Private equity (PE) firm ChrysCapital remains firmly in the race to acquire Glenmark Pharma’s stake in Glenmark Life Sciences (GLS), with reports about detergent-to-chemicals maker Nirma closing on the deal doing the rounds.

“ChrysCapital continues to maintain a robust interest and active involvement in the stake bidding process of GLS,” sources told ET.

“This engagement aligns with ChrysCapital’s reputation for making strategic investments that yield long-term value for all stakeholders involved,” a source added.

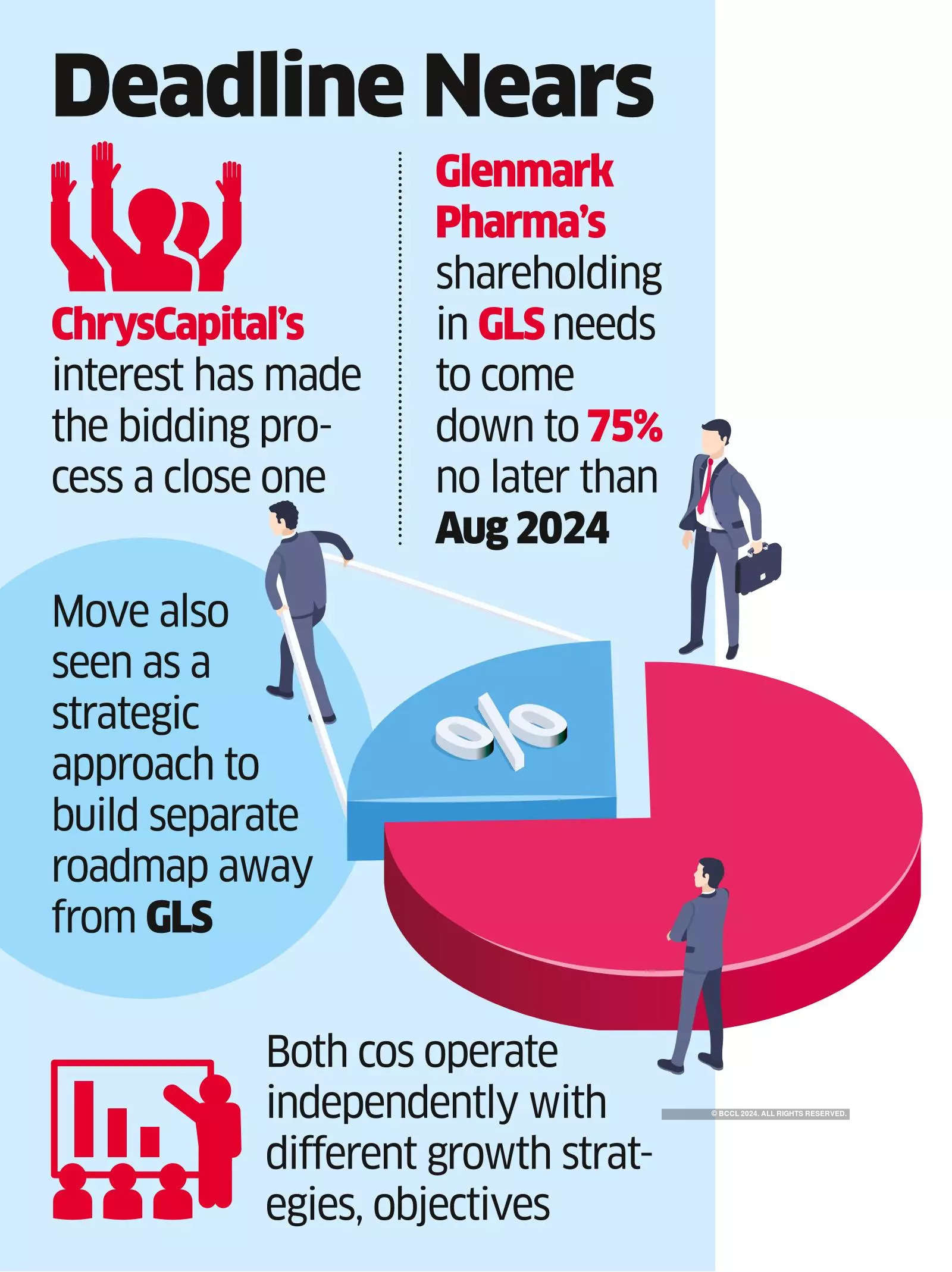

The PE firm’s interest has made the bidding process a close one.

Glenmark Pharma’s stake sale is a procedural requirement as per the listing guidelines, the company has stated earlier. Glenmark Pharma’s shareholding in GLS, which is 83% currently, needs to come down to 75% no later than August 2024. However, sources have indicated that the company may look to sell a controlling stake in GLS.

In addition to being a norm of the Securities and Exchange Board of India, the move is seen as a strategic approach to build a separate roadmap away from GLS. This regulatory requirement has prompted the stake sale, prompting several prominent entities to express their interest.

Mails sent to Glenmark Pharma and ChrysCapital were yet to elicit responses at the time of publishing the story.

Along with Nirma and ChrysCapital, Sekhmet Pharmaventures backed by PE firms PAG, CX Partners and Samara Capital also came up in the list of potential investors in the race to acquire Glenmark Pharma stake in GLS.

Glenmark Pharma is the parent of GLS but they operate independently with different growth strategies and objectives.

Glenmark Pharma is focused on building global brands and moving up the value chain by developing speciality medicines such as Ryaltris, innovative medicines and complex generics, while Glenmark Life Sciences is focused on scaling up its active pharmaceutical ingredient (API) business, developing APIs and growing its contract development and manufacturing services business.