Drugmakers Cipla and Alkem Laboratories have emerged as the frontrunners to acquire a controlling stake in Sahajanand Medical Technologies (SMT), India’s largest cardiac stent maker, said people in the know. This follows the withdrawal of rival private equity contenders KKR, TPG Capital and Apax Partners after showing initial interest.

The deal is expected to value SMT at Rs 3,500-4,000 crore, and binding offers are due by next week, the people said.

Promoters of SMT—the Kotadia family— plan to keep a minority stake after the transaction that would see other shareholders also divest their holdings. “They could retain about 15-20% stake post the deal,” said one of the persons cited above.

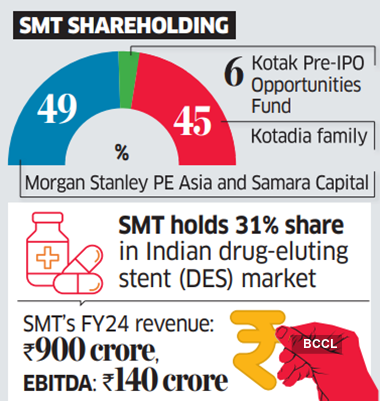

Morgan Stanley PE Asia and Samara Capital collectively own 49% of SMT, while Kotak Pre-IPO Opportunities Fund has a 6% stake. The Kotadias own the remaining 45%.

SMT is also simultaneously working on plans for a domestic public listing if the shareholders don’t get the desired valuation from the stake sale, the people said. They added that an IPO is likely to fetch a comparatively higher valuation for the company.

Had Filed Draft Papers with Sebi in 2022

SMT had filed a draft prospectus in 2022 with the market regulator to launch a Rs 1,500 crore IPO but eventually put the plans in abeyance.

Founded by Dhirajlal Kotadia in 1993, SMT is the largest drug-eluting stent (DES) maker in India with a 31% market share. It is expanding in Europe as well. SMT posted FY24 revenue of Rs 900 crore and earnings before interest, tax, depreciation and amortisation (Ebitda) of around Rs 140 crore. The shareholders are seeking a valuation that is 25 times the company’s earnings, the people said.

A spokesperson for SMT declined to comment. Samara Capital, Morgan Stanley PE Asia, Cipla, and Alkem did not respond to ET’s queries. ET first reported in August about five bidders including KKR, TPG, Apax Partners and Alkem being shortlisted for the deal with due diligence set to commence shortly. ET also reported on March 7 about SMT shareholders’ intent to sell their stakes in the company.

The cardiac stent market comprises drug-eluting stents, bare metal stents, bioresorbable vascular scaffolds, and drug-eluting balloons.

India’s coronary stent market is currently estimated at `1,300 crore, and expanding at a compound annual growth rate (CAGR) of 12%. Global manufacturers Abbott Vascular, Boston Scientific and Medtronic hold a combined about 60% share of the domestic market for cardiac stents. The top Indian stent makers are SMT, Translumina and Meril Life Sciences with a combined about 18-20% share.

Source: Economic Times