Clix Capital, a commercial lending and leasing company promoted by Genpact founder Pramod Bhasin and former GE Capital head Anil Chawla, is in talks to invest Rs 600-800 crore in Kerala-based Catholic Syrian Bank for a significantly minority stake.

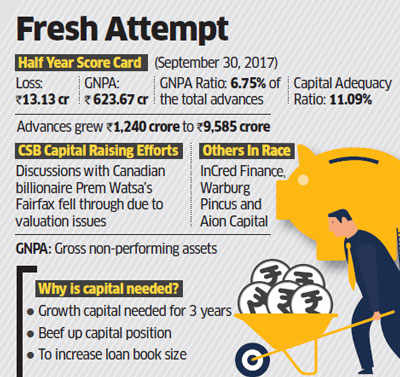

This comes after negotiations between the unlisted private sector bank and Canadian billionaire Prem Watsa-controlled Fairfax fell through due to differences over valuation, two people with direct knowledge of the development said.

CVR Rajendran, managing director at Catholic Syrian Bank (CSB), confirmed talks with Clix Capital, but said nothing has been finalised. “We are in the process of raising capital through a preferential issue,” he said. “We have met large number of investors including Pramod Bhasin and Anil Chawla during our road shows.”

Chawla declined to comment on the matter.

Clix entered financial services in January by purchasing the GE Capital’s commercial lending and leasing business for $360 million, with the backing of American private equity fund Aion Capital.

Clix will follow the same strategy in the case of CSB “by teaming up with one or two private equity investors to purchase the stake”, said second source cited earlier. CSB has appointed investment bank JM Financial, while Avendus Capital advises Clix.

Clix, which has assets of $300 million, focuses on consumer loans, loans to small and medium enterprises and commercial lending, including financing of consumer durables and used cars, and personal and educational loans.

Earlier this year, Fairfax had made a formal offer to purchase up to 51% stake in CSB but later walked out from negotiations after some minority investors demanded higher valuation.

While the Canadian firm arrived at a valuation of nearly Rs 130 a share, the bank’s own valuation pegged the share price at Rs 165-200 apiece, plus a control premium of at least 15%. CSB still has many suitors.

ETon its August 8 edition had reported that InCred Finance, backed by former Deutsche Bank co-CEO Anshu Jain, private equity giant Warburg Pincus and Aion Capital were interested in buying a controlling stake in CSB.

Around 25-30 investors had shown interest in the bank that is considering its stock market debut in the next one and a half years.