60% stake in pharmacy chain Netmeds for ₹620 crore in August 2020. E-pharmacy chain PharmEasy is also backed by global funds like Temasek, Prosus, Goldman Sachs and Canadian pension fund CDPQ.

Source: Economic Times